Best bookkeeping software programs

For small business owners, keeping careful track of finances is critical. Beyond profit, your priorities are to make sure you cover expenses and process payroll in a timely manner. Whether you’re just starting out creating invoices or working on more fleshed-out budgets, selecting the right bookkeeping software is an important decision.

If you’re still tracking your accounting by hand, it’s time to get up to speed with some of the top software programs available. In its annual report “The Practice of Now” from 2019, the enterprise software company Sage found that 56 percent of accountants point to new technologies as a reason for rising efficiency in financial management. In a more recent version of the report, 58 percent said automation improves efficiency in the accounting profession.

Using bookkeeping software isn’t just about digitizing information; it’s also about making rote, manual tasks a thing of the past through financial process automation. To unlock the potential of automation, you’ll need to find the right software for your bookkeeping needs and the overall trajectory of your business.

Here are six great options to consider.

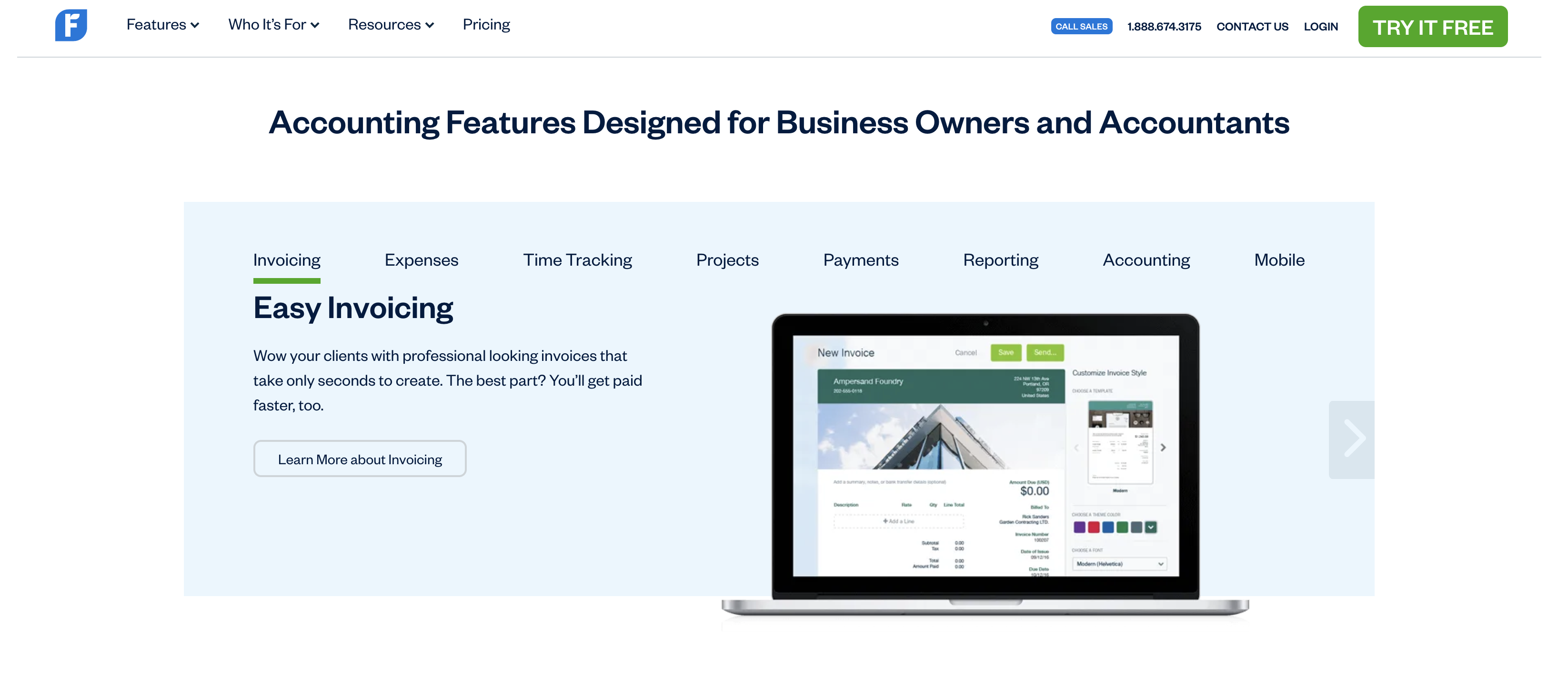

1. FreshBooks

A widely used program for freelancers, independent contractors, and small businesses, FreshBooks is one of the most popular bookkeeping software programs on the market. It helps business owners with invoicing, monitoring expenses, and tracking time to accurately charge clients. The accessible interface allows for seamless collaboration with team members on projects of any size — keeping work in sync, on budget, and on schedule.

FreshBooks is known for automating several key bookkeeping tasks. Its double-entry accounting tool, in particular, uses automatic checks and balances to ensure compliance and accuracy. Last but not least, you can take FreshBooks on the go with its mobile app to stay up to date on your finances, wherever you are.

2. Jotform

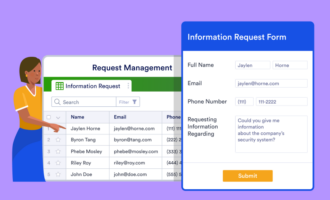

If you want a no-code solution for your bookkeeping software needs, you can handle many accounting department tasks with Jotform. First, choose from a number of prebuilt and customizable form templates, from daily expense forms to invoices, that let you keep precise records of your finances and share them with your company and clients.

With Jotform Workflows, you can organize your bookkeeping tasks into custom workflows, starting with financial workflow templates. You can plug your customized forms into these workflows and assign them to specific employees. Jotform Workflows lets you set up notifications, assign roles and approvers, and streamline tasks — like approving budgets — in just a few clicks.

3. QuickBooks

Intuit QuickBooks is a household name in accounting software programs. As one of the central products in the larger Intuit suite of financial management programs, its scope and capability are particularly impressive. The comprehensive bookkeeping software tracks payments, invoices, and cash flow — all from one business hub, making management easy from a single, central location.

QuickBooks also helps with payroll management for your employees and offers excellent integrations — like the ability to add credit card payment buttons directly to your invoices, which makes customer payment easier. If you want even more precision in handling your finances, a live bookkeeping feature connects you with a specialist who will set up your books for you and train you in keeping detailed records and reports.

4. Wave Financial

Wave is a leading choice for entrepreneurs and independent contractors. It offers a seamless, user-friendly design centered on the accounting basics for freelancers — tracking income and expenses, invoicing, and collecting and making payments.

Best of all, the majority of its features are free. If you’re a one-person business, you may not have to pay anything for basic services. You can take advantage of easily integrated payment methods to use on forms or checkout pages — Wave charges you a fee per transaction rather than requiring a subscription. If you start to take on employees, another flexible option is to use Wave’s payroll software at a low monthly cost to automate payments and organize tax statements.

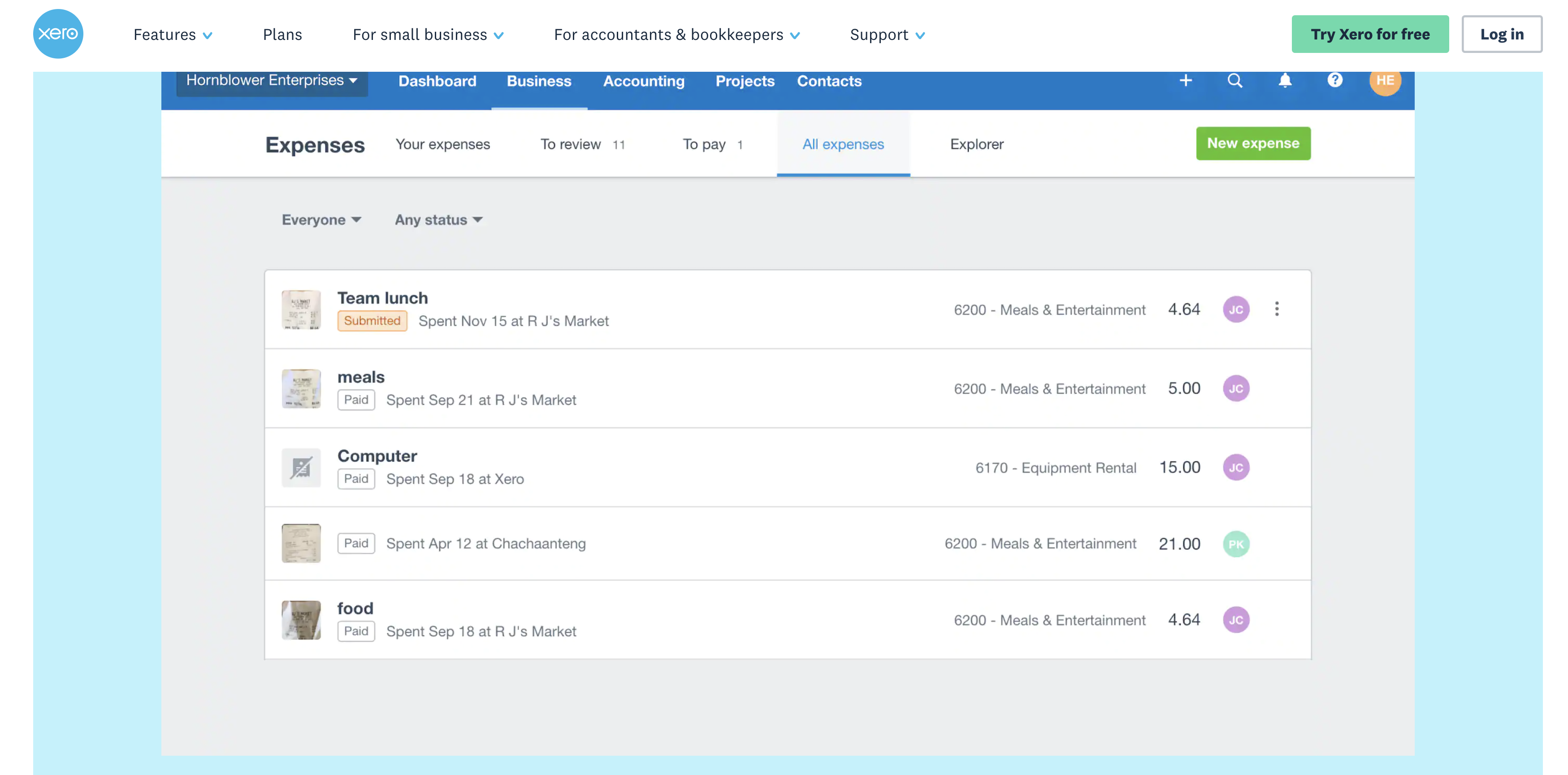

5. Xero

Xero is a no-frills bookkeeping software that promises to “simplify everyday business tasks” with a consolidated set of tools to manage your accounting. With more than 3 million subscribers globally, it’s one of the leading choices for small businesses.

Xero is also particularly adept at guiding the uninitiated through the world of bookkeeping with plenty of resources — including a directory to help you find a trusted accountant or bookkeeper and handy guides to walk you through financial processes. It offers tiered and specialized plans depending on the size of your business, and it has a partnership with Gusto to provide payroll automation as well.

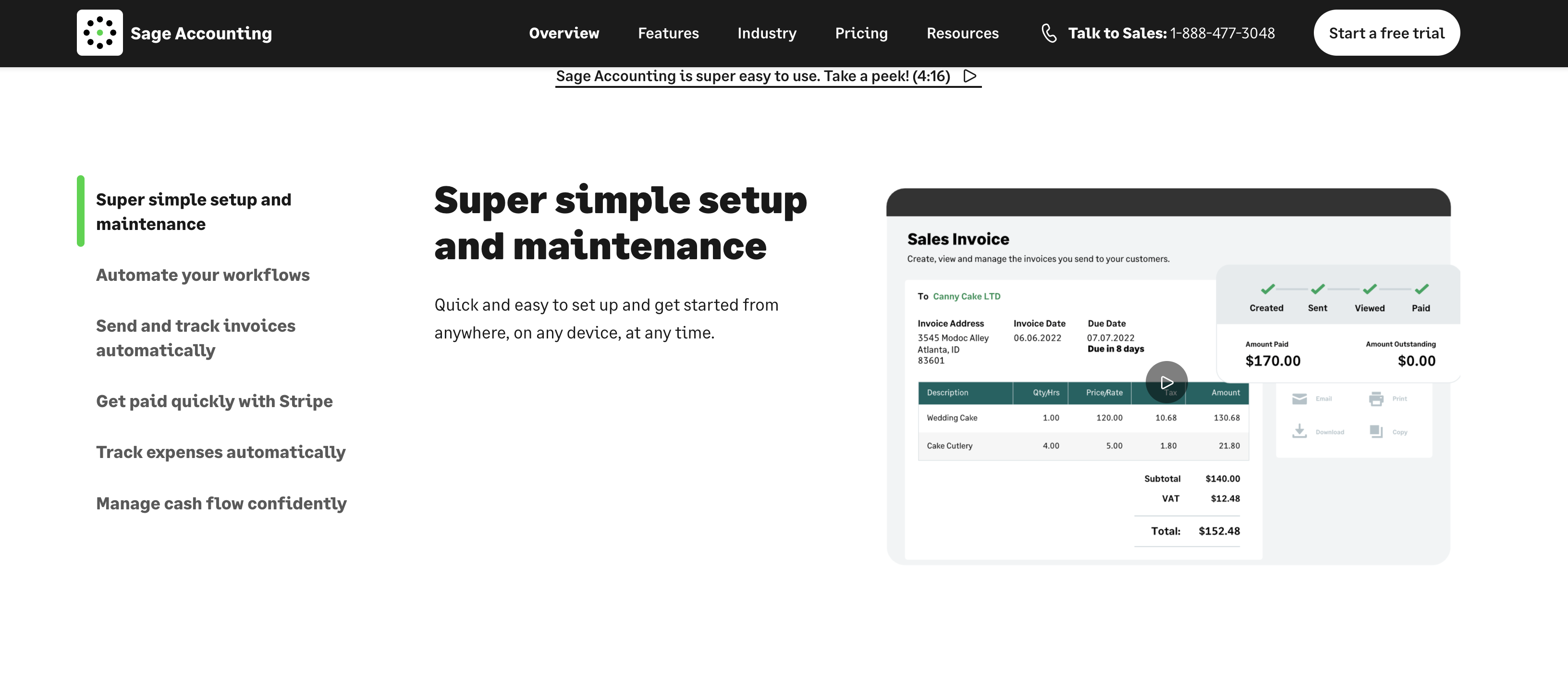

6. Sage 50cloud

A comprehensive cloud-based program, Sage 50cloud offers a range of accounting options for those looking for bookkeeping software that allows for complex finance management. In-depth tools like advanced inventory management, year-over-year reporting, and job costing make it a good choice for businesses that need expanded capabilities.

In that spirit, it also boasts a handful of helpful and niche add-ons from other companies that can take your bookkeeping to the next level. For example, AutoEntry automates the input of expenses, easily pulling information from receipts and bills to ensure timely reimbursement for your employees. The ShipGear integration helps streamline the management of shipping and logistics by connecting directly with your inventory to quickly pull information and track shipments.

Choosing the right software for your business is an important responsibility that takes research and a clear understanding of your company’s needs. When you choose the right program, you can be sure of your financial footing and stay on top of your bookkeeping like never before.

Send Comment: