California Independent Contractor Agreement FAQs

1) What is a California independent contractor agreement?

A California independent contractor agreement is a contract between two parties — a client and an independent contractor located in the state of California — that documents their agreement on the services a contractor will provide for the client and the compensation the client will pay the contractor for those services.

2) How does a California independent contractor agreement work?

This is an important agreement to use whenever an independent contractor enters into a working relationship with a client in California. Often the independent contractor draws up the agreement. However, if the client is a large organization, the organization may prefer to use its own agreement.

Simply insert the applicable information into the form fields and share the draft with the other party. Once you and your client approve the document, both parties sign and date it to make it official. The agreement remains in effect until the work is complete or the agreement ends in accordance with a termination provision outlined in the document.

3) What information should be included in an independent contractor agreement?

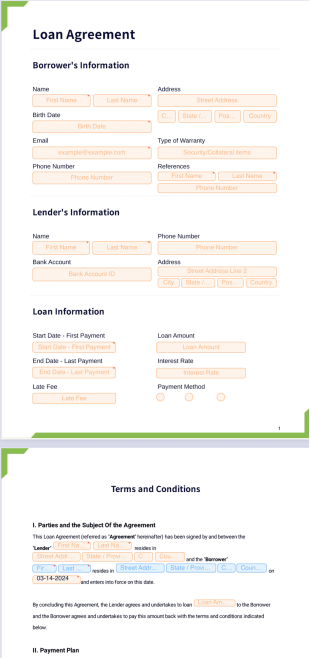

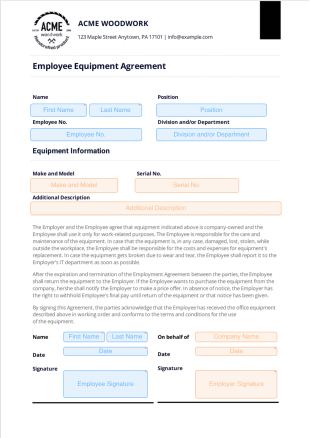

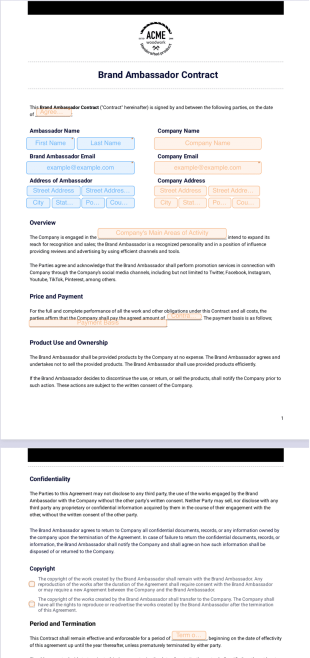

An independent contractor agreement often includes elements such as the date, names and addresses of the client and the contractor, rate for compensation, work deadline(s), details of the work product to be delivered, and the signatures of both parties. It may also include clauses that address the following:

- Ownership of the work product

- Confidentiality

- Definition of the working relationship (contractor not employee)

- Expenses incurred by the contractor

- Termination of the agreement

4) What qualifies a person for independent contractor status in California?

As in other states, an independent contractor in California is someone who receives payment from a client for performing a specific service but is not a full-time employee of that client. Independent contractors tend to do work for multiple organizations and usually have specialized knowledge or skills. They don’t receive employment benefits from the hiring organization and they usually also pay their own Social Security and any applicable Medicare taxes.

Note that in California, workers may be assumed to be employees unless you — the retaining organization — can prove otherwise. To do so, you must demonstrate that the working relationship passes the ABC test (see below).

5) What are the new rules (ABC test) for California independent contractor agreements?

In an effort to protect workers from being misclassified as independent contractors when they are, in fact, employees, California’s AB 5 law requires employers who work with independent contractors to comply with the ABC test.

Before entering into an independent contractor agreement in California, make sure you’re familiar with the ABC test and that your employment arrangement is structured so it meets the following three (“A, B, C”) conditions:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

Please note that this ABC test just offers general guidelines, like the discussion of the other legal aspects of contractor agreements discussed above. Consult a lawyer to discuss specific legal requirements that apply to your situation.