QuickBooks vs Quicken — what’s the relationship between these two software programs? Are they built for the same purpose? Both platforms are tools for managing financial data, accounting, and bookkeeping, but are they really interchangeable with each other?

Understanding the similarities and differences between these two platforms will help you choose the right option for your needs. This article should help with that, providing you with

- A brief overview of each app

- The major features of each

- A side-by-side comparison

- Pricing plan information

- Pros and cons

- Reasons Jotform might be the right alternative for you

In our comparison, we’ll look primarily at publicly disclosed information and data from both apps in addition to user and expert reviews. We’ll also provide a basic overview of how Jotform compares to these apps so you can choose the right app for your needs.

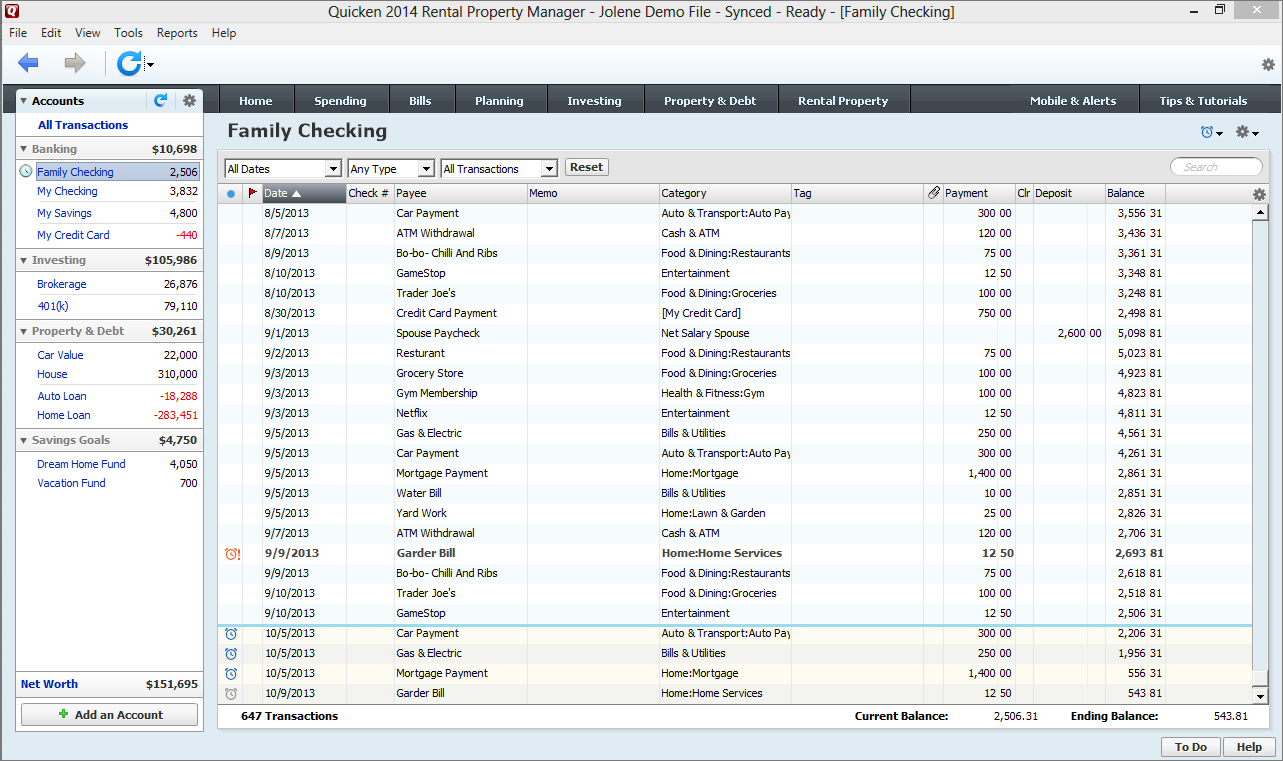

Quicken overview

Quicken is a financial information platform that’s aimed at helping individuals and families set and monitor budgets, expenses, and income as well as track and manage investments. While it’s designed for personal and family use, it also has a version that might be useful for small businesses.

Quicken was originally released in 1983 by Intuit, which then sold the app in 2016. Currently, the software is available for purchase and use in the United States and in Canada.

QuickBooks overview

QuickBooks is a suite of financial management tools for small, midsize, or large businesses. It covers accounting, payroll, tax preparation, expense and inventory management, and other similar functions.

Intuit developed QuickBooks as well, which remains one of the company’s top-selling programs today. It’s available in many different markets and languages.

Key features

Quicken

Quicken’s features are designed to assist individuals, families, and very small businesses in managing their finances. Some of those key features include

- Tools to manage investment real estate properties, including lease updates and online rent payments

- Automatic backups for desktop version users to help keep data secure and current

- Basic accounting tools that small business owners will find useful, including profit and loss reports, accounts receivable, and tools to help manage cash flow

- The ability to add and manage up to 512 different accounts (i.e., savings, checking, credit cards, loans, other debt, etc.) to a Quicken file

- The Business & Personal version, which allows users a single-interface overview of both personal and business finances

QuickBooks

QuickBooks is designed to support the financial needs of businesses. Some of its most notable key features include

- The ability to customize user reports for invoicing, expenses, bills, and project profitability

- Expansive customer service options via phone and chat; an extensive library of interactive and written help files, tutorials, and community forums; and an option to purchase more intensive support in the form of classes and ongoing live training

- Integrations with more than 750 other third-party apps, such as shopping platforms (like Etsy), inventory management tools, payroll systems, and more

- Easy scalability, giving you the ability to move up to the next plan as your company grows

- The ability to share your books with your accountant or bookkeepers

Common features

Despite the differences between their approaches and target audiences, QuickBooks and Quicken share some common features.

Both platforms offer basic financial tools to help set and manage budgets, expenses, and income. Both also provide a low-risk way for new users to evaluate the software before making a significant financial and time investment. Quicken offers a 30-day money back guarantee, and QuickBooks offers a 30-day trial for all its plans, including the top-tier Advanced plan.

Finally, both platforms also provide some basic accounting tools for small business owners, although QuickBooks goes far beyond Quicken in this regard due to its focus on business users.

Side-by-side comparison

Comparing the different features of the two platforms can help users make a more informed choice. The following table examines both QuickBooks and Quicken in terms of five different key features.

| Feature | Quicken | QuickBooks |

|---|---|---|

| Number of users | It only allows a single user per account with all plans. | It’s a scalable solution that allows you broader access to more users (up to 25) by upgrading to the next plan. |

| Integration options | It allows you to connect to banks and other financial institutions, as well as TurboTax. | It offers integrations with over 750 third-party business apps. |

| Accounting features & tools | It’s primarily for personal and family use, offering basic budgeting, expense management, and savings tools. There are a few basic business accounting functions for Business & Personal users. | It’s primarily for small to large businesses and offers tools for managing sales, taxes, invoicing, and more. |

| Customer support | Users may access support via chat seven days a week from 5 a.m. to 5 p.m. PT. Phone support is available Monday–Friday from 5 a.m. to 5 p.m. Help is also available via community forum, and users of some plans can access an AI assistant for basic support. | Users may access support via phone, chat, community forum, and a library of resources. Advanced plan users get 24-7 support from experts. |

| Cost | Four plans priced from $3.99 to $10.99 per month (when paid annually) | Four plans priced between $30 and $200 per month |

Plans and pricing

Any financial management software should provide solid value for a reasonable cost. After all, if the cost is beyond your means, it won’t really matter how well it helps you save money or meet other financial goals. Both Quicken and QuickBooks offer different tiered plans and pricing structures, and each has its own set of features and limitations.

Quicken’s plans and pricing

Quicken currently offers three plans for individual or personal use and one for business use.

The Quicken Simplifi plan, which is $3.99 per month, allows access via web and mobile app. It provides users with access to real-time reports, management tools for financial goals, cash flow projections, and personalized spending plans.

The Quicken Classic plan offers Deluxe and Premier versions, which are $5.99 and $7.99 per month respectively and are available for both Windows and Mac desktop use. Features include budgeting, investment management, built-in tax reports, bill tracking and payment, and accounting reconciliation tools.

At $10.99 per month, the Business & Personal plan allows users to track and manage both personal and small business financial data from one interface. It includes all the features from the Classic Premier version and adds tax preparation, invoice management, and rental property tools (lease management, rent collection, and more).

QuickBooks’ plans and pricing

QuickBooks offers four plans based on key needs and metrics, such as number of users who will need access, whether your business needs to account for income and expenses in different currencies, and how many sales channels you’ll need to import and account for.

Simple Start is the entry-level plan. You’ll get access to expert tax assistance, tools to manage and track income and expenses, automated workflows, invoicing and payments, and cash flow management, which are included in all QuickBooks plans. The price is $30 per month.

The Essentials plan adds the ability to connect two additional sales channels (like Shopify or Amazon), manage multiple currencies, and track time. You’ll also get access for three users. The price is $60 per month.

The Plus plan includes everything in Essentials and adds access for two additional users as well as inventory management, project profitability tracking tools, and financial planning assistance for $90 per month.

Finally, the Advanced plan, which is $200 per month, provides all features from other plans, plus access for up to 25 users, data sync with Excel, employee expense management, broader workflow automation, data restoration capabilities, access to 24-7 support and more.

Pros and cons

Quicken pros and cons

| Pros | Cons |

|---|---|

| All plans are far less expensive than the QuickBooks options. Its ease of use and the simplicity of its user interface mean users will get full benefit of its features without needing a lot of training. The Business & Personal plan comes with useful tools for landlords and rental property investors to manage leases, rents, and terms. | It’s not a scalable solution for businesses that plan to expand. It allows only one user per account. The business financial management tools aren’t nearly as robust as those QuickBooks offers. |

QuickBooks pros and cons

| Pros | Cons |

|---|---|

| The extensive list of features and benefits allows businesses of any size to track, monitor, and improve profitability. It’s highly scalable. It can accommodate up to 25 users, depending on the plan. | It costs more than Quicken. It’s not really built for individual or personal use. It may require more extensive training to make full use of its features. |

Jotform: A creative alternative

Where does online form builder Jotform fit into the QuickBooks vs Quicken discussion? Let’s look at the ways in which Jotform differs from these two products and why it’s a valuable alternative to them.

Quicken is known for its budgeting and financial management capabilities. Jotform’s advanced features and products help you achieve the same or better results. With Jotform Tables budget sheet templates, you can easily manage your expenses. You’ll also find a variety of finance templates for both businesses and individuals.

Jotform is also a valuable alternative to QuickBooks, thanks to its bookkeeping capabilities. Employees can fill out expense tracking forms so that your finance team can easily track expenses in Jotform Tables. For any financial activities that require prior approval, Jotform Approvals will help simplify and automate the approval process. You can even create your own financial app that employees can easily download to their mobile devices for better financial management and tracking on the go.

You can also use QuickBooks and Jotform together with Jotform’s QuickBooks integration and QuickBooks forms. Information entered into Jotform forms will automatically populate in your QuickBooks account.

Photo by Tima Miroshnichenko

Send Comment: