Creating an effective insurance workflow

- Create standardized procedures

- Connect your systems

- Automate workflows

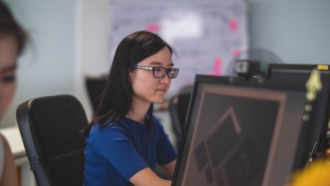

A successful insurance company has a series of workflows that need to operate seamlessly for the company to deliver on its promises to customers.

It doesn’t matter if you’re a broker, an agent, or a carrier, the quality of your systems will dictate the level of your success. Streamline and automate your quoting, onboarding, and claims workflows, for instance, and you’ll create a more efficient and profitable business.

The sheer number and complexity of workflows in the insurance industry can make workflow optimization seem like an uphill struggle. But it doesn’t have to be. With a step-by-step approach and a clear idea of how to optimize the way teams work, any insurance company can reap the benefits of improved workflows.

Which insurance workflows are ripe for improvement?

There are dozens of different workflows in the insurance industry at every stage of the customer journey, from sales and onboarding to underwriting and claims management. You can optimize all of them to streamline and improve your business. Common workflows include

- Insurance applications

- Underwriting

- Customer onboarding

- Claims management

- Customer service

What are the benefits of improving your insurance workflow?

Poorly designed workflows can result in siloed data. It’s particularly common for part of a process to be automated while another related part isn’t. For example, customers may fill out forms electronically, but if that information doesn’t get passed on to another stage of the process, employees will have to waste time searching for and reentering it.

Improving your workflow will streamline processes and lead to a more efficient and profitable business. And it doesn’t matter whether it’s in sales or claims, every insurance company has inefficient processes that could be improved.

Take the sales process, says Zviki Ben Ishay, cofounder and CEO at digital engagement platform Lightico. “With automated workflows, agents do not need to read cumbersome compliance scripts out loud, which takes up precious time. Instead, agents can easily send terms and conditions to the customer’s smartphone for immediate [one-]click consent.”

Customer satisfaction improves too. More efficient processes enable insurers and agents to respond to customers and process claims much faster, leading to an increase in repeat business in the future.

How can you improve your insurance workflow using digital process automation?

There are multiple ways to improve insurance workflows. Some firms will adopt a raft of new technology to automate and optimize workflows. Others will take a leaner approach and rely on rigorous documentation and standard operating procedures. Here are three of the most common approaches.

Create standardized procedures

The easiest way to improve workflows in your insurance business is to create procedures and assign responsibilities for everything.

When you document processes and assign responsibilities, everyone knows what they need to do and how they should do it. Employees can work confidently and quickly, meaning they can complete tasks faster without the need for new digital tools.

Connect your systems

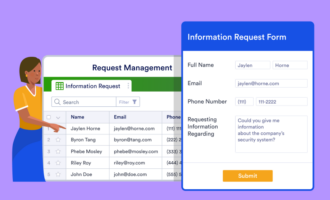

Make siloed data a thing of the past by connecting separate, segregated systems across your organization. This is particularly powerful during the claims application process, when managers usually have to sort through siloed systems one by one to find necessary information. When systems communicate with each other, you get what you need in seconds, not hours.

Automate workflows

One of the most effective ways to improve your workflow is by automating various tasks. Doing so will speed up task completion and reduce the risk of human error.

Jotform is the perfect solution for insurers looking to automate their practices. You can use our insurance form templates to automate data collection for everything from quotes to home inventories to claims. Better still, you can store, manage, and export all of that data automatically in a Jotform table.

That’s not all you can do with Jotform. If parts of your workflows require approval, you can automate that process using our approval templates. You can automate every step of the process, from data collection to responses to approvals, using a combination of forms, tables, and automated triggers, meaning your employees never have to manually run the process again.

Photo by Anna Shvets

Send Comment: