E-commerce is booming. In 2019, global online sales amounted to more than $3.5 trillion, and experts expect this to nearly double by 2023. Online shopping has gained popularity in small European markets due to the COVID-19 pandemic, altering consumer behavior in the process.

For U.S.-based business owners looking to tap into Europe’s growing e-commerce market, now may be an excellent time to get started. But international growth comes with its challenges — some of the biggest are order fulfillment, diversity of currencies, and payment methods.

Unlike the States, the European Union (EU) market has dozens of national currencies, creating problems across the board for e-commerce companies. If you’ve looked into how to accept payments from European consumers, you’ve likely discovered SEPA.

Here’s what SEPA can do for your business if you’re planning to expand into Europe.

What is SEPA?

SEPA stands for Single Euro Payments Area, a transaction system in the EU created to streamline and harmonize the way cashless, digital payment transactions are processed across EU borders.

Consumers, businesses, and government agencies that are part of SEPA use this digital infrastructure when they make payments by debit and credit transfers.

What is SEPA’s goal?

The goal of SEPA is to unite the fragmented national markets of Europe into a single financial system. The European Commission and the European Central Bank (ECB) manage this process through an entity known as the European Payments Board.

Together, they collaborate to create the rules and processes for all mobile and online payments that occur between SEPA-adherent countries. Currently, SEPA covers 36 nations, including 27 that are part of the EU.

With the euro as its base currency, SEPA makes international payments as easy and inexpensive as financial transactions that occur within the same country. In other words, the transborder euro currency allows companies to compete internationally in the payment industry by unifying the market for payment services and lowering prices drastically.

Another benefit is that it’s easier for employees to work internationally. For example, a French national with a French bank account can receive their salary from an employer in Belgium without opening a separate checking account there. Consumers can also send payments to anyone else in the eurozone.

What is SEPA’s payment process?

The EU created SEPA standards to streamline bank transfers between institutions across every country in the network. There are two main components that make this possible:

- The euro

- International bank account numbers (IBAN)

The euro avoids the hassles of international exchanges between smaller currencies, maintaining its value across the continent. The IBAN system creates uniform and consistent bank account numbers within all SEPA-participating countries, making it easier for international banking institutions to communicate with each other.

This makes life easier for consumers as well. SEPA banking simplifies international purchases and lowers the transaction fees associated with currency exchange.

A scheme called Core SDD (Core B2B SDD for business-to-business transactions) guides direct debit payments in SEPA. They function similarly to debit transfers in the U.S., following protocols to validate the funds in the account before transferring them.

SEPA Credit Transfer (SCT) allows consumers and businesses to move funds from one bank account into another, regardless of what countries they’re in. SEPA Instant Credit Transfer is a faster version of this process, crediting a payee within 10–20 seconds. Launched in November 2017, this is the most recent payment scheme created under SEPA.

A must-have payment method for companies in Europe

If you want to sell to European consumers, accepting SEPA payments is imperative. A staggering 520 million people live in participating countries — collectively, they make over 120 billion digital payments each year.

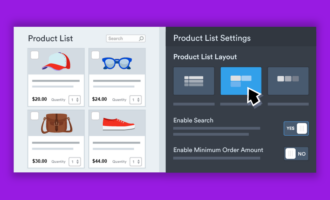

SEPA bank transfers and SEPA direct debits are just two types of popular payment methods in the EU. There’s also SOFORT, which is used by 20 million shoppers in eight different countries, and the paysafecard, which is used in more than 40 European nations.

Each country in the EU also has its own payment system, such as the Netherlands’ iDEAL, Belgium’s Bancontact, Austria’s EPS, and Italy’s Postepay. Tens of millions of consumers — consumers you may be able to reach with your products — prefer these regional payment methods.

Mollie and Jotform: Your bridge to the European market

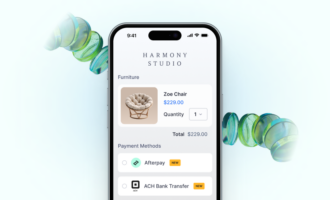

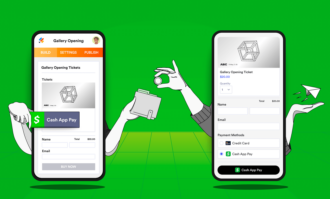

Mollie is a European payment service provider that allows businesses to collect payments from every major credit card, as well as PayPal, Apple Pay, and Klarna. It also integrates with all of the regional European payment methods listed above, including SEPA bank transfers and direct debits. Not surprisingly, it has become the fastest-growing payment service provider in Europe.

Mollie makes collecting payments for goods, donations, and even recurring subscription fees from almost every consumer in Europe a seamless process. It’s a crucial tool for EU business.

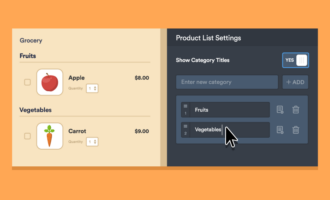

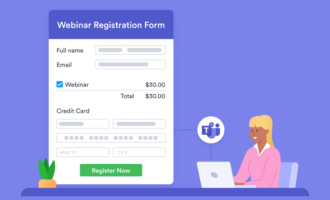

Best of all, Mollie integrates with Jotform, enabling all of your robust payment forms to accept nearly every payment method used in Europe. Since its inception, Jotform has simplified the creation of e-commerce payment portals. Now, Mollie is streamlining European payment processing and connecting businesses to more than 500 million consumers on the continent.

With Mollie and Jotform, there’s no limit to what you can accomplish when you expand into Europe.

Send Comment: