When it comes to taking payments online, Stripe and PayPal are the leaders, dominating more than 80 percent of the total market.

In fact, there’s a good chance you’ve bought something online in the last month from a company that uses either one or both of these payment gateways.

Before we dive in, it can be helpful to take a step back and understand the difference between payment processors and payment gateways. These two terms can be easily confused.

According to this blog post from BluePay, “A payment processor executes the transaction by transmitting data between you, the merchant; the issuing bank (i.e., the bank that issued your customer’s credit card); and the acquiring bank (i.e., your bank).”

A payment gateway, on the other hand, “securely transmits the online payment data to the processor to continue the lifecycle of the transaction. It also authorizes payments for card-not-present transactions.”

When you start the process of evaluating payment gateways, you need to consider the following:

- What kind of business are you running?

- How many transactions do you expect to complete in a day? A week? A month?

- What are you selling? Are any of these items high-risk? Do any have a high refund rate?

- Where is your business located? What currency do you use to collect payments?

There are advantages and disadvantages to both PayPal and Stripe, and they aren’t mutually exclusive. Many businesses choose to use both payment gateways, as this provides their customers more payment choices. For example, if you run a business where you have lots of buyers from all over the world, you can support more currencies.

PayPal vs Stripe

- What’s the difference between PayPal and Stripe?

- Products and services

- Transaction fees

- Countries supported

- Ease of Use

- Checkout experience

- Administrative features

- Getting paid

- Security and fraud detection

- High-risk accounts

- Integrations

- Customer support

- Notable customers

In this guide, we’ll compare Stripe and PayPal across 11 individual factors from transaction fees, administrative features, overall checkout experience, and countries supported to ease of use, customer support, and security.

What’s the difference between PayPal and Stripe?

The truth is these two payment gateways have more similarities than differences.

| PayPal | Stripe | |

|---|---|---|

| Transaction fees | 2.99% + $0.49 | 2.9% + $0.30 |

| Countries supported | more than 200 | 46 |

| Currencies supported | 25 | 135+ |

| Security | PCI compliant | PCI compliant |

| High-risk accounts | Not allowed | Not allowed |

| Integrations | 500+ (Inc. Jotform) | 610+ (Inc. Jotform) |

| Customer support | Phone, live chat (limited) | Phone, live chat (24-7) |

Stripe vs PayPal comparison table

The biggest difference is that PayPal was one of the very first payment gateways, founded in December 1998 by Max Levchin, Luke Nosek, Ken Howery, Elon Musk, and Peter Thiel.

All would go on to become billionaires and found the following companies: Tesla Motors, Palantir Technologies, and SpaceX.

PayPal also has massive brand recognition and is currently on more than 849,000 domains.

Stripe is the relative newcomer, founded in 2010 by two brothers, Patrick and John Collison. In the early days, the startup grew mainly from word of mouth and received some funding and mentorship from Y Combinator.

Despite being founded 11 years later, Stripe is currently collecting payments across more than 259,000 domains.

Products and services

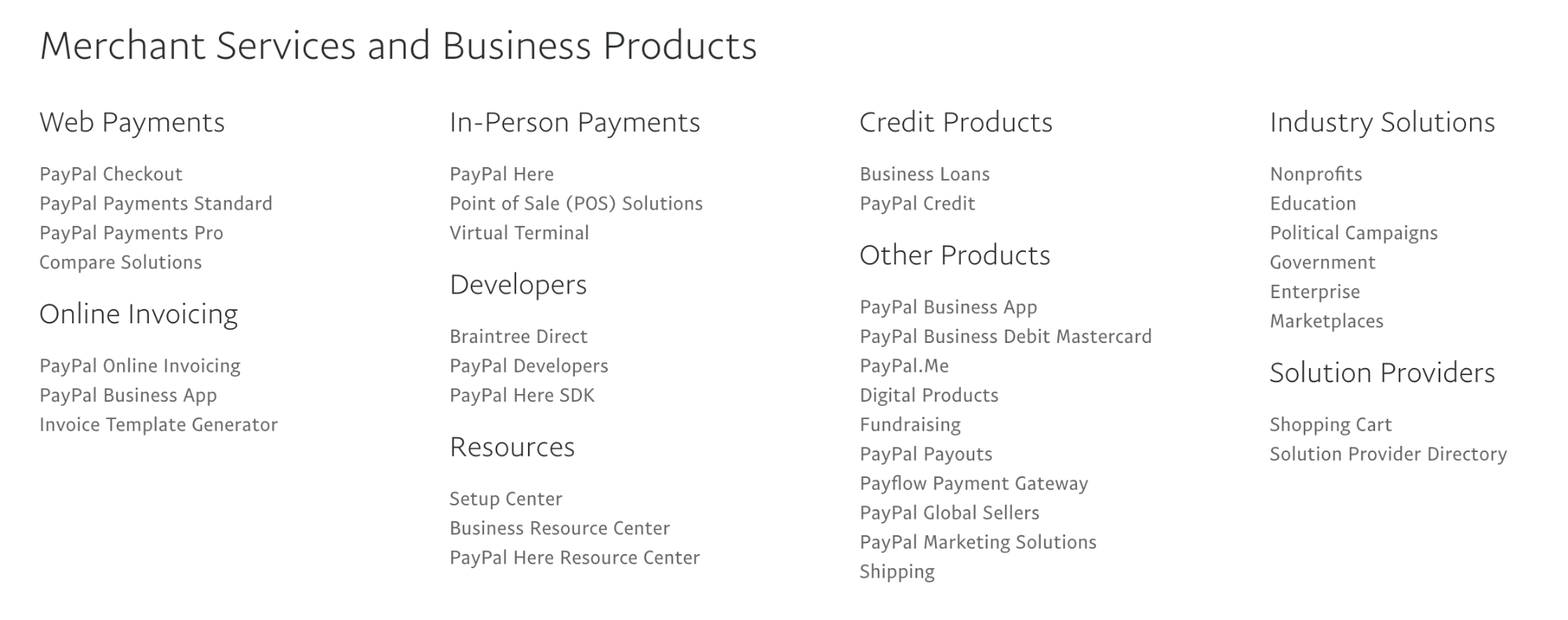

We’ll start by examining the wide variety of products and services that both PayPal and Stripe offer.

PayPal

PayPal has three main payment products: PayPal Checkout (formerly known as Express Checkout), PayPal Standard, and PayPal Payments Pro.

All three options have the same payment processing fees: 2.99 percent + $0.49 per transaction.

As for payment types, you can accept payments from Visa, Mastercard, Discover, American Express (although the AMEX processing fee charges 2.5 to 3.5 percent), JCB, UnionPay, Maestro, ACH, and many international cards.

You can also create and send invoices for free from PayPal and Excel templates.

In addition, you can pay for add-ons like recurring billing and advanced fraud protection services by talking to their sales team for pricing information.

One key difference is that you need to integrate PayPal Checkout and PayPal Standard into your website with an existing e-commerce platform like Shopify, WooCommerce, BigCommere, Magento, etc., or have a developer add them to your site.

With PayPal Payments Pro, which also has a $30-per-month fee, you can provide customers with a fully customized checkout experience right on your website. It also includes Virtual Terminal, which allows you to accept payments over the phone and in person through a point-of-sale system (POS).

POS payments have their own transaction fees: 2.29 percent + $0.09 per transaction for card-present transactions, and 3.49 percent + $0.09 per transaction for manual card entry transactions.

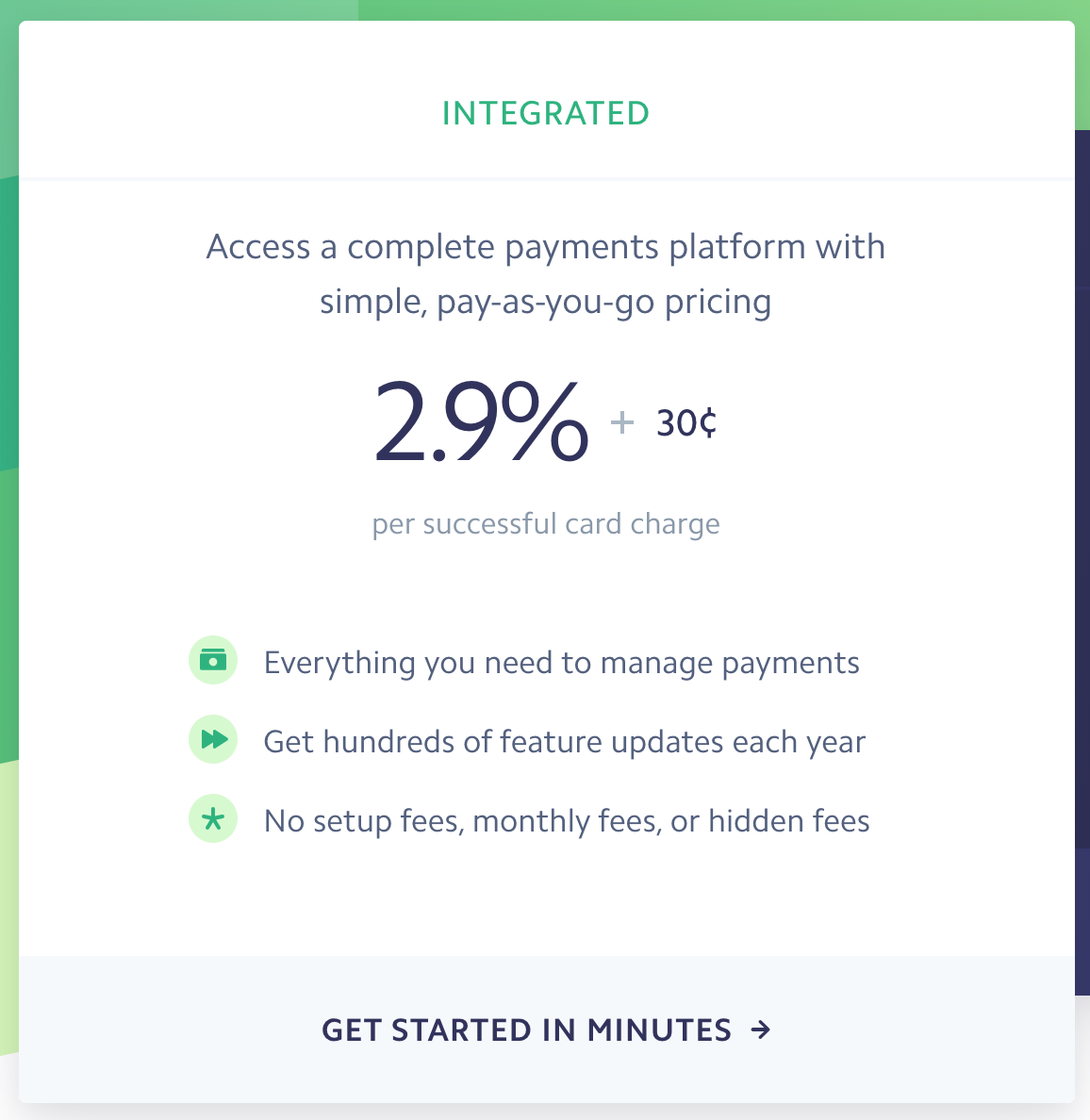

Stripe

Stripe adopts a simpler pricing structure for their main payments platform, having a fee of 2.9 percent + $0.30 per transaction. Stripe also supports Visa, Mastercard, Discover, American Express (with no extra processing fee), JCB, UnionPay, Maestro, ACH, and many international cards. Stripe Invoicing offers two pricing options, Invoicing Starter and Invoicing Plus. The cost of Invoicing Starter is 0.4% per invoice that has been paid and the Invoicing Plus costs 0.5% per paid invoice including supplementary tools to boost your revenue.

Some additional features include

- Access to hundreds of feature updates each month

- Recurring billing support

- Microtransaction support varies across different markets

- Compatibility with Apple Pay and Google Pay

Stripe also has several ancillary products built on top of Stripe Payments.

Stripe Billing

Stripe Billing is specifically designed for subscription businesses. The Starter plan is 0.5 percent on recurring charges for creating subscriptions. The Scale plan is 0.8 percent on recurring charges and payments made for a single invoice for streamlining revenue operations through automation.

For example, if you run a professional association and charge a monthly membership fee, you could use Stripe Billing to collect and automate your members’ monthly payments.

Stripe Connect

Stripe Connect is designed for online marketplaces and built on top of Stripe Payments. Stripe takes $2 per active account/seller per month + 0.25 percent + 0.25$ of account volume.

While this might sound steep, Stripe Connect comes with a host of features, including

- Seller onboarding and verification

- 1099 tax reporting for sellers

- Support for a fully customizable UI or prebuilt Express UI

- Flexible funds routing to support your business model

- Comprehensive platform-level reporting tools and customizable reporting for accounts

Some well-known marketplaces currently using Stripe Connect are Lyft, Grab, Handy, Postmates, and Instacart.

Stripe Atlas

Stripe Atlas is designed to help new entrepreneurs start and register their online businesses. There is a one-time setup fee of $500 to form either an LLC or a C corporation.

For that one-time fee, Stripe will

- Form a Stripe Atlas LLC or C Corporation in Delaware

- Pay Delaware state filing fees (costs $100)

- Sign documents to establish company rules and protect IP

- Issue stock to founders for C Corporations

- Pay the first year of registered agent fees

- File for an EIN

- Open a bank account

- Provide access to the Stripe Atlas community

- Provide free templates for post-formation legal needs

Radar

Stripe Radar offers advanced fraud protection tools using leading machine learning algorithms.

Sigma

For as little as $10 per month, Stripe Sigma allows businesses to write SQL queries to get additional business data and insights.

Issuing

Stripe Issuing allows businesses to quickly issue, distribute, and manage virtual and physical credit cards. For example, you can create a card for an employee with a preset spending limit so they can buy software, licenses, and various materials that they need without having to ask you for the main company card.

This is also useful with online marketplaces. You can create virtual cards for all of your gig workers so that they can pay for things on their phones.

Terminal

Stripe Terminal is their POS Platform, which allows sellers to take in-person and mobile payments. The transaction fees are 2.7 percent + $0.5 per transaction + hardware costs.

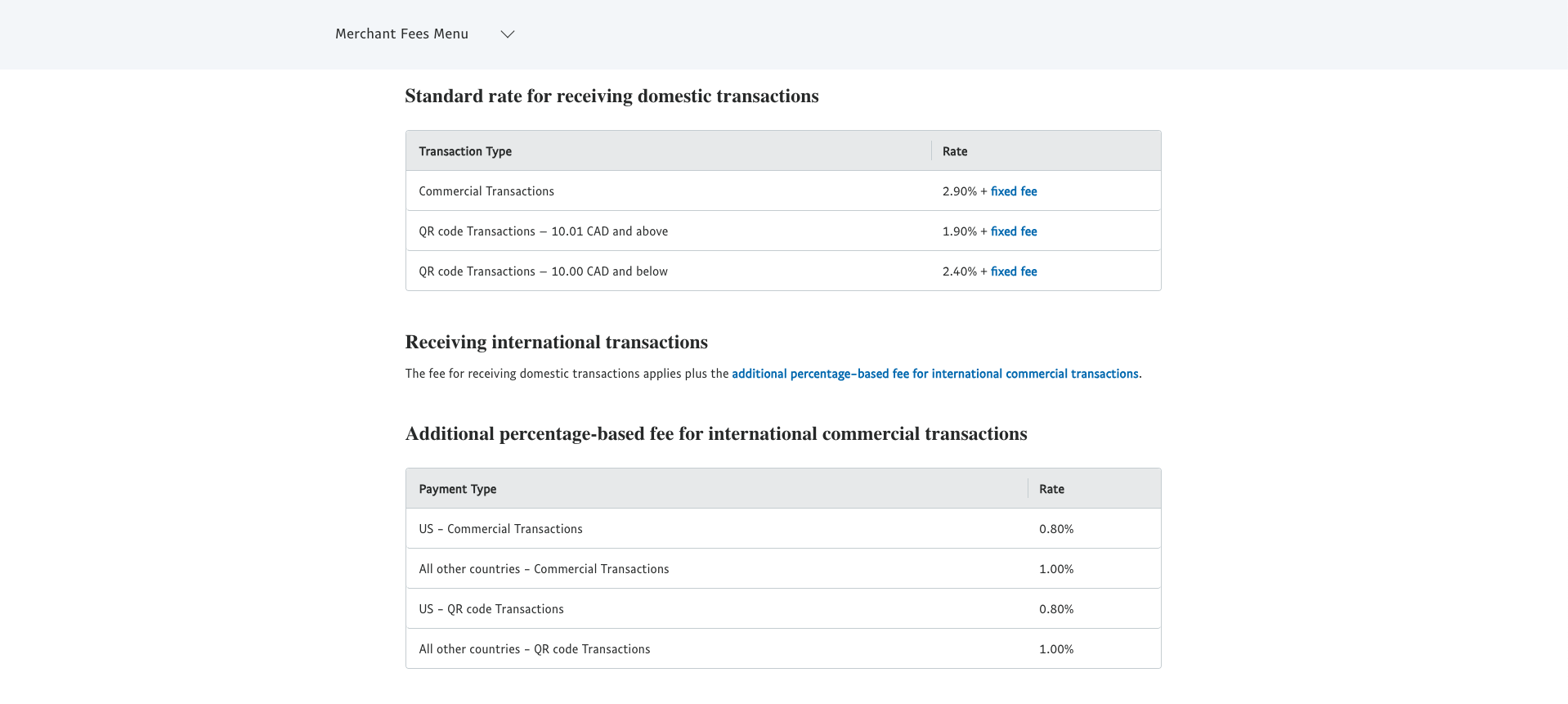

Transaction fees

The transaction fees, aka payment processing fees, for PayPal and Stripe are similar. Paypal charges an amount of 2.99 percent plus $0.49 and Stripe charges 2.9 percent plus $0.30.

One key difference is around chargebacks. Stripe charges %0.4 per transaction for chargeback protection, whereas PayPal charges $20.

Another difference is that if you have a lot of customers who pay with American Express credit cards, you’ll end up paying more with PayPal because they charge 2.5 to 3.5 percent for AMEX purchases.

Stripe fees

PayPal fees

Countries supported

PayPal

At last count, PayPal works more than 200 countries. You can see the full list here.

However, you can withdraw funds in only 25 currencies.

Stripe

On the other hand, Stripe works in only 46 countries. You can see the full list here.

Stripe has stronger multicurrency support, meaning they can accept payments in 135+ currencies. You can charge customers in their native currency while receiving funds in your preferred currency.

Ease of Use

PayPal

If you can send an email, copy and paste a file, and navigate basic websites, you’ll find PayPal easy to use. With more than 19 million merchants, it has to be.

Stripe

Stripe’s dashboard is also easy to use. However, if you want to integrate Stripe with your website and business software, it would be a good idea to reach out to a developer.

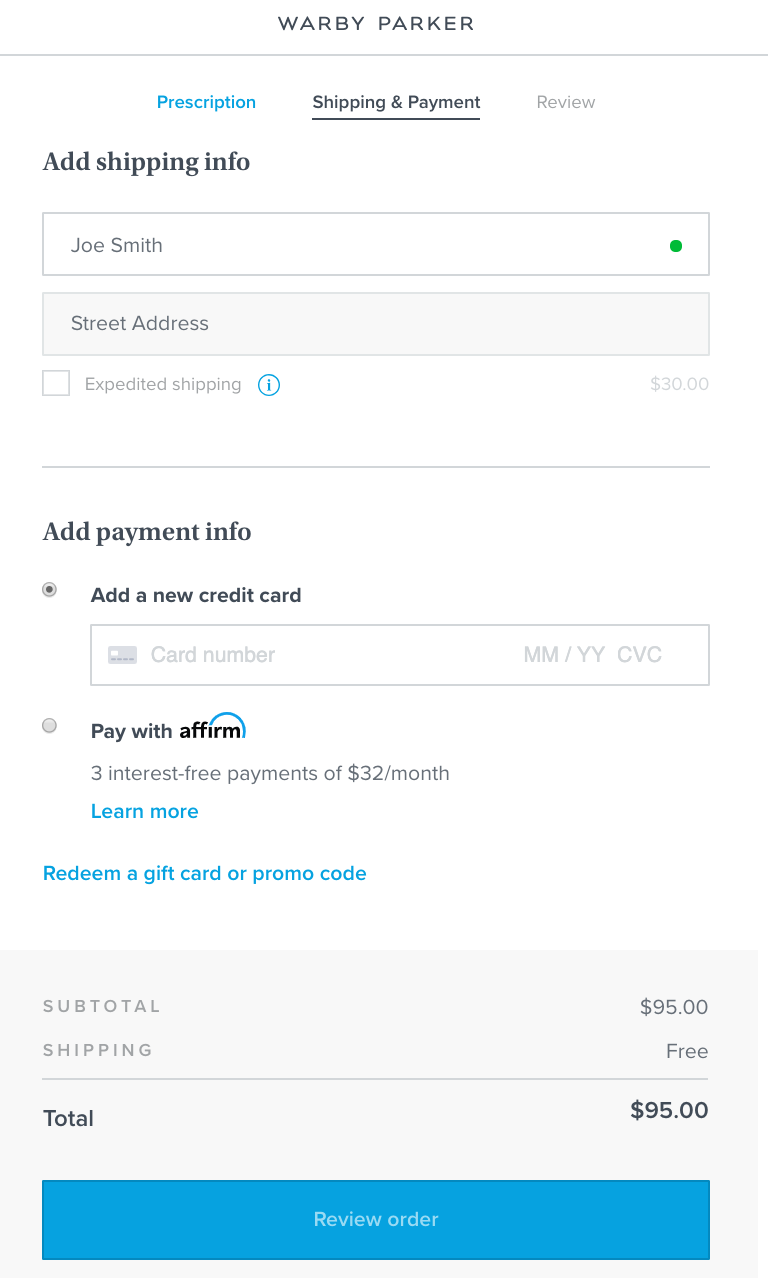

Checkout experience

Did you know that the average cart abandonment rate is 75.6 percent? The number is even higher — 81 percent — for travel industry sites.

Anything you can do to reduce friction on the add-to-cart and checkout pages can lead to more sales. This holds doubly true for your payment gateway.

Stripe

Stripe has a seamless, modern checkout experience, which accounts for its conversion rate optimization (CRO) best practices.

Here is an example of the checkout experience from Warby Parker, which is powered by Stripe. As you can see, it is a streamlined, minimalist experience with only the essential form fields.

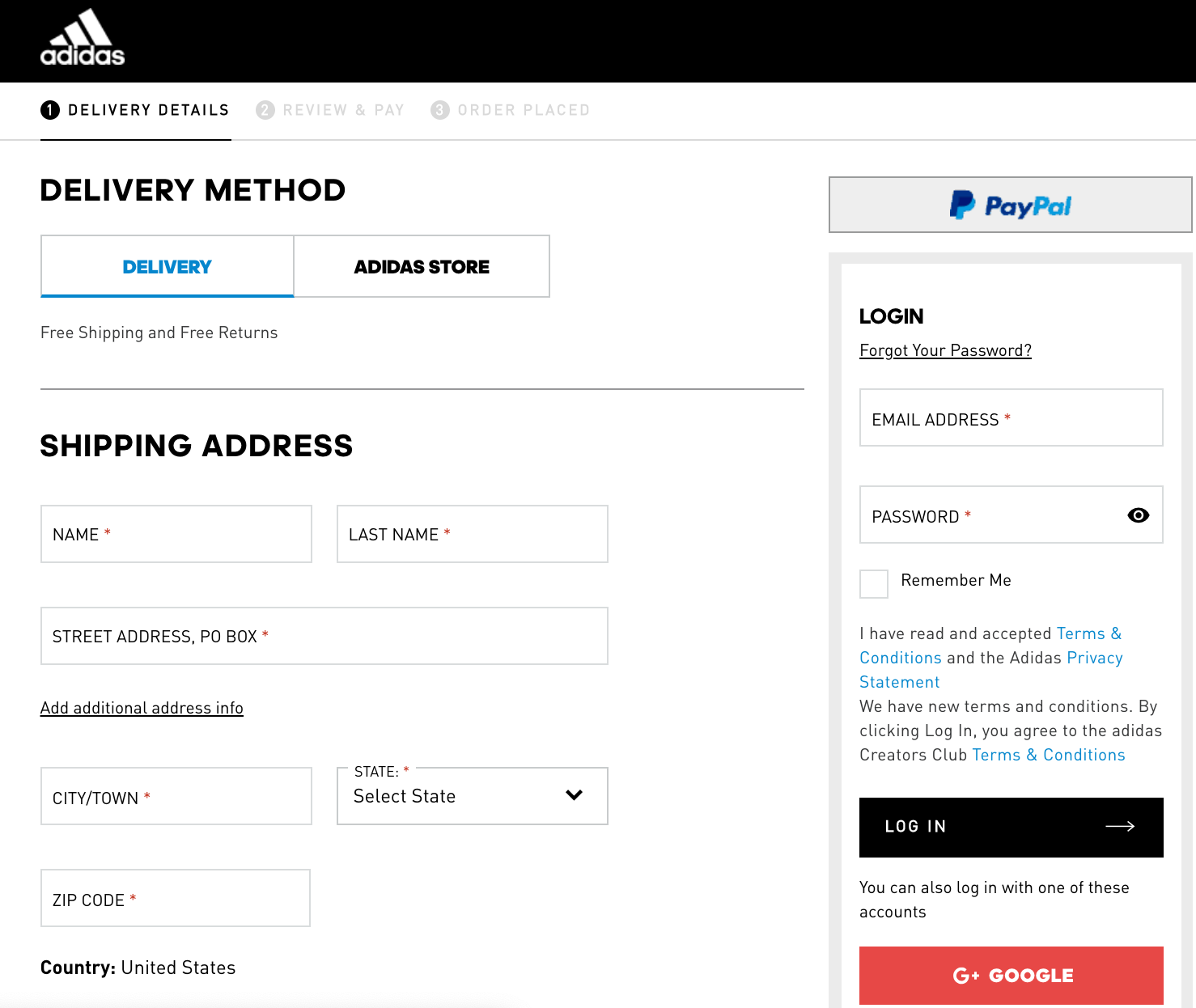

PayPal

Just like Stripe, PayPal has a seamless checkout experience.

Here is an example of the checkout experience from Adidas, which is powered by PayPal. While not as minimal as the prior example, the process is still streamlined and easy to follow.

Administrative features

Administrative features — such as setup, terms and conditions, user permissions, and reporting — are often the features that people forget to check, but they can cause big problems down the road.

PayPal

When it comes to setting up a PayPal business account, all you need is your name, business address, and either your EIN or SSN (if a single-member LLC).

The signup process is straightforward and doesn’t require any contracts. There are also no early termination fees, other hidden fees, or bait-and-switch advertising gimmicks.

Once in your account, you can create up to 200 user roles for team members. Depending on the employee’s role, you can assign them various levels of permissions. You can also set up an email alias for customer service inquiries.

Easy-to-use reporting tools allow you to see sales volume, spot trends, and export the data to your accounting software or as a CSV file.

One caveat: If you run a business with recurring subscriptions, you might find yourself disappointed by the lack of reporting related to customer acquisition and churn. You’ll likely need to pay for a recurring revenue platform like Chargebee, Recurly, or Chargify.

Stripe

Just like with PayPal, when it comes to setting up a Stripe business account, all you need is your name, business address, and either your EIN or SSN (if a single-member LLC). While most customers will be approved within a few hours, the account approval process has taken a lot longer for some.

Stripe also doesn’t require any contracts. There are no early termination fees, other hidden fees, or bait-and-switch advertising gimmicks.

Once in your account, you can create an unlimited number of user roles for team members. Depending on the employee’s role, you can assign them various levels of permissions. Team members can also leave internal support notes on payments and refunds right within the dashboard.

Where Stripe really shines is in their reporting features. They are not only easy to use, but you can also expand the capabilities infinitely with Sigma, their business insights product.

Getting paid

If you’re signing up for a payment gateway, you need to not only collect payments but also easily and conveniently transfer money into your business’s bank account.

PayPal

PayPal offers immediate payouts, for free if you link to your bank account. The funds are usually deposited into your account within one to two business days. You can expedite fund delivery to a matter of minutes with their new instant transfer option for a small fee.

While I doubt this will be a dealbreaker for many, PayPal limits the amount you can transfer out:

- $60,000 per transaction

- $100,000 per day

- $250,000 per week

- $500,000 per month

Stripe

With Stripe, there are no fees and fewer restrictions than with PayPal. However, they only offer two-day payouts.

Security and fraud detection

One major thing to look into is safety and security. Does the payment gateway protect against fraudulent purchases? What are the dispute policies? Are they PCI compliant, etc.?

PayPal

For starters, PayPal is fully PCI compliant.

Pro tip: According to the PCI Compliance Guide, “The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that ALL companies that accept, process, store or transmit credit card information maintain a secure environment.”

https://www.pcicomplianceguide.org/faq/

They also offer 24-7 fraud monitoring, dispute resolution, and chargebacks. One common complaint from sellers is that PayPal always sides with the buyer, even when the seller provides proof/documentation to the contrary. These chargeback fees can really add up.

In addition, they also offer seller protection for eligible physical products. However, to be eligible, your business address must be in the U.S. and present required documentation within 10 days of the dispute being opened.

You can buy advanced fraud protection features for $10 per month + $0.05 per transaction.

Stripe

Stripe is also fully PCI compliant.

They offer dispute resolution and chargebacks. In addition, they have more advanced fraud monitoring (24-7) and detection tools, including the ability to block fraudulent sellers and IP addresses quickly. All of this is complimentary.

High-risk accounts

If you own a business that is classified as “high risk,” PayPal and Stripe might not be the best payment gateways for you.

PayPal

PayPal doesn’t allow any high-risk businesses on their platform. This includes anyone selling cigarettes (including e-cigarettes), tobacco, marijuana, CBD products, illegal drugs, controlled substances, counterfeit items, adult entertainment, knives, firearms/ammunition, MLMs, payday loans, and anything highly regulated by a government agency.

While technically allowed, you may run into a longer vetting process if you sell jewelry, airline tickets, file-sharing services, investment services, or online gaming.

Stripe

Stripe also doesn’t cater to high-risk businesses. They classify the following as high risk: counterfeit items, illegal drugs, marijuana (including medical marijuana), pirated music, alcohol, online pharmacies, MLMs, get-rich schemes, drop shipping businesses, airline tickets, preorder campaigns, cell phones, gift cards, porn, and sex toys.

| PayPal | Stripe | |

|---|---|---|

| Transaction fees | 2.99% + $0.49 | 2.9% + $0.30 |

| Countries supported | more than 200 | 46 |

| Currencies supported | 25 | 135+ |

| Security | PCI compliant | PCI compliant |

| High-risk accounts | Not allowed | Not allowed |

| Integrations | 500+ (Inc. Jotform) | 610+ (Inc. Jotform) |

| Customer support | Phone, live chat (limited) | Phone, live chat (24-7) |

Stripe vs PayPal comparison table

Integrations

Both PayPal and Stripe integrate with hundreds of software applications.

PayPal

PayPal integrates with more than 500 apps either directly or through a tool like Zapier. Some popular integrations include Xero, Slack, Google Drive, Mailchimp, Zoom, and HubSpot.

You can also integrate Jotform directly with PayPal. Here is a step-by-step guide.

Stripe

Stripe integrates with more than 610 apps, including HubSpot, Intercom, Zapier, Profitwell, Baremetrics, Slack, and Google Drive.

In addition, you can integrate with Stripe with Jotform. Check out this guide.

Customer support

Excellent customer support can offer peace of mind as well as act as an advisor when you have a question or an issue emerges.

PayPal

They also have extensive self-service resources for customers, including a knowledge base and Developer Portal. The Developer Portal has an interactive API explorer, Github repositories, a support forum, and a special bug reporting ticket portal.

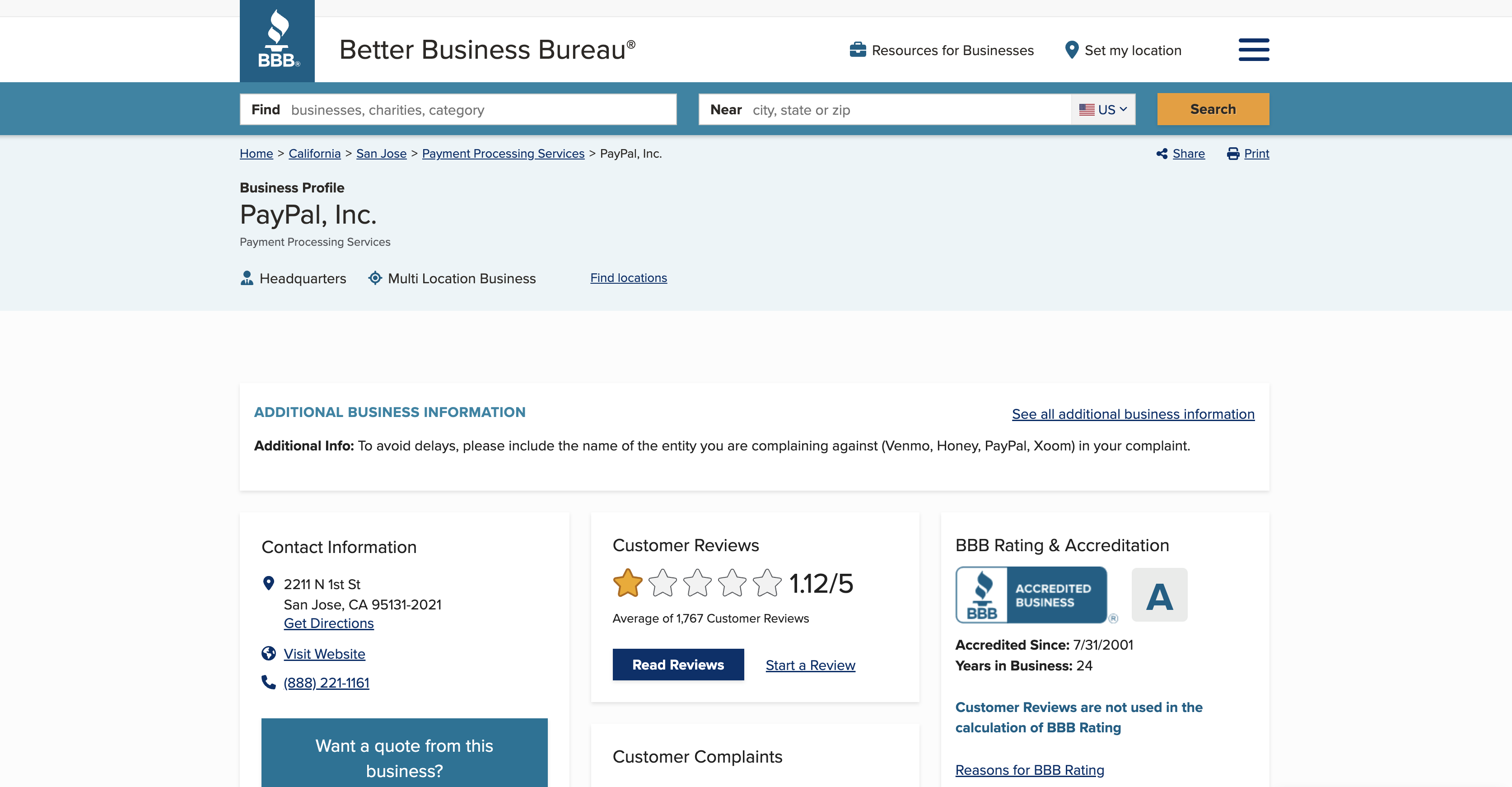

However, you can often learn the most about their customer support from online reviews. While they have an “A rating” on the Better Business Bureau (BBB), they also have 1760 reviews (mostly one star).

Stripe

Unlike PayPal, Stripe offers true 24-7 customer support via phone and live-chat. They also have email support and an IRC channel for developers.

Their extensive self-service resources for customers include a knowledge base, a developer portal, and a Status page (where you can monitor issues and outages).

You can also buy a premium support package by contacting sales.

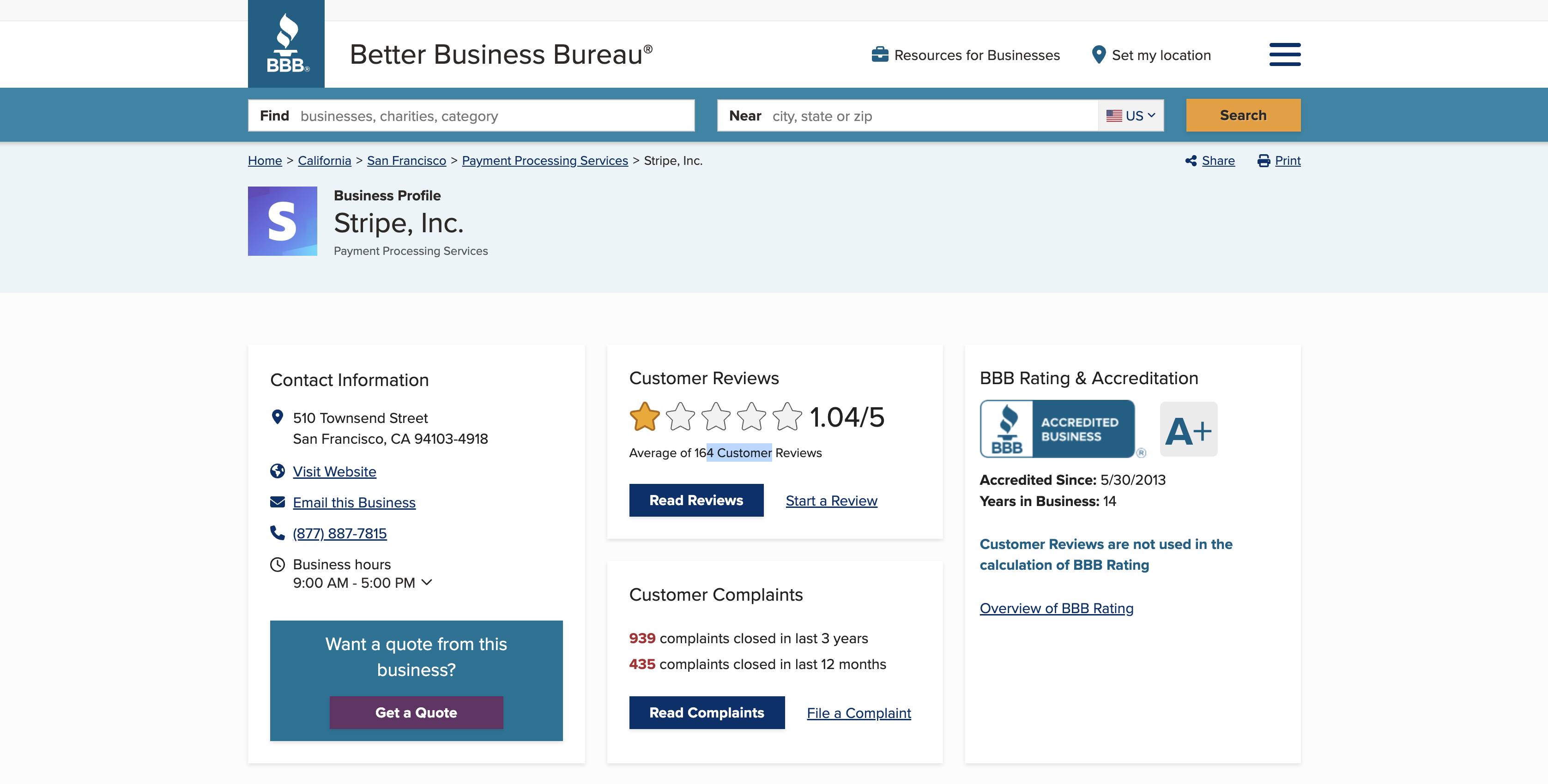

When you look at their BBB page, they were accredited in 2013 and have 939 customer complaints and 164 reviews (mostly one and two stars).

Notable customers

You can tell a lot about a platform based on the organizations they serve.

PayPal

PayPal is significantly more substantial but serves a lot of freelancers, solopreneurs, smaller nonprofits, and small and medium-sized businesses.

Stripe

Stripe, on the other hand, has no shortage of big brands, including Target, OpenTable, Blue Apron, Warby Parker, Wish, Under Armour, Lyft, Grab, Postmates, DoorDash, Slack, HubSpot, Tableau, Charity: Water, NPR, and UNICEF, among many others.

Conclusion

Both Stripe and PayPal are great payment gateways. When you’re deciding which one to use, we recommend taking into account the type of business you are running and creating a detailed list of pros and cons.

PayPal tends to work better for freelancers, solopreneurs, small business owners, e-commerce shops, and nonprofits.

Stripe is a better fit for online marketplaces, subscription or recurring revenue businesses, tech startups, and large enterprise companies.

However, it’s up to you to decide which payment gateway (or both!) best fits your specific business needs.

Send Comment:

2 Comments:

More than a year ago

Cool! Thanks for the info because I'm setting up another online store and I am currently using and I'm so happy and contented with it. It's just that I want to separate the earnings coming from my new business. I think I'll go with Paypal this time as my online payment processing gateway. Thanks again and more power to your blog.

More than a year ago

I don't know how to add account