Clearpay Payment Forms

Give your customers payment flexibility with Clearpay and Jotform. Add Clearpay as a payment option through our Square integration. Accept payments for products, donations, and user-defined amounts with the advantage of buy now, pay later functionality.

Create Clearpay Forms

Pay No Extra Fees

Jotform won’t charge additional fees for accepting payments through your Clearpay form.

Clearpay Payment Form Templates

Don’t want to build your payment form from scratch? Customize one of our ready-made templates to meet your every need and integrate it with Clearpay — no coding required.

How it works?

Build a payment form

Drag and drop to create the secure payment form.

Add Clearpay

Select Clearpay as a payment to offer installment payments.

Connect via Square

Set up the Square payment integration for your form.

Start receiving payments

Share your payment form and start collecting payments!

Enabling Clearpay with Square is free — there are no monthly fees or startup costs. The Clearpay processing fee is 6% + 30p per order.

Boost Your Sales with Flexible Payment Options

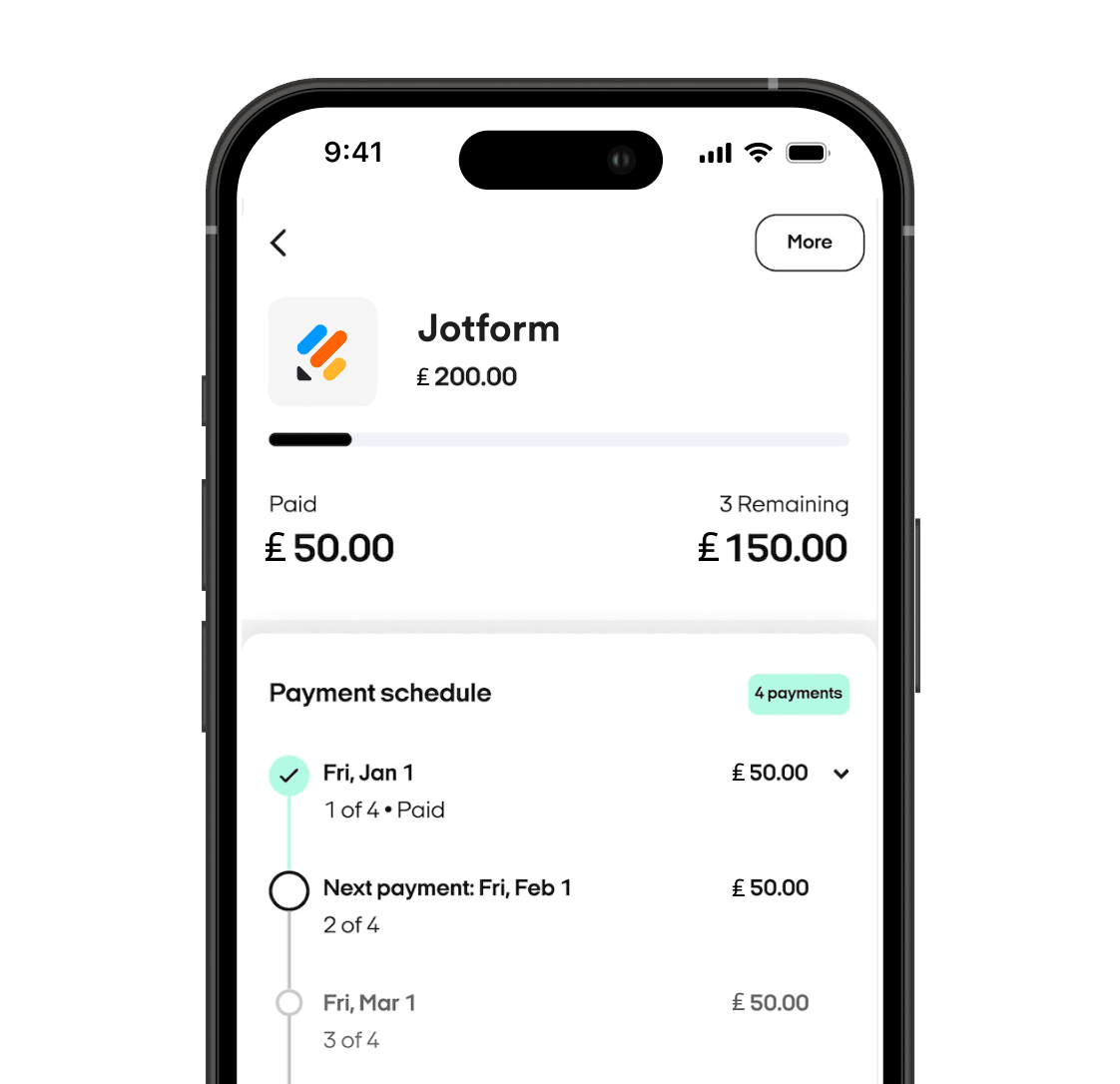

Provide your customers with greater payment flexibility by allowing them to pay in four interest-free installments over six weeks. With Clearpay payment forms, they can buy now and pay later while you get paid up front.

Create Clearpay FormsSecurity You Can Trust

Jotform protects your form data with PCI certification, GDPR and CCPA compliance features, a 256-bit SSL connection, and the option to encrypt your payment forms. Healthcare professionals can take advantage of optional HIPAA compliance features with Jotform’s Gold or Enterprise plans.

Create Clearpay Forms

Buy Now, Pay Later

Give your customers payment flexibility at checkout. Afterpay’s Buy Now, Pay Later (BNPL) model splits up the cost into four payments, creating a more accessible way to pay. Afterpay is a great alternative to other BNPL payment services like PayPal’s Pay in 4.

Frequently Asked Questions (FAQs)

La tua ricerca "{searchValue}" non ha portato nessun risultato.

-

What is Clearpay? How does it work with Jotform?

Clearpay, known as Afterpay in the U.S., is a buy now, pay later service that allows customers to make purchases and pay for them in four equal installments. You can add Clearpay to your forms, where it will function as an in-form payment option that allows users to purchase goods or services.

-

How do I create a Clearpay payment form?

Creating a Clearpay payment form is simple and easy with Jotform’s Form Builder. Start by selecting a ready-made payment form template or build your form from scratch. Drag and drop to make any content or design changes you see fit — change fonts and colors, upload branding assets, add helpful widgets, edit text, and more. Once you’re satisfied with the look and feel of your Clearpay form, go to Payments under Form Elements and select Clearpay. Connect your Clearpay account with your form and you’re good to go!

-

How can I enable Clearpay as a payment option for my customers?

To enable Clearpay on your Jotform payment form, start by creating and customizing a payment form with our drag-and-drop Form Builder. After you’ve designed the form to match your needs, go to Payments under Form Elements and select Clearpay. Drag and drop it onto your form and connect to your Square account. Log into your Square account and then configure your integration settings.

-

How does Clearpay work for merchants?

With Jotform, merchants can add Clearpay as a payment option on their custom order forms. After a customer purchases an item from your website or business via Clearpay, you’ll get a settlement fund from Clearpay within 1–5 business days.

-

Can I add my Clearpay form to my website?

Yes, you can add your Clearpay form to your website seamlessly with Jotform. To do this, copy and paste your form’s embed code into your website. Jotform also offers form embed codes that allow you to publish your Clearpay form on third-party platforms like Squarespace, WordPress, Wix, and more.

-

Are there any additional fees for using Clearpay with Jotform?

No, there are zero additional fees or startup costs for using Clearpay with Jotform. The only fees to keep in mind are the ones that Clearpay charges. The Clearpay processing fee is 6% + 30p per order across all Square products that accept Clearpay.

-

How will I receive payments made through a Clearpay payment form on Jotform?

Payments made through your Clearpay payment form on Jotform go directly into your Clearpay account or connected bank account, depending on your Clearpay account settings. To ensure your money is going to the right place, check your Clearpay account settings before collecting payments with this integration.

-

Is Clearpay available for all Jotform plans? Are there any limitations on using it?

Yes, Clearpay is available for all Jotform plans. However, if your business expects to receive a lot of orders, it’s imperative to review what our free plan offers versus our paid plans. Jotform’s free plan includes only 100 monthly submissions and 10 monthly payment submissions. If you’ll be receiving more than 10 payments each month, you’ll need to upgrade to a paid plan. For businesses that plan to scale and need more than what our regular plans offer, please reach out to our Enterprise Sales Team.

-

Can customers use Clearpay for recurring payments or subscriptions with Jotform payment forms?

Clearpay isn’t typically used for recurring payments or subscriptions. It’s primarily used for one-time purchases split into installments. If you’re looking for a payment processor that enables recurring payments and subscriptions, consider other payment integrations more suitable for recurring billing, such as PayPal or Stripe.

-

What happens if a customer misses a Clearpay installment?

If a customer fails to pay a scheduled Clearpay installment, Clearpay will usually charge them a late fee after a 10-day grace period. Additionally, Clearpay may decrease the customer’s spending limit. This is because repayment history is a large factor in calculating a customer’s spending limit. If a customer has overdue payments for an extended period of time, Clearpay may restrict or prohibit that customer’s use of the service in the future.