Best tools to automate payroll

Supporting your employees affects their workplace satisfaction and confidence in you as an employer. If employees feel supported, it makes it easier for them to complete their tasks. That means ensuring you have the fundamentals of your business in order — particularly payroll.

Over the course of the past year, small businesses in particular took a hit, putting timely payroll processing in jeopardy. In a recent survey from Statista, nearly 70 percent of small businesses experienced moderate or large negative effects as a direct result of the COVID-19 pandemic. Business owners had to turn to federal interventions, like Payroll Protection Program (PPP) loans, but they were still unsure about their ability to give employees timely payouts.

With these and other economic fluctuations, ensuring the consistency of your payroll is more important than ever. The best way you can effectively deploy and track payroll is by integrating payroll automation into your operations. Without automation, you’ll find the process difficult to manage by yourself — with it, you’ll handle a significant chunk of your human resources responsibilities in a snap.

Some background on payroll automation

Finding tools that take repetitive tasks off your plate should be at the top of your to-do list as a small business owner. Payroll automation creates a self-sufficient system for compensating employees.

When to do it

Automating your payroll can help your business at any phase of its development, whether you’re a two-person operation or you’re supervising dozens of staff. You’ll certainly feel the advantages more as you grow, but a business of any size benefits from automating payroll. Payroll software is always a good investment, no matter the size of your business, especially when you’re taking on new employees.

Why you should do it

There are numerous benefits to automating your payroll. With automation, you can

- Pay employees faster and reduce pay stub errors

- Track information more effectively with automatically updated payroll records

- Maintain and update tax documents easily for both your business and employees

- Improve employees’ experience with accessible payroll software your human resource and accounting staff can easily access and change as needed

What it looks like

Depending on the type of software you use, you can streamline a wide variety of tasks related to payroll. Typically, automation starts with setting up a portal for an employee to enter their start date as well as their tax documentation and information, putting them into your payroll system and officially making them a paid employee.

From there, you can automatically deploy weekly or biweekly timesheets for employees to submit. You can also adjust for factors like overtime, benefits, holidays, paid time off, or even worker’s compensation insurance. With the right tools, payroll automation makes managing an otherwise demanding part of your HR much easier.

Best payroll automation tools

As you look for the right software, consider the following options. These are some of the most popular payroll automation programs, and they offer a range of features you can review to see what best fits your small business.

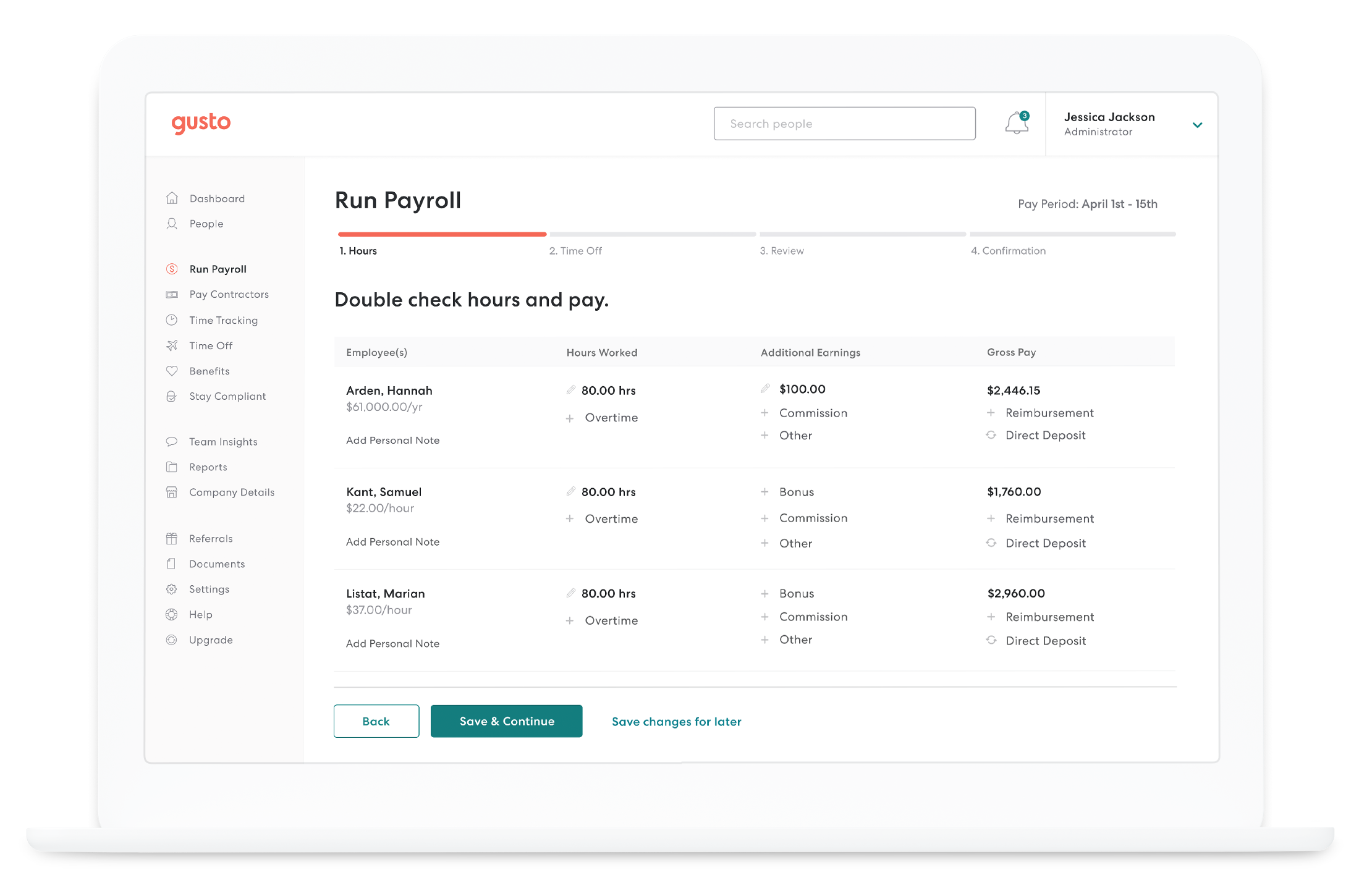

1. Gusto

Overall Capterra user rating: 4.7 out of 5 (3,850 reviews)

Overall G2 user rating: 4.5 out of 5 (1,895 reviews)

One of the most widely used HR software programs for small businesses, Gusto features a comprehensive suite of products that automate payroll and benefits management to ease the burdens of running a small business. It serves more than 200,000 businesses and offers different pricing tiers to make it not only effective but affordable as well.

Pricing: Gusto’s paid plans begin with the Simple plan, which costs $40 per month, plus an additional $6 per person per month. The next tier, the Plus plan, charges $60 per month, with an extra $9 per person per month. For access to premium features, please contact their sales team for exclusive pricing details.

User review:

“I love how simple and relatable Gusto is. It is very user-friendly and super easy to use as an employee.” (Source: Capterra)

2. QuickBooks

Overall Capterra user rating: 4.3 out of 5 (6,438 reviews)

Overall G2 user rating: 4.4 out of 5 (254 reviews)

A more comprehensive offering, QuickBooks from Intuit helps you manage all things financial, from payroll and bookkeeping to general, day-to-day accounting. It helps that they’re under the umbrella of Intuit, the same company that runs TurboTax, as the program also tracks and maintains tax records and even actively searches for potential deductions at the end of the year.

Pricing: QuickBooks offers four different payment plans, starting with the Simple Start plan, which costs $15 per month. This plan includes features such as free guided setup, income importing, expense organization, and receipt capture. The Essential plan, priced at $30 per month, allows users to connect up to 3 sales channels and record transactions in other currencies. For more advanced capabilities, you can consider the Plus and Advanced plans, priced at $45 and $100 per month, respectively.

User review:

“This has been a lifesaver on multiple occasions. Another feature I like is the ease of use with categorizing bank transactions and expenses.” (Source: Capterra)

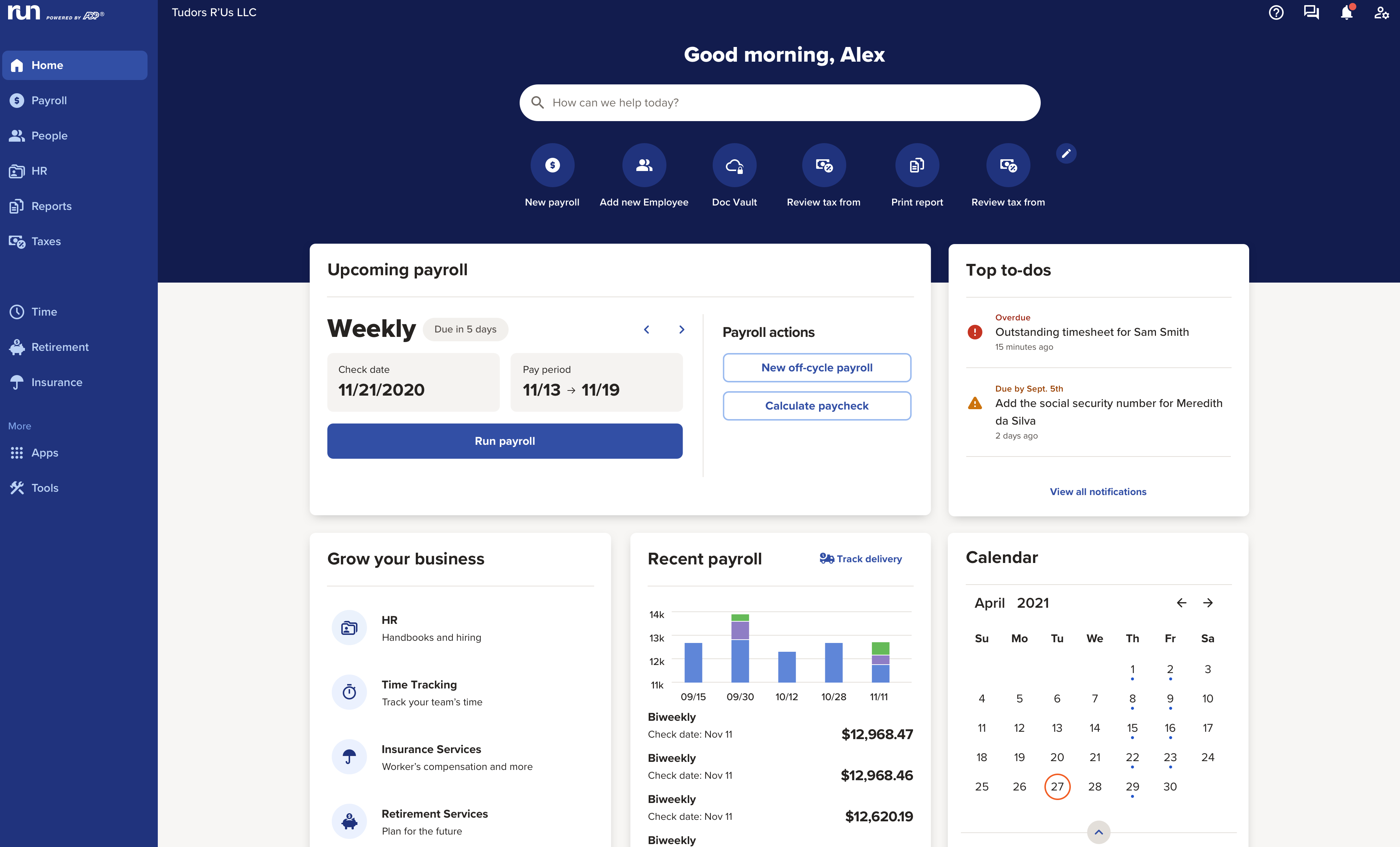

3. RUN Powered by ADP

Overall Capterra user rating: 4.5 out of 5 (772 reviews)

Overall G2 user rating: 4.5 out of 5 (1,294 reviews)

A widely used tool for small and medium-sized businesses, RUN Powered by ADP is a top choice for customized HR services, boasting almost 700,000 small businesses as active customers. It offers a number of payroll payment plans that include HR features such as background checks. The Essential package allows you to manage payroll delivery, W-2 forms, and direct deposit.

Pricing: RUN Powered by ADP offers four different payroll packages with custom pricing tailored to the needs of your small business.

User review:

“I like the amount of detail and information you can get about each paycheck you receive. Especially useful to help insure expense reimbursements go through.” (Source: Capterra)

4. Jotform

Jotform is a great no-code solution to help you automate your small business payroll. With numerous forms you can customize to fit your needs, Jotform is also an excellent no-frills method for collecting both payroll and HR data.

You can customize forms to collect payroll enrollment information from new employees and track your workers’ hours with employee pay rate forms, allowing you to complete weekly payment forms to help you get people paid on time. You can also update active employee payroll records by using Jotform’s payroll change notice form or deduction form.

Plus, you can collect and monitor this information within Jotform Tables using a payroll table template to manage your data in one place. You can connect forms to this spreadsheet so that form data populates it automatically, letting you automate and track employee timesheets and ensure accurate payments.

When you harness the best technology available for your small business, you protect your workers from the frustration of missed paychecks. Automation helps you maintain a strong and trustworthy company culture, keeping an engaged workforce that trusts in your ability to run the business.

Photo by Cytonn Photography

Send Comment: