In 2013 a device started to show up wherever people needed to collect payments. It was simple, easy to use, and just plain cool. It was a credit card reader you could plug into the headphone jack on your phone. The Square payment system had arrived.

This simple little device allowed business owners to take credit card payments from anyone at any time with a device that fit in the coin pocket of their favorite jeans. It was a real breakthrough that gave small businesses a professional edge. Best of all, it was free.

But Square didn’t stop at the credit card reader. The company introduced a whole suite of point-of-sale (POS) solutions and software that changed the face of small business.

Point-of-sale options

Within a few years of the release of the magnetic stripe swiper for credit cards, Square POS terminals started to show up in edgy coffeehouses, funky brewpubs, and posh boutiques everywhere. The POS system replaced the traditional clunky cash registers and credit card swipers that you used to find in retail locations.

The Square POS tool is popular in part because it makes things so easy. It also lowers the bar of entry for small businesses, allowing them to get up and running faster, for less.

The modern-looking, web-inspired graphical user interface (GUI) makes training employees much easier. Instead of teaching people to memorize complex sets of buttons or menus, the Square POS looks and feels like a modern web app. The user-facing interface is also simple and intuitive. On top of that, the credit card processing fees are very reasonable.

Financial and business services

On the software side of Square’s offering is a large suite of tools to manage the day-to-day running of your business. Its software tools include services like payroll, invoicing, and loyalty programs.

Having a single service that provides business management as well as POS functionality in one place is a huge benefit for small businesses — for example, the small mom-and-pop bookstores that used to be everywhere are now almost completely gone. People still read, but those businesses just couldn’t compete with the convenience and affordability of websites like Amazon.

But some of those bookstores are still around, and they learned that services like Square allow them to maintain a web presence and even manage their inventory. An online presence lets them sell more books than they ever could have the traditional way.

Financial details and security

Some people find it hard to trust young startups over traditional financial institutions. When money is involved, it’s important to be smart about the decisions that affect your business and income.

Square’s dedication to security

Square has been around since 2009, and it employs more than 3,000 people. It’s a publicly traded corporation that has raised more than $400 million in funding.

Square places security at the core of its business. Every transaction adheres to the highest PCI standards. The company manufactures all of its hardware with security in mind.

All transaction data is encrypted before being sent to the Square servers. In fact, no financial data is ever saved locally on any Square devices or in the software used to access the system. On top of that, Square constantly stress-tests its software for vulnerabilities.

The cost of doing business with Square

(Note: Prices and fees are subject to change at any time.)

Most transactions through Square’s POS system — like credit card swipes, chip inserts, and contactless transactions — cost 2.6 percent plus 10 cents per transaction. Manual entries and card-on-file transactions cost 3.5 percent plus 15 cents. Invoices and online transactions are 2.9 percent plus 30 cents.

The original magnetic stripe reader is still free when you sign up. An extra one is only $10. The basic stand you see at coffeehouses everywhere only costs $169 — but it does require you to have an iPad, which Square also sells.

Most of Square’s services are offered at no additional charge beyond the transaction fees. But there is a charge for add-on services, like payroll, email marketing, and loyalty programs.

Square doesn’t limit you

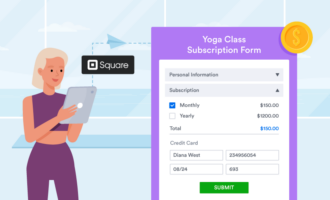

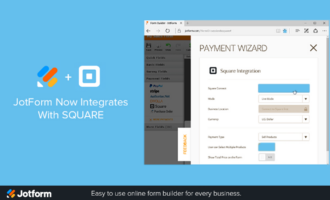

If you want to make transactions available through your own website or app, Square integrates beautifully with many other tools, like Jotform. Jotform lets you set up a payment page that offers more than a simple transaction. You can leverage Jotform to collect lead information and offer additional products or services. You can also use Jotform to present customer satisfaction surveys and collect reviews after each transaction.

Send Comment:

1 Comment:

More than a year ago

Do you have a phone number