Declaration Letter FAQs

1) What is the purpose of a declaration letter?

The purpose of a declaration letter is to formally state ownership or otherwise declare something for legal purposes. Though these letters are mainly used for business — such as in loan applications, mergers, or acquisitions — they are also used as part of legal proceedings, such as in immigration or custody cases. Declaration letters ensure that a party can’t claim they didn’t have knowledge of something related to an agreement, and they also confirm that the party accepts any risks associated with that agreement.

2) How do I draft a declaration letter?

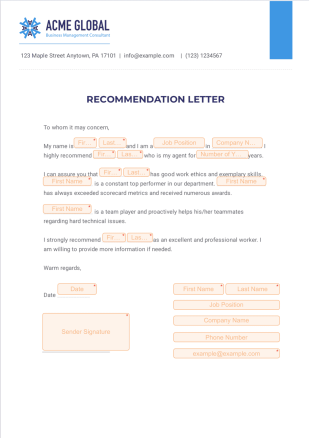

You can draft a declaration letter on your own, or you can use this free template from Jotform. Our declaration letter template offers a structure for you to work from that you can customize to meet your needs. Once you’ve covered all your bases and made the letter look exactly how you want, you can easily share it via email or link for recipients to sign in seconds.

3) What should be included in a declaration letter?

Every declaration letter should include identifying information about both the issuing party and the receiving party, such as name, address, and phone number. Then, the letter should provide a statement of declaration, noting the names of both parties, the date, account balances (for financial declarations), and any other pertinent information in an agreement. Lastly, include a space for the signature of one or both parties to confirm ownership or acknowledgment.

4) Are there specific formatting guidelines for a declaration letter?

Generally, it’s best to structure the declaration letter in an easy-to-read letter format, which addresses the recipient formally and includes identifying information. This format holds up well in both business and legal proceedings because it makes the declarative content clear for recipients, so they know exactly what they’re signing.

5) Can I use a declaration letter to declare my financial situation?

Yes, you can use a declaration letter to disclose your financial situation. This can be done in any number of circumstances, such as when you’re setting up an account with a new bank, making a case to a landlord, applying for a loan to purchase a car, or even declaring bankruptcy. The letter is a formal way of stating your income, net worth, or assets to relevant parties and authorities.

6) What are the subtypes of letters of declaration?

While you can create a letter of declaration for just about anything, its common use cases are for declarations of intent, income, consent, and compliance. Whether it’s for a business negotiating deals or acknowledging compliance requirements, an individual declaring their income for tax purposes, or a doctor seeking consent for a medical operation, Jotform makes it easy to create a letter of declaration.

7) Can a declaration letter be submitted electronically?

Yes! With Jotform Sign, you can request e-signatures for your declaration letter online so users can submit them in seconds. It’s as easy as building your letter, sending out the link, and letting recipients sign on any computer, tablet, or smartphone. And that’s it — you have an electronic declaration letter, completely hassle-free!