Running a nonprofit is no easy task. Often, the staff at these organizations are trying to fulfill an important mission with a small budget. Many nonprofits rely heavily on donations from community members and others who feel compelled to support the great work an organization is doing.

That’s why it’s crucial to make the donation process smooth and easy — if you can eliminate obstacles, you’ll encourage donors to help you fund your mission.

Offering a payment method such as Google Pay offers donors flexibility; they can choose to pay with their debit or credit card and know their online transaction is secure.

Is your nonprofit considering implementing Google Pay? In this article, we look at everything you need to know about using Google Pay for nonprofits.

Google Pay for nonprofits: How it works

When working with nonprofits, Google Pay partners with a U.S.-based organization called Network for Good (NFG). NFG collects and distributes the donations it receives using a donor-advised fund.

A nonprofit doesn’t need to be a member of NFG in order to receive donations through Google Pay; NFG will reimburse the donations to the address the nonprofit lists in the Guidestar database, a compilation of every single nonprofit listed with the IRS. It can take up to two months for a nonprofit to receive donations that have come through Google Pay.

However, while nonprofits don’t have to be a part of NFG to receive donations, signing up with the organization offers nonprofits more control over managing payments, reviewing donor transaction history, and accessing other related details. To receive payments through Google Pay, nonprofits should also make sure that they haven’t opted out of receiving online donations in the Guidestar database.

Key details: What your donors need to know

If your nonprofit organization wants to set up online donations via Google Pay, it’s important to notify donors who might choose this method that their payment will be listed as going to Network for Good instead of the name of your nonprofit — a technicality that could cause confusion. While the payment may be listed as going to NFG, it will eventually be distributed to your nonprofit through the Google Pay partnership.

Be sure to let donors know a few other important bits of information:

- Donors don’t need to have a Google account in order to make a donation with Google Pay, as they can use the guest checkout option and their credit card.

- Google Pay won’t charge them any fees if they’re in the United States.

- If donors are making the payment from another country, Google Pay may charge them currency conversion or credit card fees when they make the donation.

- All donations made through Google Pay are non-refundable.

Nonprofit FAQs: What you need to know

Some nonprofit organizations may be new to digital payment methods. Here are the answers to some frequently asked questions below.

Will Google Pay send us donor contact information?

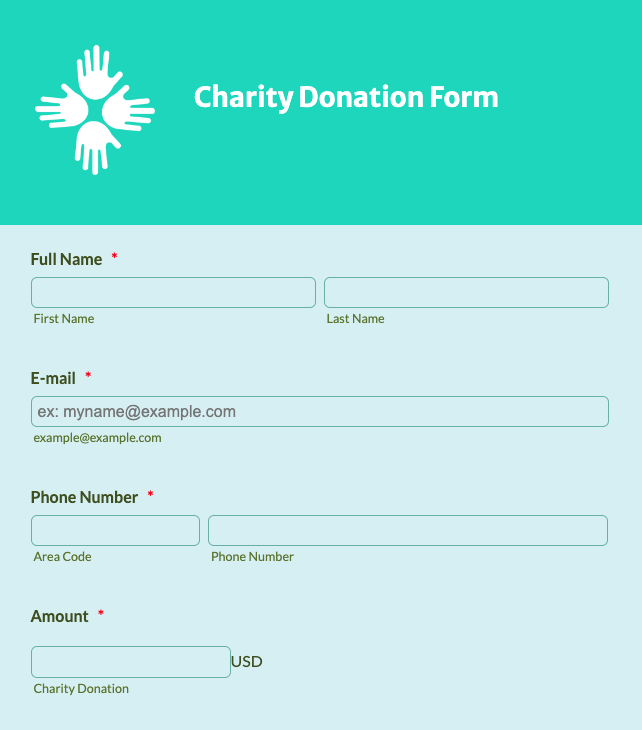

No. Currently, Google Pay doesn’t share donor contact information. This could be considered a drawback, because it’s important for nonprofits to know who their donors are so they can thank them and further nurture relationships with them. If you’d like to offer Google Pay but also want the names of your donors, you can simply create a form on your website for donors to complete before they make an online donation.

Will donors get a donation receipt?

Yes. When using Google Pay for nonprofit donations, a donor can view their receipt. Donors can also review their donation history through donate.google.com/history when they sign in with the Google account they used to make the payment.

Will Google Pay show me how much money we’ve raised?

Nonprofit organizations can see their donations when they sign up for a Network for Good DonateNow Lite account. This is a free service for nonprofits.

Send Comment: