Online merchants face many questions as they develop their sites and checkout processes. One of the biggest choices to consider is whether to use a hosted vs a non-hosted payment gateway on the checkout page.

Why is this so important?

The way your online store accepts payment has an impact on the customer experience. Whether you’re soliciting donations, collecting registration fees, or selling products online, you have to decide how you will transfer those funds from the payer.

According to a Baymard Institute study, 21 percent of shoppers have given up on purchases simply because they felt that the process of checking out took too long or was too complicated. It’s up to merchants to ensure they aren’t putting up roadblocks in the checkout process that hinder shoppers from completing a transaction.

That means it’s important to make the right choice about which type of payment gateway your online store or website will use for its checkout process.

What is a payment gateway?

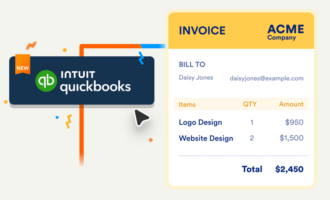

Every website or online store that collects payment needs a payment gateway — an e-commerce service that approves and authorizes the transfer of credit and debit card payments between buyer and seller. A payment gateway is essentially the intermediary between buyer and seller that ensures a smooth transaction.

There are two basic payment gateways to choose from: hosted vs non-hosted. Which one you select depends on the type of experience you want to offer a payment plan to your customers and the amount of control you want to retain over the payment process.

Pro Tip

Jotform lets you collect payments online — with no extra transaction fees — via popular gateways like PayPal and Square.

What is a hosted payment gateway?

A hosted payment gateway is a third-party checkout system that redirects the user to the payment service provider’s (PSP) page. This means that the user will leave your website to complete payment and then be sent back to your website to finish the checkout process.

This benefits the merchant because (for a fee) the payment service provider handles the entire transaction process and provides enhanced security and data protection.

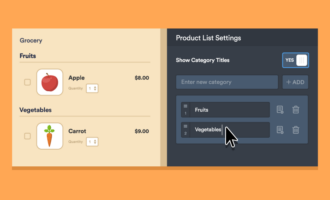

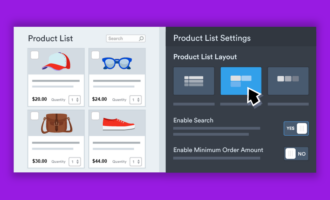

Hosted payment gateways are simple to set up — they often use templates that require you to simply input information — and are maintenance free for merchants because the payment service provider (PSP) controls the process.

Most of the top-rated PSPs allow you to customize the checkout page to some extent so it displays your company’s branding. This is an important visual cue to assure customers that they aren’t being scammed into giving away their credit card information.

In fact, risking customer trust is one of the biggest pitfalls to hosted payment gateways. When they’re redirected to another page for payment, cautious shoppers may hesitate to complete the transaction. If the checkout process “doesn’t convey trust, is difficult to use, or looks out of place, it can cause you to lose sales,” Nicole Kohler at Woo Commerce writes.

Using a hosted payment gateway also means the merchant is relinquishing control of some part of the transaction process. Yes, you may be able to customize the checkout page, and you can choose which PSP to use, but ultimately, the PSP controls the process.

What is a non-hosted payment gateway?

The other option is to have your customers complete the checkout process on your web page. This is known as a non-hosted or onsite payment gateway. With this option, your customers aren’t directed to another page to complete the transaction. They enter their payment information directly on your website.

With a non-hosted payment gateway, merchants have complete control of the customer experience. This may help improve conversions because buyers are dealing only with a trusted brand — yours. The checkout page looks exactly like the rest of your branded website, so there’s no confusion about where the payment is going.

This method of payment collection also allows you to better track customer data that you can use in future marketing efforts. When a customer completes a transaction through a non-hosted gateway, you can link that purchase with the customer’s account and track their purchasing habits.

While that level of control is a big plus, employing a non-hosted payment gateway means you’re responsible for ensuring transaction security and data protection throughout the entire checkout process. That can require a lot of resources — and many merchants may not have access to those.

Technical support could also be a challenge for merchants who choose a non-hosted payment gateway option. If there are any issues with the checkout page, you’ll be responsible for troubleshooting the problems. This may require you to hire a professional, which could be costly.

When trying to decide which payment collection option — hosted vs non-hosted — is best for you, Allen Burt, founder of e-commerce scaling agency Blue Stout, recommends asking yourself these three questions:

- How does the gateway on your site enhance the customer checkout experience?

- Will the gateway integrate seamlessly with your current website platform?

- Can the gateway grow as your business does?

Understanding the answers to these questions — as well as your customer and business needs — will help you make the right choice between a hosted vs a non-hosted payment gateway.

Send Comment: