Buy now, pay later (BNPL) is becoming more popular, thanks to the seismic shift the retail industry has experienced over the course of the COVID-19 pandemic.

As a result of movement restrictions and lockdowns, changes in consumers’ financial circumstances, and new regulations retailers have to follow, customer behavior has changed.

The impact is apparent in every aspect of consumer behavior — from what and how they buy to how they pay. For many retailers, customers have gone from a fairly predictable demographic to more of a moving target.

BNPL is a magnet that you can use to attract customers to your e-commerce business. And since revenues have become more uncertain, retailers are looking for new and creative ways to attract customers. Let’s look at the advantages of offering this type of payment plan to your audience.

Increased conversion rate

Being able to take home a purchase without paying for it immediately is extremely attractive to a lot of consumers. People are more likely to buy something if they can pay for it in installments.

Industry data supports this. BNPL provider Afterpay has found that conversion rates increase between 20 to 30 percent for retailers that offer this service.

Increased sales per customer

Customers love flexibility when it comes to paying for purchases. Businesses that offer flexible consumer credit options like BNPL generally see their average order value increase 15 percent. For big-ticket items and other large purchases, flexible payment options can be the difference between a low or high cart abandonment rate on large purchases.

In one study, 30 percent of shoppers said a flexible payment plan option meant the difference between making a purchase and forgoing it. Whenever a payment system helps a retailer increase sales, it’s worth considering.

Improved user experience

Few things are worse for a small business than a customer who loves the product and the price but gets cold feet at the point of checkout. Whether in a store or shopping online, consumers expect to have multiple ways to pay.

Implementing BNPL gives them an additional option and the increased payment flexibility they crave. In fact, 76 percent of consumers are more likely to complete the purchasing process if a retailer offers them a simple and seamless payment plan.

Increased affordability

One advantage of BNPL plans over credit cards is that many BNPL payment options are interest free.

These payment plans come in many forms. Some offer an interest-free period, with interest accruing (but the buyer not yet owing) in the background. The buyer doesn’t have to pay that interest if they pay the balance within the interest-free period. Other plans offer entirely interest-free financing — with the merchant paying a fee for financing services.

Increased affordability is also the result of decreased sticker shock for higher-priced items. That’s because retailers can advertise the item with a plan based on affordable monthly payments, rather than posting the total price, which may seem out of reach.

Potentially free BNPL implementation

With a BNPL provider like PayPal Credit, you can offer a payment plan to your customers without incurring up-front implementation costs. Not all BNPL lending providers offer this benefit, though. Some charge a monthly fee for their services. Make sure to read the fine print before signing up.

Up-front payments

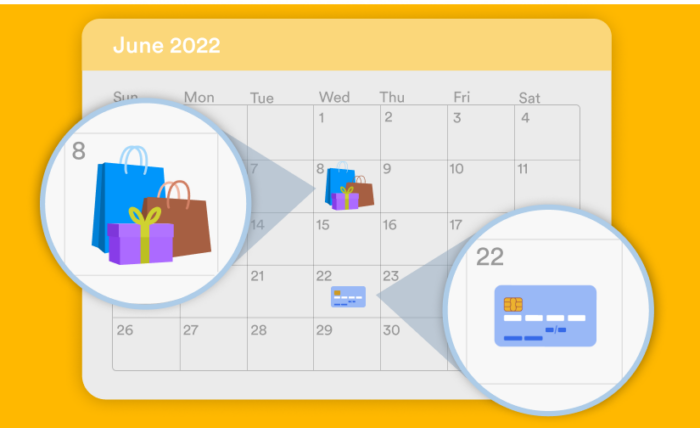

When a retailer offers a BNPL option through a third-party provider, the retailer receives the proceeds of the sale up front, much like a credit card transaction. The responsibility for collecting installment payments then falls to the provider.

Increased traffic from younger customers

An increasing number of millennial consumers are using debit cards rather than credit cards for purchases. However, even though credit card use is declining among this demographic, you can still offer flexible payment options.

Apps such as PayPal and Venmo are on the rise among this same group. Younger consumers want flexibility in payment options without the “trap” of being locked into high interest rates and revolving balances.

Plans like Pay in 4, offered by PayPal, are perfect for this type of customer. Pay in 4 lets a buyer pay over time, but it limits the payments to four installments collected every two weeks. It’s an interest-free option millions of online retailers accept, and it can apply to purchases of $30 to $600.

Fewer returns

When merchandise boomerangs back, it’s a hassle for any retailer. Adding a BNPL option to your e-commerce store can decrease returns. BNPL provider Afterpay reports their clients have seen an 8 to 18 percent reduction in customer returns.

Faster approval

Unlike credit cards, BNPL doesn’t do an exhaustive credit check before allowing the purchaser to use the service. The customer simply provides some basic payment information, such as the account and routing numbers of the bank account they’ll use to make payments. In most cases, approval happens within minutes.

Customers often have the option to automate payments, which can reduce delinquencies for the BNPL provider.

With BNPL options, such as PayPal Pay in 4, your business could increase not only the total amount in sales but also the number of sales, including the number per customer. The flexibility in payment options can also improve the user experience — all good things for your business.

Send Comment: