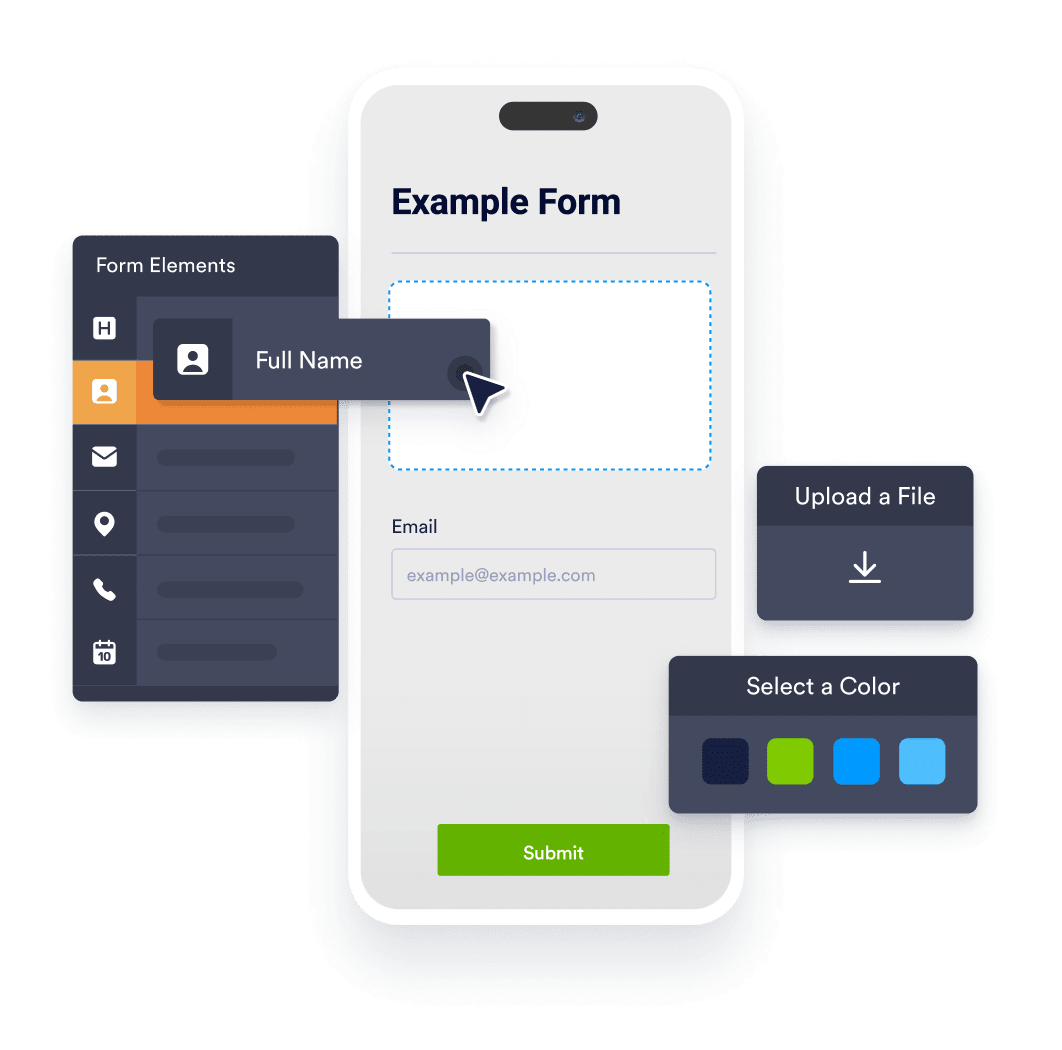

Make your tax forms match your needs and branding. Drag and drop to rearrange fields, split your online tax form into multiple pages, and add your logo and brand colors with no coding required.

1040 Generator

Generate 1040 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1040-SE Generator

Generate 1040SE forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1098 Generator

Generate your 1098 form hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1098-E Generator

Generate your 1098-E form hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1098-T Generator

Generate your 1098-T form hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1099 Generator

Generate 1099 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1099-NEC Generator

Generate 1099-NEC forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1310 Generator

Generate 1310 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

2120 Generator

Generate 2120 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

4506 Generator

Generate 4506 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

4506-T Generator

Generate 4506-T forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

4868 Generator

Generate 4868 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

5329 Generator

Generate 5329 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

7004 Generator

Generate 7004 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W8-BEN Generator

Generate W8-BEN forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W8-BEN-E Generator

Generate W8-BEN-E forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W2 Generator

Generate W2 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W4 Generator

Generate W4 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W4P Generator

Generate W4P forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W9 Generator

Generate W9 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

540 Generator

Generate 540 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

540-ES Generator

Generate 540-ES forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

Your search "" did not match any results.

Benefits of Tax Form Generator

Upload a tax form and convert it into an online form. With Jotform Sign, you can create tax documents, add multiple signers, and share your documents to be filled out and signed securely on any device.

作成したフォームをウェブサイトに埋め込んだり、リンクで共有したりすることで、他のユーザーから納税情報を収集することができます。Jotformは256ビットのSSL接続とフォームの暗号化オプションでデータを保護します。

Manage form submissions in Jotform Tables in a spreadsheet, a calendar, or easy-to-read cards. By keeping track of tax information in one place, you can keep your tax forms organized and access them on any device.

Add the Form Calculation widget to your tax forms to automatically perform calculations. No coding required — just set up calculations in your tax form’s settings in a few easy clicks.

Jotformに関するユーザーの声

“... Jotform has been great in helping us organize our forms.”

“Jotform has been great in helping us organize our forms. What was previously a hodgepodge of different .pdf forms from various companies, all being updated at different times is now a single online form with Jotform. We can be sure that we have the most up-to-date form with correct information using Jotform.”

—Brandon Blevins,

制御専門家

Learn More About Tax Forms

-

What is a W-2 form? When and why do you need a W-2 form?

Form W-2 — or Wage and Tax Statement — is a United States tax form that shows important tax information, including the income a taxpayer has earned, the amount of taxes that have been withheld from their paycheck, benefits information, and more. Taxpayers need Form W-2 when filing state and federal taxes.

-

What does a W-2 form look like?

A W-2 form is provided by an employer and includes important tax information. It’s half a page long and provides an overview of a taxpayer’s yearly earnings.

-

What is a W-4 form? When and why do you need a W-4 form?

Form W-4 — or Employee’s Withholding Certificate — is a United States tax form that’s completed by employees so that employers can withhold the correct amount of tax from their paychecks. New W-4 forms are filled out annually or when the employee’s financial or personal circumstances change.

-

What does a W-4 form look like?

A W-4 form is one page long and is filled out by the employee. It also includes a worksheet for people with multiple jobs, and instructions for filling out the form and entering the correct annual taxable salary.

-

What is a W-9 form? When and why do you need a W-9 form?

Form W-9 — or Request for Taxpayer Identification Number and Certification — provides a Taxpayer Identification Number (TIN) to someone who is required to file an information return. Taxpayers use this form to provide their TIN when income is paid to them, for real estate transactions, for mortgage interest, and other circumstances.

JotformのW9ジェネレーターを使ってW-9フォームを作成することができます。

-

What does a W-9 form look like?

A W-9 form is one page long and requires the form filler to include their Taxpayer Identification Number (TIN), personal or business information, and signature.

-

What is the difference between Form W-2, Form W-4, and Form W-9?

All of these forms are tax forms, but their purposes vary. Form W-2 is sent by employers to employees, whereas Form W-4 is filled out by employees and given to employers. Form W-9 is provided to someone who must file an information return to the IRS.

-

Are there any major deadlines for tax forms?

Yes. Taxes for each calendar year — starting January 1 and ending December 31 — are due in April of the following year, typically April 15. If Tax Day falls on a weekend or holiday, it will be officially observed on the closest weekday.

-

What are the most common mistakes to avoid?

When filling out taxes, be sure to double- or even triple-check that the information provided is correct. Make sure calculations are done correctly, that you’re filing the correct forms, and that you submit your tax forms on time.