Optimizing your accounts payable workflow

- Centralize communication

- Integrate with your enterprise resource planning system

- Increase internal controls

Managing invoices for goods and services is a basic workflow process handled by virtually every type of business.

Whether you’re purchasing standard office supplies, paying for a consultant’s services, or working with an outside business partner to deliver a product, making payments on time is essential for maintaining positive relationships and keeping processes running smoothly.

The process of managing and paying invoices is typically known as an accounts payable workflow. This article will look at what an accounts payable workflow is, the common challenges these workflows pose, and how you can optimize your workflow by using the right tools.

What is an accounts payable workflow?

An accounts payable workflow, or AP workflow, is a process in which a business pays a vendor for providing goods or services. There are several steps in this process, including

- Receiving invoices

- Approving invoices

- Paying invoices

- Recording payments

Businesses use AP workflows to track invoices, review and approve them, send payment on time, and record the transaction. Without a standardized AP workflow, a business could miss payments, make late or incorrect payments, or keep incomplete records.

Who manages an accounts payable workflow?

The AP workflow is typically the responsibility of the accounts or finance department. In a smaller business, this could be a single accounts payable manager or a finance or accounting manager.

Why is accounts payable workflow management important?

Implementing a standard accounts payable workflow is essential for maintaining a healthy relationship with your vendor base. Improper management of your accounts payable workflows can lead to significant issues, such as

- Making duplicate payments

- Missing payments

- Making late payments

- Incurring unnecessary additional costs caused by inefficiencies

By managing your AP workflow effectively, your business can build trust with vendors through accurate, on-time payments. AP workflow management ensures payments are made efficiently and correctly and saves your team time by standardizing steps in the process and automatically triggering tasks.

What are common challenges to an efficient accounts payable workflow?

Although an accounts payable workflow may seem straightforward, there are plenty of opportunities for error. Here are a few common issues that can negatively affect your workflow:

- Manual data entry: Manual invoice and payment data entry can lead to numerical errors, miscommunication about payments, a lack of data integrity, and even the risk of fraud.

- Paper-based documentation: Paper documents are harder to organize and access, and pose challenges for a distributed workforce.

- Complex approval workflows: The more complicated your AP approval process is, the longer it can take for you to pay your vendors. Overly complex workflows can lead to delays, poor supplier relationships, and employee frustration.

- Lack of scalability: Without the right setup, your accounts payable workflow may prove difficult to scale as you grow. You need to set up a system that can easily adapt and remain consistent — even as your organization takes on more invoices.

- Workflow visibility issues: If employees can’t easily access an overview of your AP workflow, the process may suffer from confusion and mistakes.

By creating an effective system, you can dodge many common pitfalls associated with accounts payable workflows.

How to improve your AP workflow: A few tips and tricks

Taking the time to optimize your accounts payable workflow can prevent serious mistakes, save your team time, and keep your vendors happy. Here are some tips.

Centralize communication

Silos are the enemy of an effective workflow. If your data is living in several different locations and transferred manually, you run the risk of introducing human error. Centralized workflows allow your data to flow smoothly from one point to the next.

Centralization also allows your team to work more collaboratively, allowing you to identify inefficiencies and optimize your processes.

Integrate with your enterprise resource planning system

Integrating your enterprise resource planning (ERP) system with your AP workflow system allows you instant access to essential data — without the risk of manual entry.

Connecting these two systems creates a seamless flow of information, allowing you to validate invoice data and enhance your workflow accuracy. This integration also improves your workflow visibility by making AP workflow data visible through your ERP solution.

Increase internal controls

Think of internal controls as gates that stop incorrect information from traveling from one stage to the next. By setting up internal controls, like data entry rules, duplicate payment controls, approval checkpoints, and three-way matching, your team can monitor and prevent errors from causing serious consequences in your AP workflow.

Improving your AP workflow is simple when you have the right solution. That’s where Jotform Workflows comes in.

How Jotform Workflows can improve your accounts payable workflow

Jotform Workflows is an automated workflow platform that can simplify and automate your accounts payable workflows. You can build payment workflows that host multiple forms, include tasks with due dates and team assignments, automatically trigger notifications for next steps, integrate with other software systems, and much more.

Here are just some of the workflow automation features you can access with Jotform:

- Payment collection: You can add payment forms to your workflow, with access to more than 40 payment processor integrations. Jotform makes it easy to accept payments online from customers. Simply create an online payment form using one of Jotform’s 250-plus payment form templates, or start from scratch.

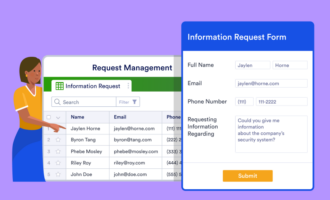

- Data tracking: Using Jotform Tables, your team can monitor invoice and payment data in a centralized location using an automatically generated database.

- Finance and accounting workflows: Using Jotform Workflows, your finance and accounting teams can automate and streamline approvals for budget requests, reimbursements, and invoices — ensuring their accuracy and efficiency.

- Automatic notifications: As your workflow progresses, your team will be automatically notified of updates and completion.

- Workflow templates: Are you worried about the time it takes to set up an automated accounts payable workflow? With Jotform Workflows, you can quickly customize workflow templates in a simple interface. Check out the invoice approval workflow template, business trip approval workflow template, and capex approval process workflow template, for example.

Optimize your accounts payable workflow process with Jotform Workflows today. Take the time to implement these tips and discover the benefits of using a powerful automated solution.

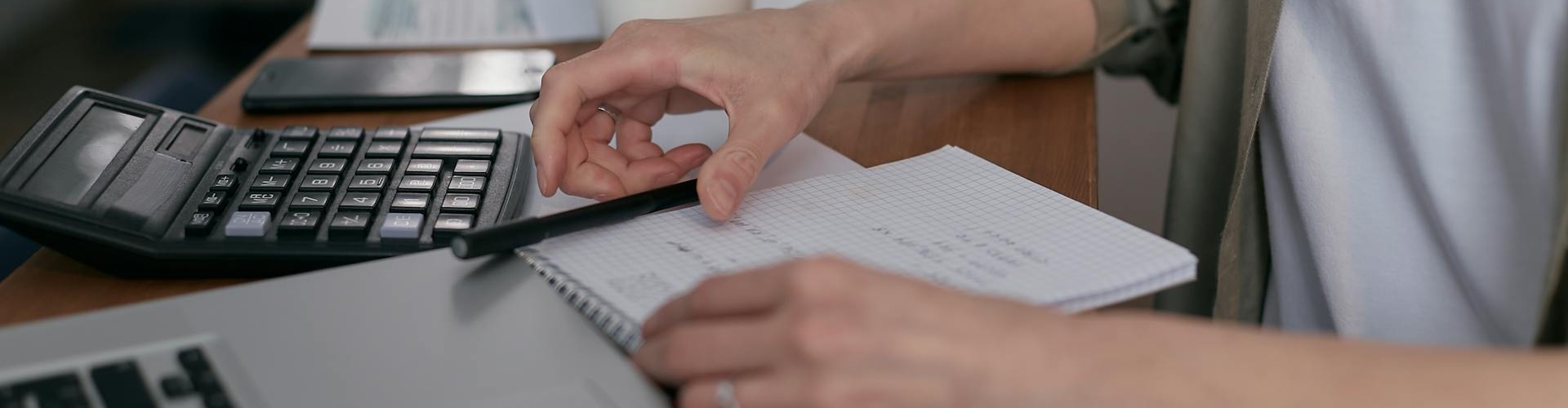

Photo by Mikhail Nilov

Send Comment: