Unfortunately, Dwolla is discontinuing its product as of October 2018. But worry not! While businesses like using Dwolla for straightforward, secure automated clearing house (ACH) payments, that doesn’t mean it is the only option available.

Here are other choices that integrate with Jotform and might work better for you:

Square ACH

Powered by Plaid, Square ACH is a feature of Square that enables users to swiftly collect ACH payments from their customers. By integrating Jotform’s free Square ACH payment option into your online payment forms, you can securely gather customer payments.

Square ACH doesn’t have a monthly fee, and the processing fee is only 1% per ACH transaction, with a minimum fee of $1 per transaction.

Pro Tip

As a special offer to Jotform users, you can get free processing on your first $5,000 in Square payments, plus get $20 off Square hardware. Sign up here to take advantage of the offer!

eCheck.Net

eCheck.Net is Authorize.Net’s electronic check payment service, and it’s incredibly popular. It’s loaded with helpful features, including automated recurring billing, advanced fraud detection, invoicing, and no setup fee. You can integrate Jotform with eCheck.Net and create custom order forms, payment forms, or donation forms with ease.

It costs $25 a month to run the service but only takes a .75% fee per transaction. If you’re accepting higher value transactions, this is a really affordable and reliable option.

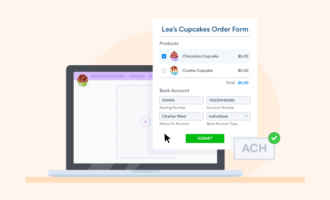

Stripe ACH

No one would blame you if you didn’t know that Stripe also helps businesses accept ACH payments in addition to credit cards, but they do! You can begin collecting ACH payments online with Jotform’s Stripe ACH integration by simply customizing your online form with your products and pricing, then link it to your Stripe ACH account.

Jotform and Stripe connect using Plaid, which allows you to instantly receive a verified bank account — great for immediate charging. To do this, you’ll need a Plaid account.

ACH payments on Stripe cost .8%, capped at $5, with no monthly fees or verification fees.

Another alternative: Stripe ACH Manual

Stripe ACH Manual enables you to accept Stripe ACH payments directly from a customer’s bank account, bypassing the need for credit or debit cards similar to Stripe ACH. However, this Stripe ACH Manual integration eliminates the requirement for Plaid to verify bank accounts, allowing you to connect to Stripe directly through our Form Builder.

Pro Tip

We recommend using Stripe ACH integration if you want to keep Jotform Sign as Jotform Sign disables the edit submission flow, which is required by the integration’s payment verification flow.

With all of these options, you can quickly and painlessly integrate with Jotform. If your company accepts high-value transactions, it probably makes more sense for you to use ACH than credit cards. Popular Jotform use cases include commercial landlords, utility companies, and nonprofits collecting higher value gifts.

Send Comment: