Have you ever experienced the frustration of sending an invoice only to wait — and then wait some more — for payment? If your organization is slow to receive payment for invoices, or struggles itself to stay on top of incoming invoices, you might be searching for a solution.

Making timely, accurate payments is critical for success in business. After all, late or incorrect payments not only affect your business operations but also strain your professional relationships. Luckily, there’s something you can do to avoid the headache: Automate your payment process.

In this article, we look at what payment automation is, how it works, and what advantages it can offer your organization. Plus, we show you how Jotform can support your payment automation efforts.

An introduction to payment automation

So, what is payment automation? As the name suggests, it’s a way to transfer money without significant human intervention. In a professional context, a business implements payment automation by setting up a digitized process to handle submitting invoices and requesting payment, or alternatively receiving invoices, approving them, and transferring funds to a payee’s account.

Payments can be made in different ways, such as by credit card, ACH transfer, check, wire, or virtual card, and are typically made to vendors, partners, and suppliers, though they can sometimes also be made to customers (in the case of a refund, for example).

Businesses set up payment automation to streamline and speed up the payments process. Done manually, making or receiving payments can often take weeks or months — which can be frustrating and affect budgets.

Manual payments also come with greater chances of errors, such as sending the wrong amount of money to the wrong bank account. Automation makes the process quick, efficient, and comparatively error-free.

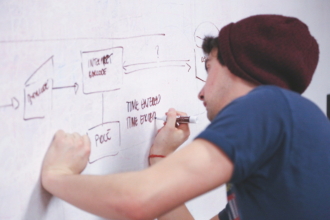

The payment automation process

While you can automate much of the payment process with technology, some steps still require human input. In general, here’s how payment automation works:

- Setup: Prior to any automatic payments being made, the payor has to set up the payee’s financial account information in their accounts payable system. This ensures the payor can send funds to the right account.

- Invoice processing: The payee sends the payor an invoice or other business document that outlines the payment that needs to be made. The payor’s system uses technology, such as artificial intelligence or optical character recognition (OCR), to interpret the document and understand the amount that needs to be paid, as well as when, how, and to whom.

- Payment approval: This part of the process varies from business to business. Some route approvals to specific individuals within the organization who decide when and how to pay the invoice. Others completely automate the approval process using a complex rules-based algorithm to determine next steps.

- Payment completion: Once the payment is approved, the funds are automatically transferred from the payor’s account to the payee’s account. The system also sends confirmation of payment to both parties. If the transaction fails for any reason — such as when the account has insufficient funds, for example — the system notifies the payor so they can resolve the issue.

Fraud is becoming more common in accounts payable transactions, and it’s making an impact. In fact, one 2022 study estimated businesses lost 5 percent in annual revenue as a result of fraud. That’s why businesses need to prioritize fraud detection as part of the payment automation process.

Technology can detect anomalies in payment trends and call your attention to them before a payment goes through. Many payment automation solutions track payments in real time. If an issue is detected, you get an immediate alert so you can intervene and stop the payment before it’s complete.

Types of payment automation systems

Businesses use different types of payment automation systems for different payment types. Here are some:

- Invoice payments: Typically, businesses and vendors use invoices to request payment from other businesses. A business can make invoice payments in different ways, such as via check or online. Invoices are often used for one-time payments, but they can also be used for recurring payments.

- ACH payments: Automated Clearing House (ACH) payments are sent directly from one bank account to another bank account through the ACH network. Businesses can use these for things like bill payments and payroll automation.

- Credit card payments: Credit card payments are usually for recurring expenses such as subscriptions for goods or services that require payments at specific intervals.

- Digital wallets: Services like PayPal, Google Pay, and Apple Pay have digital wallets, which can be charged for recurring or one-time expenses. Digital wallets are also useful for a business that wants to accept payments online without sending the incoming funds directly to their bank account.

- Electronic transfers: This type of payment is typically used for large international fund transfers between businesses. Some electronic transfers are also ACH payments.

Benefits of payment automation

There are many reasons to use payment automation in your business. Here are some of the major benefits:

- Improved operational efficiency: As with most automated processes, payment automation saves your team members time by taking repetitive administrative tasks off their plates. Automated systems can typically complete these tasks much faster than their human counterparts can.

- Shorter payment cycles: Manual payment cycles can take weeks or months. With an automated system, businesses can shorten their cycles to days, sometimes even hours. This greatly benefits suppliers, vendors, and partners, improving professional relationships and building goodwill.

- Fewer errors: People can make mistakes — emails can get buried and tasks can get forgotten, especially when someone has a large to-do list. Automated systems, on the other hand, don’t make these errors. Businesses can take advantage of this accuracy, further improving their operations.

- Better compliance: Automated systems can be set up to meet compliance rules regarding payments, such as hitting deadlines for payment terms. Manual workflows can sometimes fall out of compliance, whereas you can program automated workflows to meet all rules required.

- Fraud protection: Many automated systems can spot and flag financial irregularities and discrepancies in payments. With a manual process, employees may not be able to identify issues before it’s too late and the payment has gone through.

Tips for setting up an automated payment system with Jotform

Wondering how you can set up an automated payment system for your business? Jotform is an excellent option.

With Jotform Workflows, you can set up workflow automations that handle payment requests, invoice processing, and purchase orders.

How the automated workflow process works

Here’s an example of what an automated payment process built in Jotform Workflows looks like.

Create an invoice form that vendors can fill out to request payment and add it to your workflow. When a form submission is made, the workflow automatically forwards it to the reviewer in your workflow, who will approve, deny, or forward the request.

When the payment approval flow reaches its final decision, the person who filled out your form will receive an automated email letting them know the outcome and your accounts team will also automatically be notified so they can trigger the payment.

How Jotform can make payment automation easier for your business

Jotform comes with several form templates you can use within your automated payment workflows, such as an invoice approval workflow template, a capex approval process workflow template, and a purchase requisition approval workflow template. If you need something else, there are over 300 payment form templates that you can customize based on your business needs.

With 40-plus payment processor integrations, Jotform has multiple options for collecting payments via forms as well. It’s easy to add a payment gateway to any form and then share the form with stakeholders using a link, an email, or a QR code for easy access. You can also embed forms in your website.

If you want to improve your accounting workflow, you can track incoming and outgoing payments with Jotform Tables and get a clear picture of each payment being made — including all the details — and manage the data within your table.

Automated payments can streamline your business operations and support your team, and Jotform is the ideal solution to help. Give Jotform a try today!

Photo by Antoni Shkraba

Send Comment:

1 Comment:

More than a year ago

Payment automation simplifies the complex world of finance. It automates tasks like invoice processing, payment approvals, and fund transfers, saving time and reducing errors. With tools like Jotform, businesses can easily create automated workflows to manage and track payments efficiently. This leads to improved operational efficiency and stronger financial control. Start Your Free Trial