Tax Deduction Letter

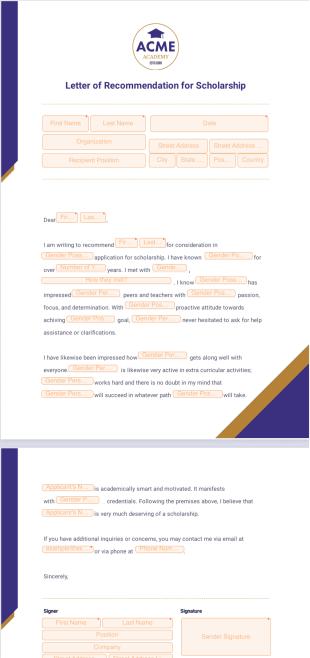

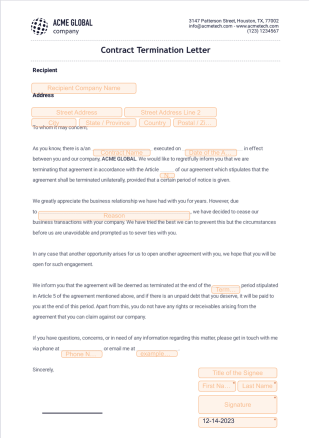

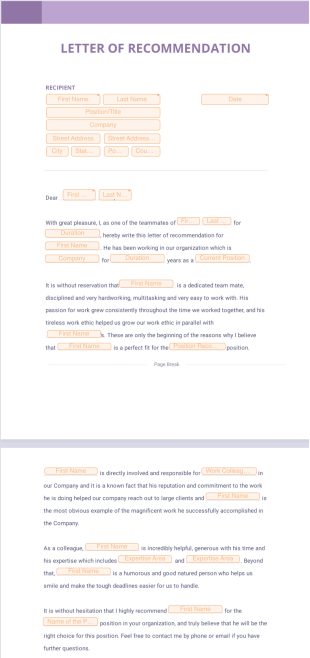

A tax deduction letter is used by charities and foundations to acknowledge donations, thank donors, and give each donor the information required to use the donation as a tax deduction. If your charity or nonprofit needs a more efficient way to write tax deduction letters, do it with this automated Tax Deduction Letter from Jotform Sign.

Start by customizing the letter design as you like. You can update the text, include your logo, and make other design changes with ease. Then fill out each donor’s information into your templated letter and watch as it’s converted to a PDF document — ready to be downloaded and sent to donors.

These templates are suggested forms only. If you're using a form as a contract, or to gather personal (or personal health) info, or for some other purpose with legal implications, we recommend that you do your homework to ensure you are complying with applicable laws and that you consult an attorney before relying on any particular form.