Top best business expense tracker appsppet

Tracking your business expenses — and your profits — is a key part of managing a successful business. Whether you’re starting your business from scratch or managing a successful business through an expansion, business expense tracking is essential.

Expense tracking refers to the process of recording, organizing, and monitoring what your business is paying in bills, fees, and other expenses. It’s also important to accurately track expenses because some expenses may be tax-deductible. Accurate expense tracking can help you decrease your tax payments, and it also helps you monitor your budget and determine just how profitable your business is.

Top benefits of using business expense tracker apps

Expense tracker apps offer many benefits. They can streamline the process of tracking expenses, saving you time. Often, these apps are set up with expense categories, so you can organize expenses in a way that makes sense when it comes time to file your taxes.

Apps have other perks too. Some apps allow you to automatically track expenses. You may be able to sync the app with a business checking account or credit card so you don’t have to worry about manually inputting expenses. This feature can help prevent data entry errors, ensuring that you capture all your expenses.

Many apps also allow you to digitize your receipts, leaving you better organized and saving you from having to track and manually input paper receipts.

Perhaps most importantly, expense tracker apps allow you to easily see all of your expenses in one place. You can create reports, monitor expenses, and quickly tell if something isn’t right.

Tips for finding the right business expense tracker app

To get the maximum value out of your business expense tracker app, you’ll need to choose the app that’s best for your business. Consider a few factors as you explore your options:

- Features: Think about the features that are most important to you. Features like automatic mileage tracking, the ability to create and monitor invoices, payroll capabilities, and receipt digitization are all helpful, but they can also drive up the cost of an app subscription. Focus on the features that will be the most beneficial to your business.

- Integrations: Look for an app that integrates with your existing systems, like your payroll and bookkeeping software and your invoicing system.

- Number of users: Think about how many people need to be able to access the app. Some app plans allow for a certain number of users, while others charge by the seat.

- Price: Finally, consider the app’s price, which can vary significantly. Be sure to pay attention to what’s included with each tier, since the lower tiers for some apps come with limited features. While you don’t want to overspend on an app, remember that expense tracker apps can offer significant value in terms of accuracy and time savings.

7 top business expense tracker apps

Let’s take a look at some of the top expense-tracking apps to consider.

1. Jotform Apps

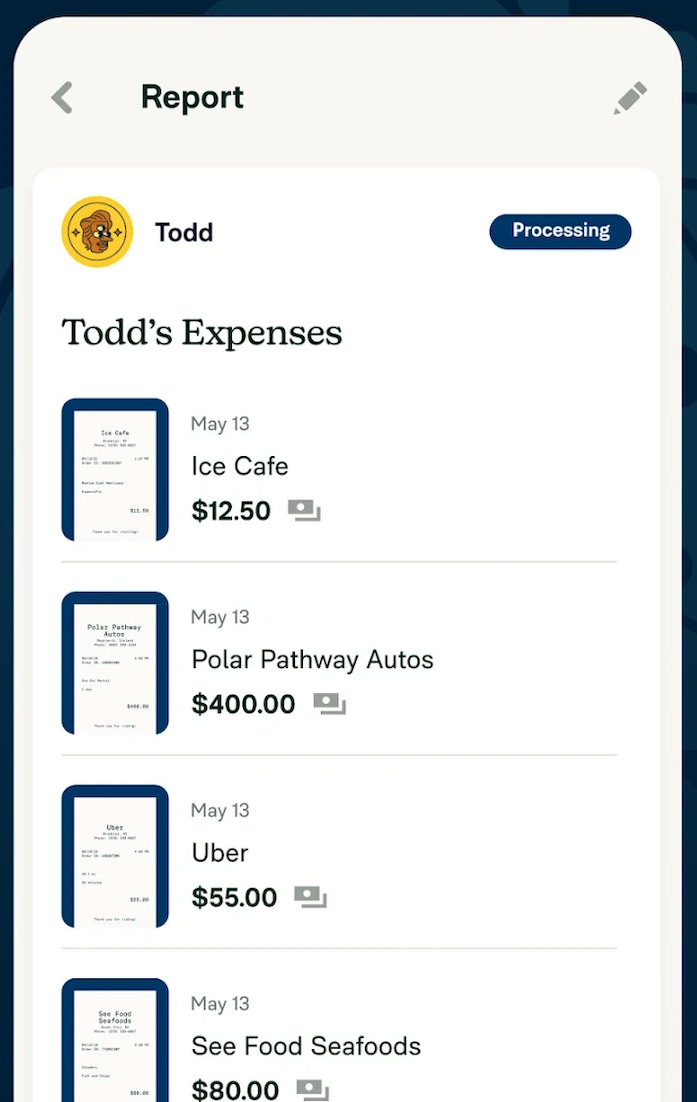

Jotform is a versatile platform that you can use to create forms, apps, spreadsheets, and more. Jotform’s shared expense tracker app allows you to manage expenses, and it integrates with more than 30 payment platforms. You can also customize one of Jotform’s many finance app templates and tailor it to your expense tracking needs.

With Jotform’s expense report app, you can track employee expenses. Employees can fill out the expense report form, choosing a payment type, expense type, description, and more, for detailed recordkeeping. The expense report template lets managers and finance staff easily track their expenses.

Plus, Jotform Workflows simplifies and streamline the expense approval process so you can easily monitor your expenses.

Pricing

Jotform offers five plans, including a free Starter plan, a Bronze plan for $34 per month, a Silver plan for $39 per month, a Gold plan for $99 per month, and an Enterprise plan with custom pricing.

Key features

Multiple expense-tracking templates, integration with 30-plus payment gateways to collect payments, no-code app building, easy sharing options

Pros and cons

Pros

- Ready-to-use templates make it easy to start tracking expenses.

- You can easily share your tracking app through a link, email invitation, or QR code, or embed it in your website.

- It’s a highly versatile tool that you can customize to your needs without any coding.

Cons

- Jotform Apps isn’t a dedicated expense-tracking app, so it may require some customization.

Available platforms

iOS and Android

Ratings

5.0 stars on the App Store, 4.8 stars on Google Play

2. Expensify

Expensify is a comprehensive business expense tracker app. In addition to expense tracking and expense report generation, it also offers bill pay, invoicing, and payroll capabilities, so it’s an all-in-one choice for businesses and startups.

Expensify’s receipt-scanning app automatically identifies the receipt merchant, date, and amount, saving you time from having to enter data manually, making it a simple way to digitize your records. Businesses can also apply for the Expensify Visa credit card, which includes perks like up to two percent cash back on purchases and savings of 50 percent on your monthly Expensify subscription.

Pricing

Expensify offers multiple plans, including a Collect plan for $5 per user per month and a Control plan for $9 per user per month.

Key features

Receipt-scanning app, payroll and invoicing management, Expensify Visa corporate credit card, expense reports

Pros and cons

Pros

- Businesses with an Expensify credit card can save 50 percent on their Expensify bills.

- The receipt-scanning app simplifies the process of digitizing receipts.

- It’s a highly versatile platform that integrates with tools like QuickBooks and Xero.

Cons

- Because plans are charged per user and per month, costs can add up for larger businesses with many users.

- Some features are only available with the more expensive plan.

Available platforms

iOS and Android

Ratings

4.7 stars on the App Store, 4.4 stars on Google Play

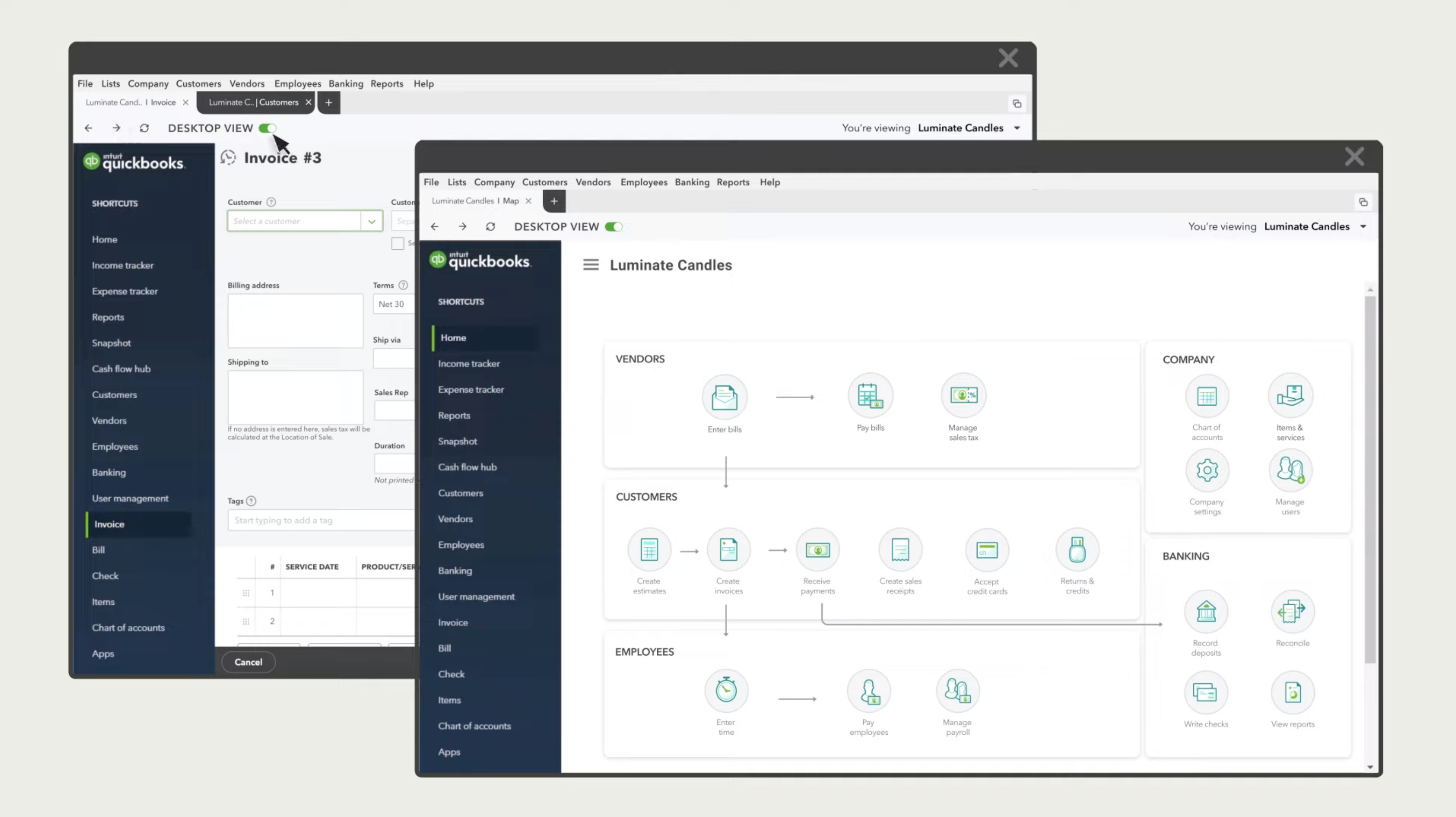

3. QuickBooks Online

The QuickBooks Online desktop app allows you to stay signed in to your QuickBooks account for up to six months at a time, so you don’t have to repeatedly log in through a web browser. You can access a navigation map similar to what you use in QuickBooks Desktop, and you can access records for multiple companies and switch between records with ease.

The app is available for Windows and Mac computers and allows finance managers and accountants to easily navigate and work in records for different companies without worrying about time-consuming sign-ins. As you work in the app, all of your changes automatically synchronize with the web version of QuickBooks.

Pricing

The QuickBooks Online app is free with a QuickBooks subscription.

Key features

Automatic syncing of bank and credit card transactions, invoicing functionality, option to create estimates and collect payments, detailed reporting, tax tutorials and support, automatic syncing across the web and app versions

Pros and cons

Pros

- You can stay signed in to the app version of QuickBooks for up to six months.

- The app makes it easy to navigate between different companies’ accounts without having to sign in multiple times.

- It has comprehensive features for estimating, invoicing, payroll, taxes, and more.

Cons

- The app is for desktop, not mobile.

- QuickBooks can involve a significant learning curve if you’re just getting started.

Available platforms

Windows and macOS computers

Ratings

QuickBooks Online isn’t available in app stores.

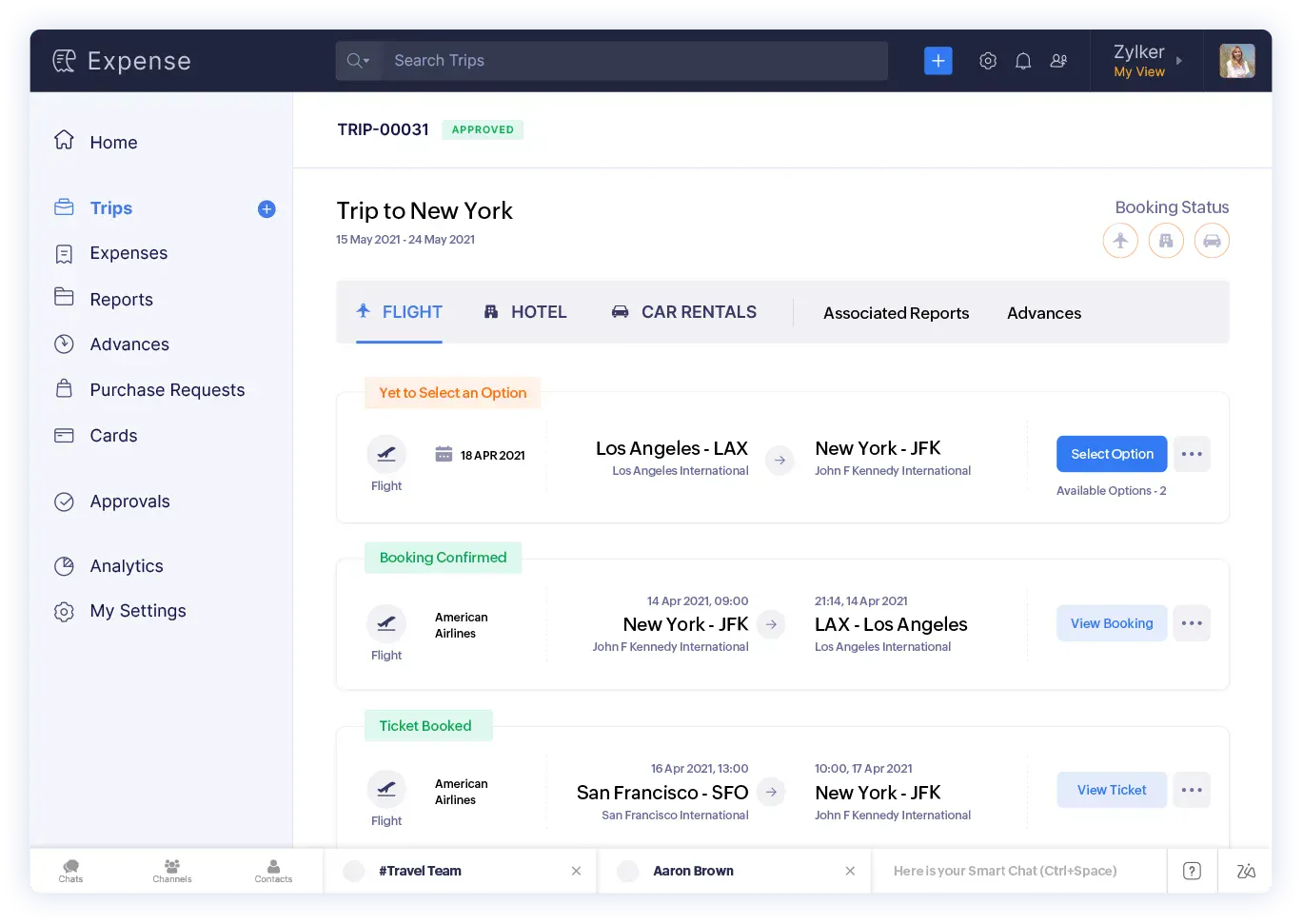

4. Zoho Expense

Zoho Expense is an online expense tracker that simplifies the process of tracking your expenses. The platform automates your expense reporting, helping you avoid manual errors. It includes the option to create budgets and spending limits. Zoho Expense even has AI-driven fraud detection to help spot issues as you prepare for tax season.

Pricing

Zoho offers four plans, including a free plan, a Standard plan for $4 per user per month, a Premium plan for $7 per user per month, and a custom plan.

Key features

Corporate card reconciliation, receipt management, mileage tracking, purchase requests, expense auditing, expense reports, purchase requests, reimbursement

Pros and cons

Pros

- It offers a strong suite of travel expense management tools, including a self-booking tool, pre-travel approval flows, and automated visa requests.

- AI-driven insights help spot fraud issues and prepare businesses for tax seasons and audits.

- It offers many automation options, including workflow rules, automated reporting, and custom functions.

Cons

- Features are limited with the free and low-tier plans.

- Access to premium, personalized support is a paid add-on.

Available platforms

iOS and Android

Ratings

4.8 stars on the App Store, 4.7 stars on Google Play

5. SAP Concur

The SAP Concur mobile app allows you to easily manage expenses on the go. The Expenselt feature automatically creates, itemizes, and categorizes expenses when you take a photo of your receipts. The automatic distance capture feature helps track travel-related costs for more accurate employee reimbursement. You can use the app to review and approve expense reports and invoices, book flights and hotel rooms, get hotel suggestions, and more.

Pricing

The mobile app is free for SAP Concur subscribers. Subscription prices aren’t listed on the SAP Concur website.

Key features

Flight and hotel booking, automatic distance capture, automatic receipt digitization, automated hotel suggestions based on preferences, option to integrate travel itinerary with the Triplt app for travel alerts

Pros and cons

Pros

- The digital invoice capture feature streamlines data input.

- Travel resources include the ability to book flights and hotels and receive travel updates.

- Automatic distance capture allows more accurate mileage tracking.

Cons

- Pricing isn’t available on the website.

Available platforms

iOS and Android

Ratings

4.8 stars on the App Store, 4.5 stars on Google Play

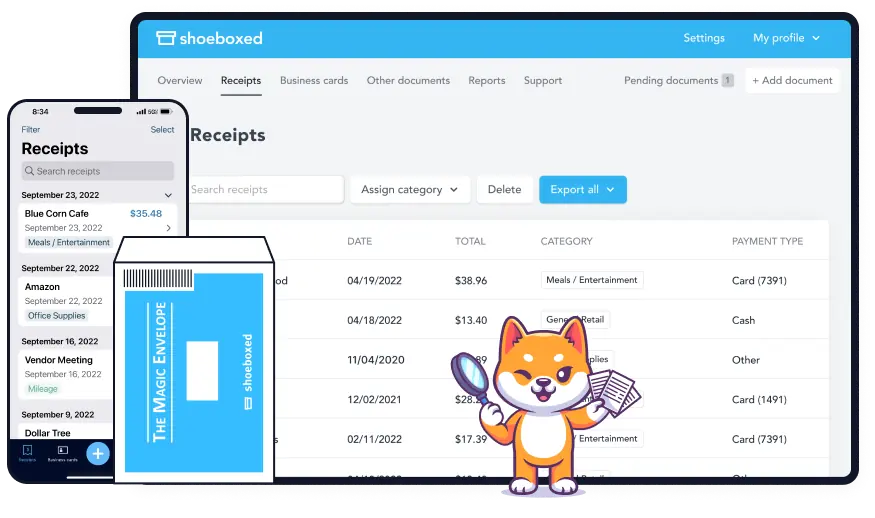

6. Shoeboxed

Shoeboxed is a receipt scanner app that simplifies the process of tracking your receipts. You can use the app to take photos of your receipts, and the app will then automatically import receipt data. You can then search and edit receipts for your expense reporting, and the data will automatically be organized into 15 tax categories for easier tax filing. The app also features a free mileage tracker so you can monitor your business mileage. If you have a huge backlog of receipts, Shoeboxed offers a service where you can mail in your physical receipts to be digitized.

Pricing

The Shoeboxed app is included with a Shoeboxed subscription. The Startup subscription is $23 per month, the Professional plan is $47 per month, and the Business plan is $71 per month.

Key features

Custom reporting, easy receipt digitization, mileage tracker

Pros and cons

Pros

- You have the option to use the app to digitize receipts or mail them in to be scanned and added to your account.

- Receipts are sorted into 15 categories for easier tax filing.

- The app includes a mileage tracker.

Cons

- Features are somewhat limited compared to other expense tracker apps.

Available platforms

iOS and Android

Ratings

4.5 stars on the App Store, 2.3 stars on Google Play

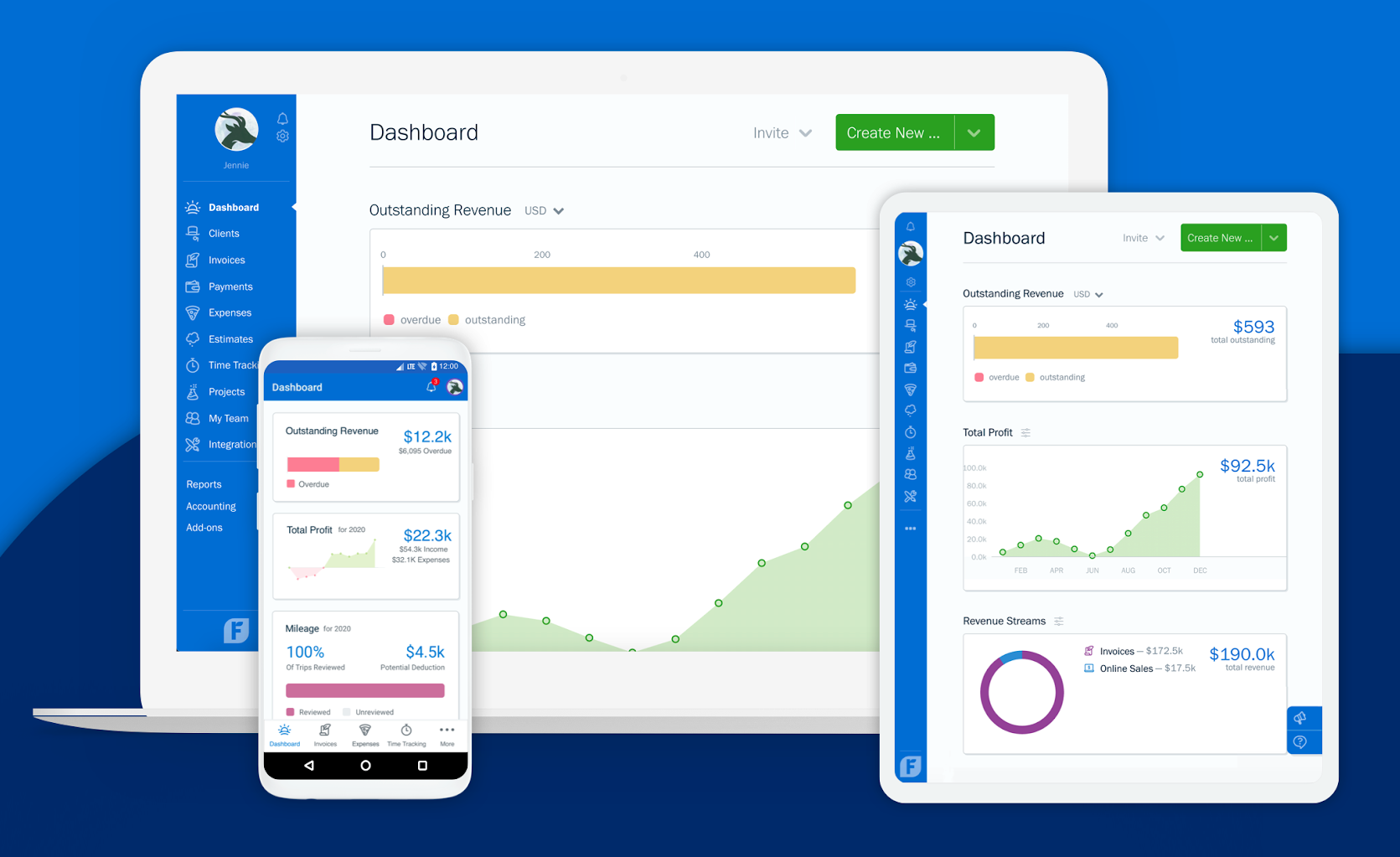

7. FreshBooks

The FreshBooks app allows you to do your expense tracking and accounting anywhere while accessing FreshBooks’ full suite of tools. When you connect the app to your bank account or credit card, your expenses are updated daily, so it’s easy to stay on top of your spending. The platform’s automatic mobile receipt scanning will automatically capture the merchant, total, and taxes from each receipt, saving you time on data entry.

QuickBooks also categorizes expenses for tax time, making it easier to file. All of the app activity automatically syncs with your FreshBooks desktop platform, so you’re always looking at the most up-to-date information.

Pro Tip

With Jotform’s Freshbooks integration, accessible via Zapier, you can effortlessly generate professional invoices for your customers as they fill out your Jotform forms.

Pricing

FreshBooks features four plans. The Lite plan is $19 per month, the Plus is $33 per month, the Premium is $60 per month, and the Select plan is available with customized pricing.

Key features

Automatic mileage tracking, mobile invoice creation, automatic receipt digitization, in-app messaging for recordkeeping

Pros and cons

Pros

- Automatic receipt digitization captures key information like totals and merchant details to save you time on data entry.

- When connected to your credit cards or bank account, the platform automatically collects expense information daily.

- It offers a 30-day free trial.

Cons

- Features are limited with the lower-tier plans.

Available platforms

iOS and Android

Ratings

4.7 stars on the App Store, 4.5 stars on Google Play

The best business expense tracker app for your needs

Accurately tracking your business expenses isn’t only important for tax purposes. It’s also an essential step in monitoring and reducing your expenses and increasing your profits. All of these apps are great options, but it’s important to choose an app that’s right for your business, your specific tracking needs, and your budget.

With the right app, you can save time and improve the accuracy of your expense tracking.

Photo by Karolina Kaboompics

Send Comment: