Top spending tracker apps

If you’re trying to gain control of your spending and improve your financial health overall, there’s no better place to start than with the right spending tracker app.

Tracking spending helps individuals and businesses alike get a clear, accurate picture of their current finances. It also helps with creating and sticking to a budget. If you’re not sure where to start, keep reading. We’ve researched and evaluated the best spending tracker apps for 2026 and beyond.

What is a spending tracker app?

A spending tracker app is designed to help you capture financial data for each purchase you make. Some apps may offer additional features, such as the ability to sort and categorize expenditures, which can make refining and sticking to your budget even easier.

The benefits of using a spending tracker app

Using an app to track your spending has a number of benefits. An app makes it easy to capture relevant data and access it from a number of devices, even when you’re out and about or on vacation, helping you stick to your budget.

A clear, up-to-the-minute picture of your finances helps you gain control of purchasing habits and identify areas where you can trim your spending. Tracking your spending with an app can help you reach your financial goals and even plan more efficiently for tax season too.

How to choose the right spending tracker app

Generally, you’re more likely to use a tracking app consistently if it offers the features you need and helps you meet your goals. That’s why it’s a good idea to review a few different apps and choose the one that’s best suited for your particular needs.

That said, with so many potential apps to choose from, it’s helpful to look for a few important features. Consider the following:

- Security features: Above all else, the tracking app you choose should boast strong security measures. Backup and restore functions help you reclaim data in the event of errors or loss.

- User-friendly navigation and user interface (UI): Any app that’s intended for consistent, daily use should offer an intuitive layout and easy navigation. Can you find what you’re looking for fairly quickly and without assistance? Is the interface uncluttered and logically designed? If not, you might find it a challenge to make using the app part of your daily routine.

- Integrations with other banking and financial apps: Unless you want to manually input every expenditure, look for an app that integrates with your financial institution’s site or app. A seamless connection between the two will help ensure all purchases are logged.

10 best spending tracker apps

1. Jotform

Key features

Jotform Apps’ Spending Tracker App template can help you oversee your spending, calculate your savings, and more. It’s a way to create your own spending tracker app customized to your specific needs. Use the personal budget tracking form in the app to log and categorize both income and expenses.

Your records are automatically saved to Jotform Tables. You can even add more forms to cover specific project budgets, like a budget for upcoming travel or a special event.

Pros and cons

Pros

- It’s highly customizable.

- You can add fields for whatever you need to track.

Cons

- You’ll need to estimate your usage needs (such as how many form submissions you expect each month) to choose the right plan.

- It may offer more features than some people need to just track spending.

Plans and pricing

Choose from five plans at varying price points, each offering higher limits on data storage and the number of form submissions, and more access to premium features. Jotform also offers a free Starter plan.

Available platforms and devices

You can access Jotform Apps on any device, including smartphones, tablets, and desktop computers.

Ratings on App Store and Google Play Store

- Apple App Store: 5.0 out of 5 stars, with nearly 32,000 ratings (for the Mobile Forms app)

- Google Play Store: 4.8 out of 5 stars, with more than 22,000 ratings (for the Mobile Forms app)

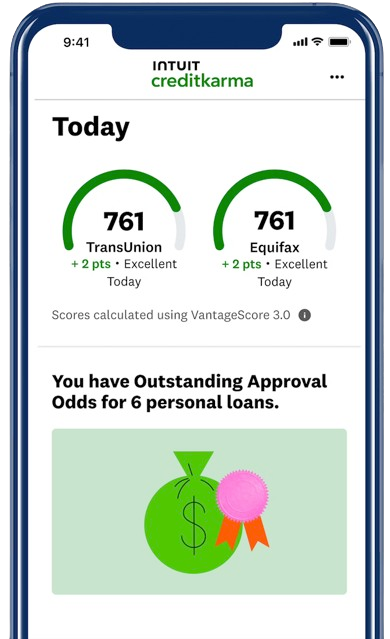

2. Credit Karma

Key features

Many features of the popular budgeting app Mint (which was closed in early 2024) have been migrated over to Credit Karma’s app. You can track all expenses and account balances, work to build your credit rating with Credit Builder, monitor your net worth over time, and spot places where you can trim expenses and save more.

Pros and cons

Pros

- It provides daily credit scores.

- It offers a Credit Builder program to help users improve their credit scores.

Cons

- The platform has ads and promotions.

- To use the Credit Builder tools, you must open a Credit Karma checking account.

Plans and pricing

Credit Karma is free to use.

Available platforms

Intuit’s Credit Karma is available in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.8 stars out of 5, with more than 6.9 million ratings

- Google Play Store: 4.7 stars out of 5, with more than 2.8 million ratings

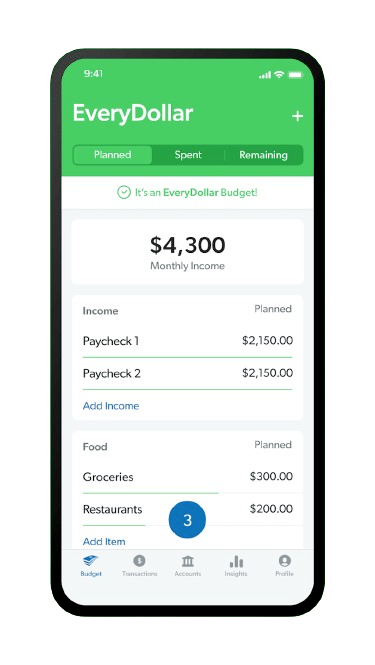

3. EveryDollar

Key features

Financial guru Dave Ramsey’s EveryDollar app uses back-to-basics features to put the focus squarely on budgeting and expense tracking. It allows users to create custom categories, in addition to the eight default categories.

Pros and cons

Pros

- It’s easy to use.

- The free version offers essential budgeting functions.

- It includes budget customization options.

Cons

- Some features, including syncing with bank accounts, are behind the paywall.

- It’s a simple tool that may not have all the features some users need, like advanced reporting.

Plans and pricing

The free account offers access to basic budgeting tools. The paid account adds bank integration, customized budget reports, and goal setting features for $79.99 per year or $17.99 per month when paid monthly.

Available platforms and devices

EveryDollar is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.7 out of 5 stars, with more than 63,000 ratings

- Google Play Store: 3.4 out of 5 stars, with more than 11,000 reviews

4. Expensify

Key features

Financial management app Expensify offers both individuals and organizations a simple yet powerful way to manage money and expenses. Free features include expense tracking, as well as reimbursement, invoicing, bill payment, and even travel-booking features.

Pros and cons

Pros

- It has a user-friendly interface

- It offers a wide variety of tools and features.

Cons

- Some users report problems with the receipt-scanning function.

Plans and pricing

Expensify offers free access and a free trial period for individuals. Groups can take advantage of two plans: Collect, which offers automated receipt organization and reimbursement for $5 per month and Control, which adds corporate card management, expense reporting, approvals and reimbursements for $9 per month.

Available platforms and devices

Expensify is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.7 out of 5 stars, with more than 136,000 ratings

- Google Play Store: 4.4 of 5 stars, with more than 26,000 ratings

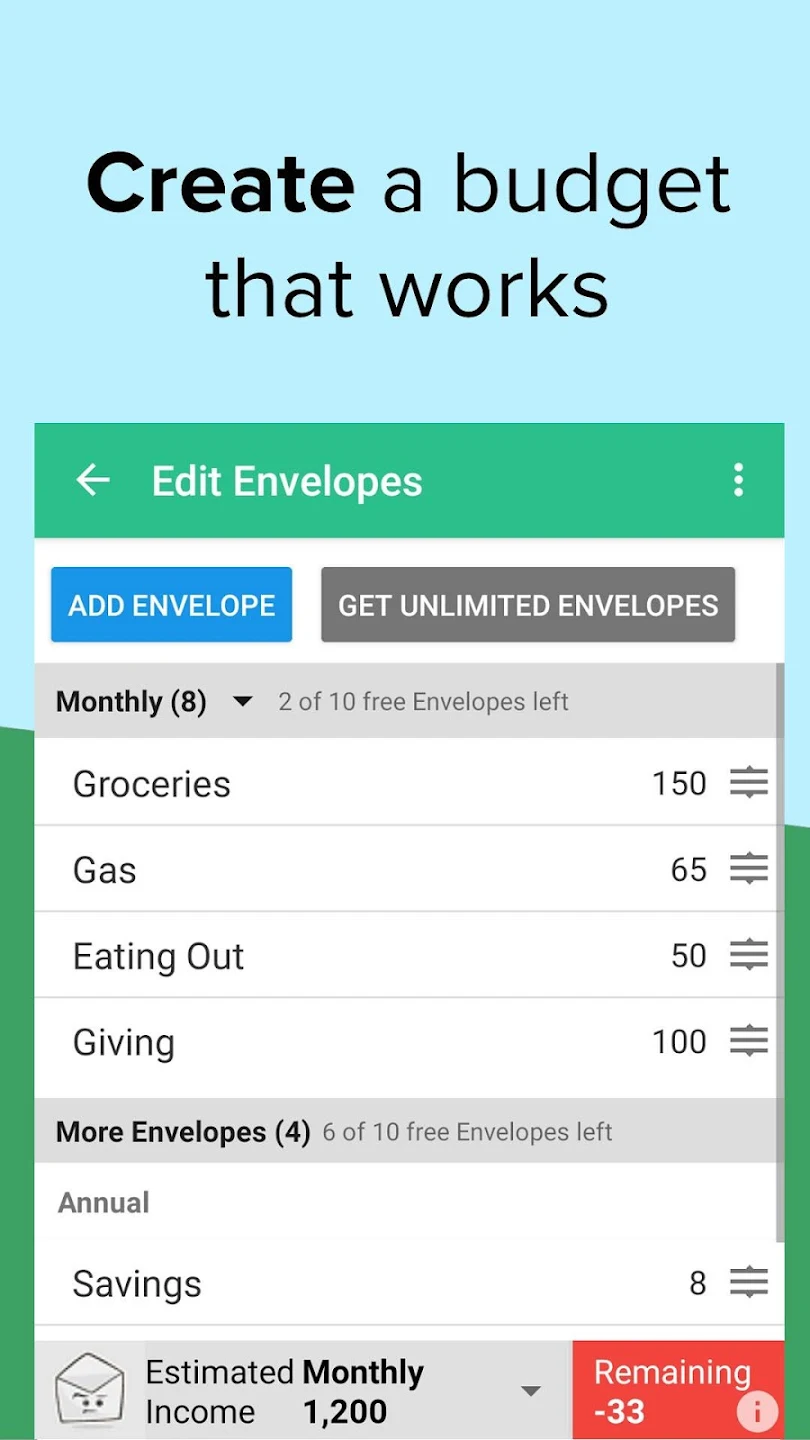

5. Goodbudget

Key features

Goodbudget offers debt-tracking and budget-syncing among family members, as well as the ability to set and manage savings goals. However, it requires 100 percent manual input, as the app does not support bank account integration.

Pros and cons

Pros

- It has a simple, effective layout.

- It uses the popular “envelope” budgeting system.

Cons

- It doesn’t integrate with bank accounts, so all data has to be entered manually.

- The free plan only includes 20 “envelopes,” or expense categories.

Plans and pricing

Goodbudget offers two different plans. There’s a free version that comes with 10 regular envelopes — these are for everyday categories of spending like eating out, groceries, child expenses — plus 10 annual or goal envelopes. The Goodbudget Premium plan costs either $10 per month or $80 annually, and offers access to unlimited regular and annual or goal envelopes, plus seven years of transaction history, debt tracking, and support through email.

Available platforms and devices

Goodbudget is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.6 out of 5 stars, with nearly 13,000 ratings

- Google Play Store: 4 out of 5 stars, with more than 19,000 ratings

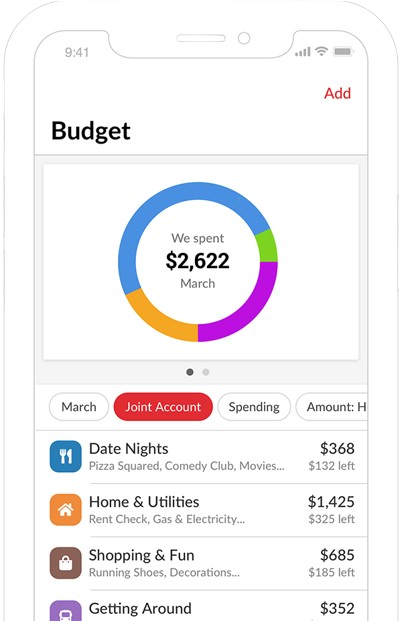

6. Honeydue

Key features

Honeydue is a budgeting app geared toward couples. You can track spending, get bill reminders, and sync your budget with a partner.

Pros and cons

Pros

- It’s designed specifically for couples.

- It offers Integrations with banking apps and websites.

- It also helps couples manage investment accounts.

Cons

- It doesn’t offer a desktop version.

- Customer support is only available through a community forum.

- Ads within the app can be distracting.

Plans and pricing

Honeydue is free to use. It’s supported by ads within the app.

Available platforms and devices

Honeydue is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.5 of 5 stars, with more than 8,800 ratings

- Google Play Store: 3.7 out of 5 stars, with more than 2,400 ratings

7. PocketGuard

Key features

PocketGuard offers integrations with thousands of financial institutions, as well as personalized spending reports and budget tools. With the “In My Pocket” function, you’ll know how much you have in your discretionary funds at any time.

Pros and cons

Pros

- You can sync an unlimited number of bank accounts to the app.

- It lets you keep track of how much you have left to spend in a budget period.

Cons

- The free plan is somewhat limited.

- Users must connect the app with at least one of their bank accounts.

Plans and pricing

While many people find the free plan adequate, you’ll need to pay to use some of the more advanced tools. You can choose to pay $12.99 monthly or $74.99 annually.

Available platforms and devices

PocketGuard is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.6 out of 5 stars, with more than 7,000 ratings

- Google Play Store: 3.7 out of 5 stars, with more than 2,000 ratings

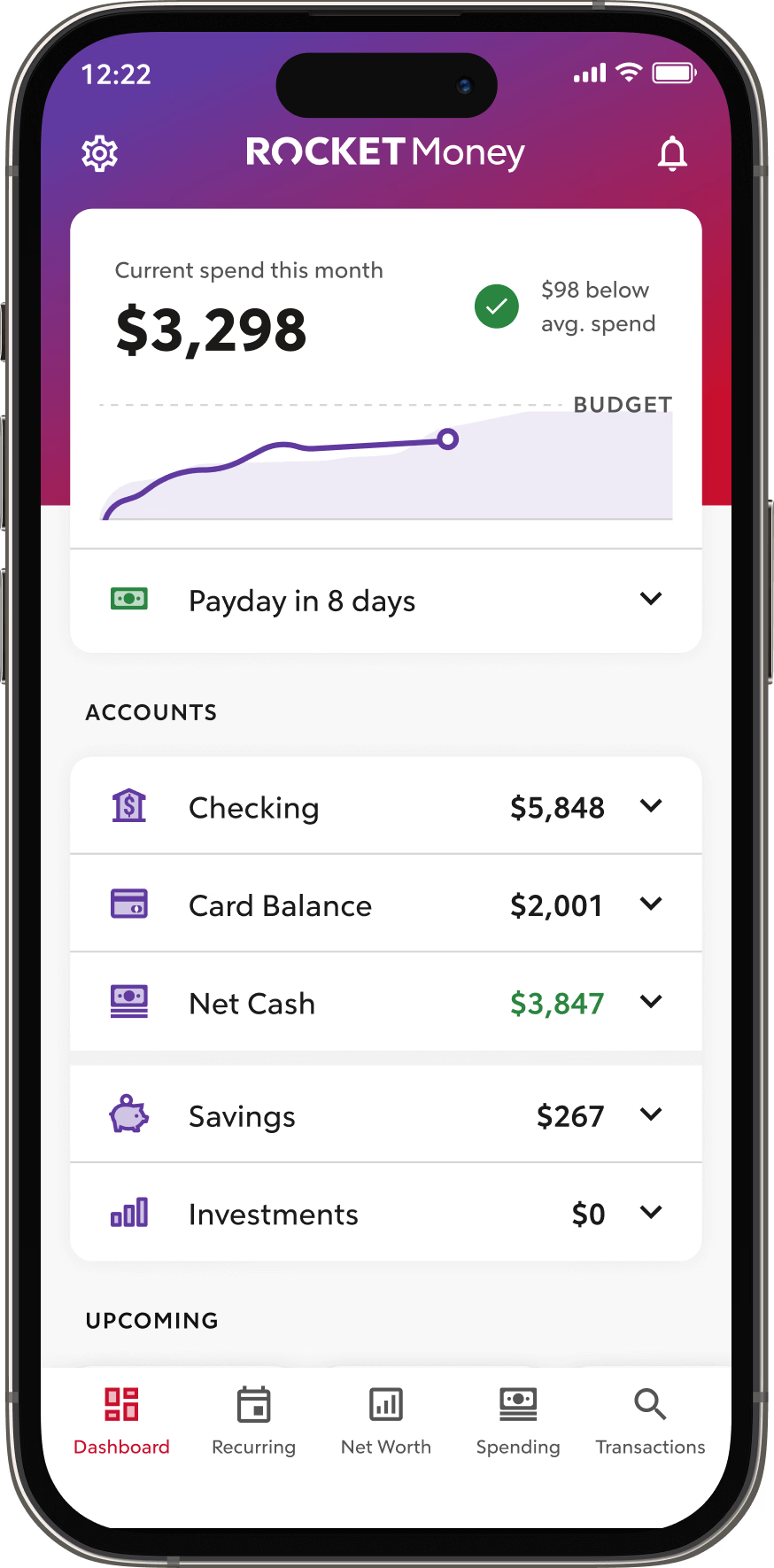

8. Rocket Money

Key features

Rocket Money may be better known for its robust subscription cancellation concierge tool. But it also provides a fairly extensive suite of financial management tools — including budgeting, expense tracking, and bill management — that can connect and sync with a number of different account types. While that function isn’t available to users of the free plan, you can take advantage of it for a relatively low monthly payment.

Pros and cons

Pros

- It offers a reasonably priced premium plan.

- It offers tools to help you easily identify and cancel subscriptions.

- The user interface is easy to navigate.

Cons

- It doesn’t offer debt repayment tools.

- It offers only basic investment tracking and analysis tools.

- Most features require you to pay a subscription fee.

Plans and pricing

Although Rocket Money is free to download and use, most of its more useful features are behind the premium paywall. Premium features range from $6–$12 per month when paid monthly.

Available platforms and devices

Rocket Money is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.2 out of 5 stars, with more than 65,100 ratings

- Google Play Store: 4.3 out of 5 stars, with more than 56,000 ratings

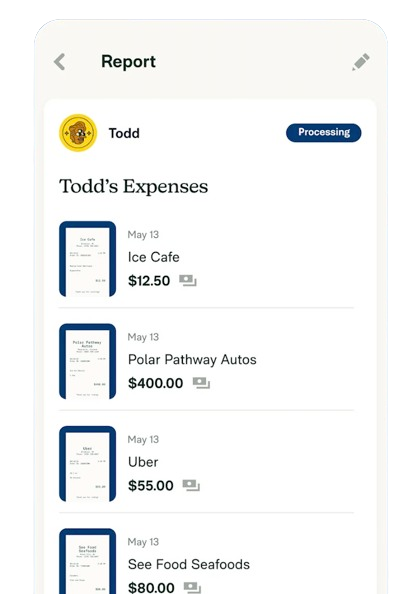

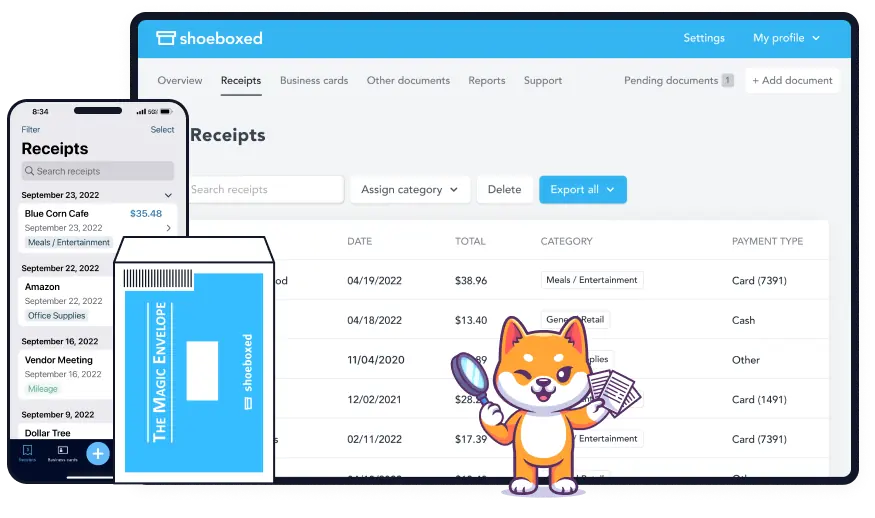

9. Shoeboxed

Key features

Keep track of and efficiently categorize all your receipts with Shoeboxed. You can even forward receipts through email to be recorded in your Shoeboxed account. It offers integrations with other apps such as Quickbooks for more efficient bookkeeping.

Pros and cons

Pros

- It has a clutter-free user interface.

- Users can add transactions by forwarding receipts via email.

Cons

- It offers limited collaboration features.

- All users can see any documents that have been uploaded to the account. It does not offer user permissions settings.

Plans and pricing

Shoeboxed does not offer a free plan, but it does offer a 30-day free trial period on all of its paid plans. Those plans start at $23 per month, when paid annually, for freelancers and individuals, and go up to $71 per month, paid annually, for high-volume businesses.

Available platforms and devices

Shoeboxed is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store/Play Store

- Apple App Store: 4.1 out of 5 stars, with about 125 ratings

- Google Play Store: 2.3 out of 5 stars, with about 300 ratings

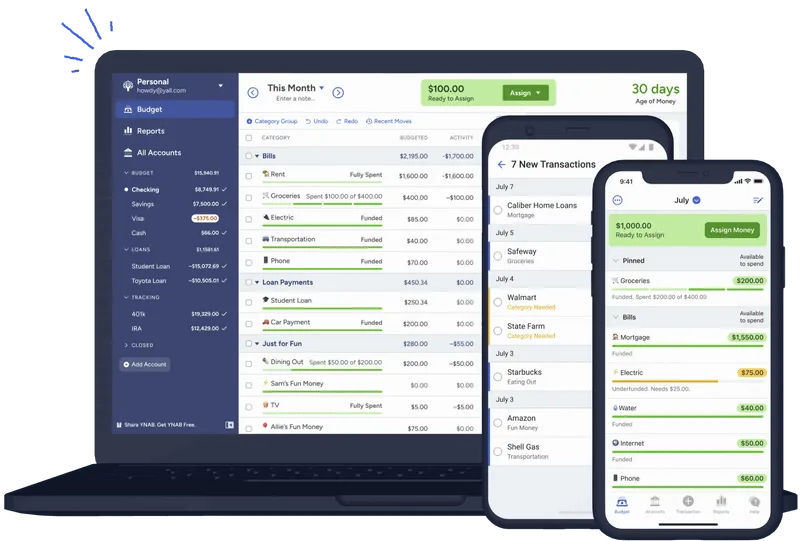

10. YNAB (You Need A Budget)

Key features

It’s not hard to understand why this is one of the most popular and often-recommended spending tracker apps around. Offering robust goal-setting tools, detailed financial reports, educational resources, budget sharing, and more, YNAB is a budgeting app that’s suitable for most consumer needs.

Pros and cons

Pros

- Its Direct Import feature links with many global financial institutions.

- Enables you to share budgets with others.

- Its “give every dollar a job” approach helps you rein in spending.

Cons

- It doesn’t offer bill payment reminders.

- It has a steeper learning curve than some other apps.

- It doesn’t offer a free plan.

Plans and pricing

YNAB offers a free trial for 34 days. After that trial period expires, users pay a flat fee of $14.99 per month, or $99 per year if paid annually.

Available platforms and devices

YNAB is available for download in both the Apple App Store and the Google Play Store.

Ratings on App Store / Play Store

- Apple App Store: 4.8 out of 5 stars, with nearly 51,000 ratings

- Google Play Store: 4.7 out of 5 stars, with more than 18,500 ratings

Choosing a spending tracker app

No matter your personal circumstances, there’s a spending tracker app that’s right for you. Some offer a streamlined tracking environment, while others add robust financial management tools for budgeting and more. It’s a good idea to take advantage of free trial periods when offered so you can be sure you’re selecting the app that best fits your financial needs.

Photo by Ono Kosuki

Send Comment: