Top budgeting apps

It can be painful to check your bank account and realize that your spending has been out of control, you haven’t met your savings goals, or your debt hasn’t gotten any smaller. We all want to feel in control of our finances, but getting a comprehensive picture of our money and where it’s going can be difficult.

Budgeting doesn’t have to be a chore. With the right app, managing your money can become a seamless part of your daily routine. In this article, we’ll look at seven budgeting apps that can help you take control of your finances.

Benefits of budgeting apps

You can use budgeting apps to monitor expenses, set financial goals, and manage bills. Tools like automatic transaction syncing and bill notifications can help you stay on track, have real-time visibility into your finances, and make smart spending decisions.

Whether you’re saving for a vacation, trying to pay off debt, or building a financial safety net, these apps can make budgeting more manageable and effective.

Things to consider when choosing the best budgeting app for you

When you’re looking at budgeting apps, consider your budgeting needs, financial goals, and personal preferences. For example, do you want an app that integrates with your bank? Are you looking for financial advice and resources? Do you want to track granular spending habits or focus on broader spending categories? Can you customize the app to suit your needs?

To help you review your options, we’ve made a list of seven of the best budgeting apps.

7 best budgeting apps

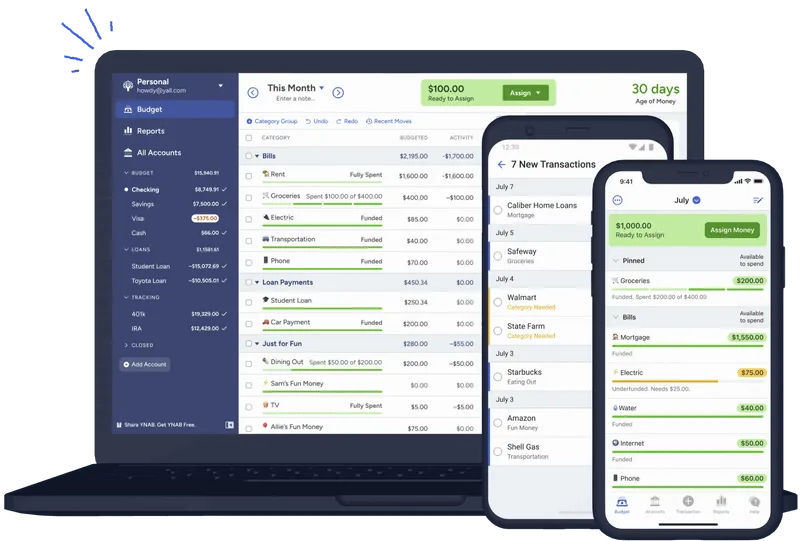

1. YNAB

- Key features: zero-based budgeting, goal setting, bank account syncing, detailed financial reports

- Pros: detailed target categories, cross-platform syncing, loan calculator, shared subscriptions, learning resources

- Cons: no free plan

- Pricing: 34-day free trial then $14.99 per month or $99 per year

- Platforms: browser, iOS, Android, Apple Watch

- User ratings: 4.8 on Apple’s App Store, 4.7 on Google Play

YNAB is a budgeting app that lets you assign each dollar you earn to custom expense categories. Once you’ve established your expense categories and savings goals, you’ll have a comprehensive financial plan for the money you actually have. You can then track your progress toward achieving your financial targets or modify your targets as needed.

YNAB also offers free live workshops to teach users how to manage money as well as guides, videos, and podcasts. YNAB connects directly to bank accounts, so transactions are synced and tracked automatically. Users can set spending and saving goals, use a loan calculator to figure out how to pay off debt, and access graphs and charts to analyze their spending.

2. Jotform Apps

- Key features: no-code drag-and-drop custom app builder with form and table features

- Pros: highly customizable, easy to use, software integrations

- Cons: not a dedicated budgeting tool

- Pricing: free plan; three paid, single-user plans: Bronze ($34 per month), Silver ($39 per month), Gold ($99 per month); Enterprise multiuser plan (contact sales for pricing)

- Platforms: browser, iOS, Android

- User ratings: 5.0 on Apple’s App Store, 4.8 on Google Play

Jotform Apps is an easy-to-use app creation tool that lets users create highly customizable apps from scratch or from one of over 700 templates, without needing to know any code. You can create a custom budgeting app, tailored to your specific financial goals and habits, that you can use to track and update your income and expenses on the go.

The apps you create with Jotform Apps essentially act as repositories for customizable spreadsheets, forms, and reports. You can create your own budgeting table or multiple tables, integrate them into your custom app, add other features and resources you might want, like links and videos, and then access all of your budgeting resources in a central location by downloading the app to your phone or accessing it from your computer.

If the idea of building your own budgeting app appeals to you, go to the end of this article for more information and a step-by-step guide.

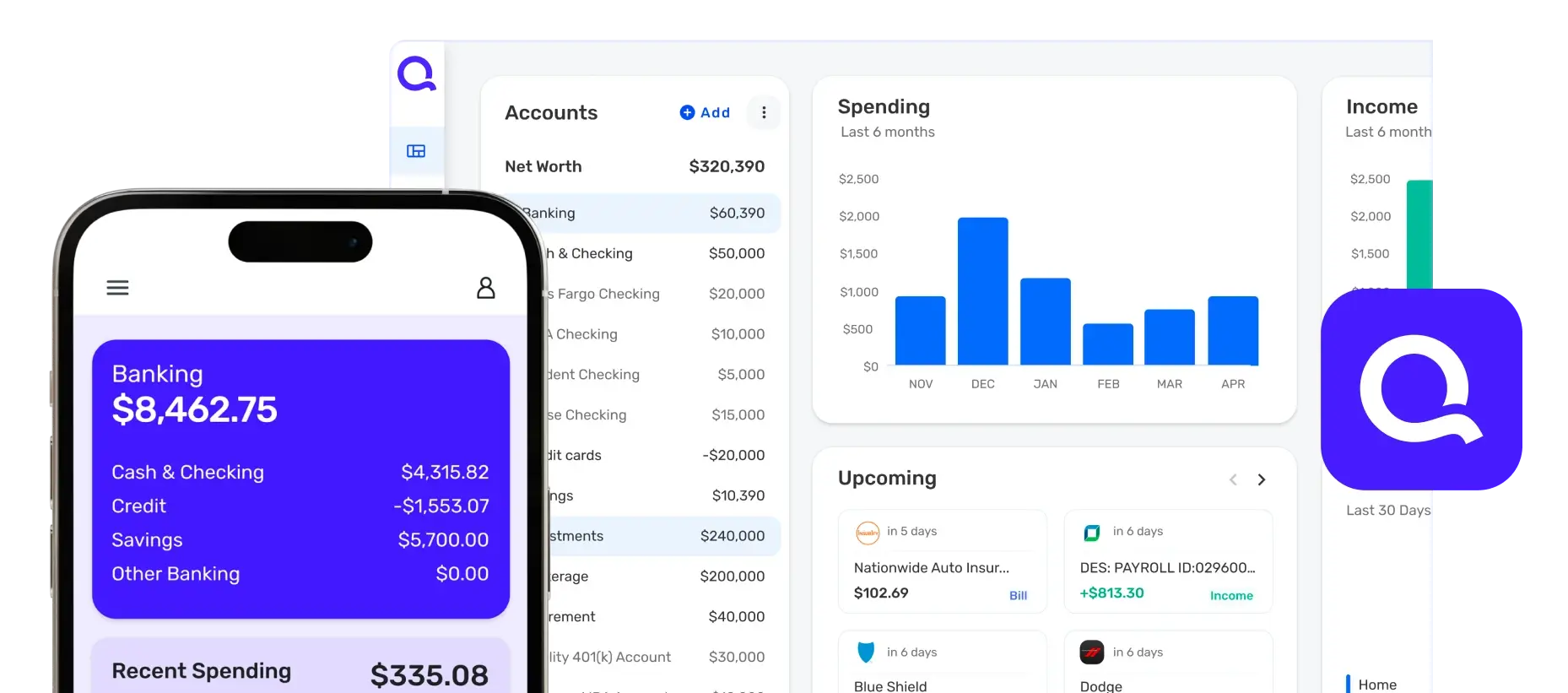

3. PocketGuard

- Key features: automatically track all accounts, loans, and investments in one place; bill tracker; zero-based budgeting

- Pros: progress tracking, spending categories, historical spending data

- Cons: some users have experienced issues with transactions and accounts syncing

- Pricing: $12.99 per month or $74.99 per year

- Platforms: iOS, Android, web

- User ratings: 4.6 on Apple’s App Store, 3.9 on Google Play

PocketGuard is designed to be a single comprehensive platform where you can see all of your accounts, loans, and investments. The app shows users how much disposable income they have after bills, goals, and necessities. Users can generate personalized financial reports, set up debt repayment strategies, and sort spending with their own categories and tags.

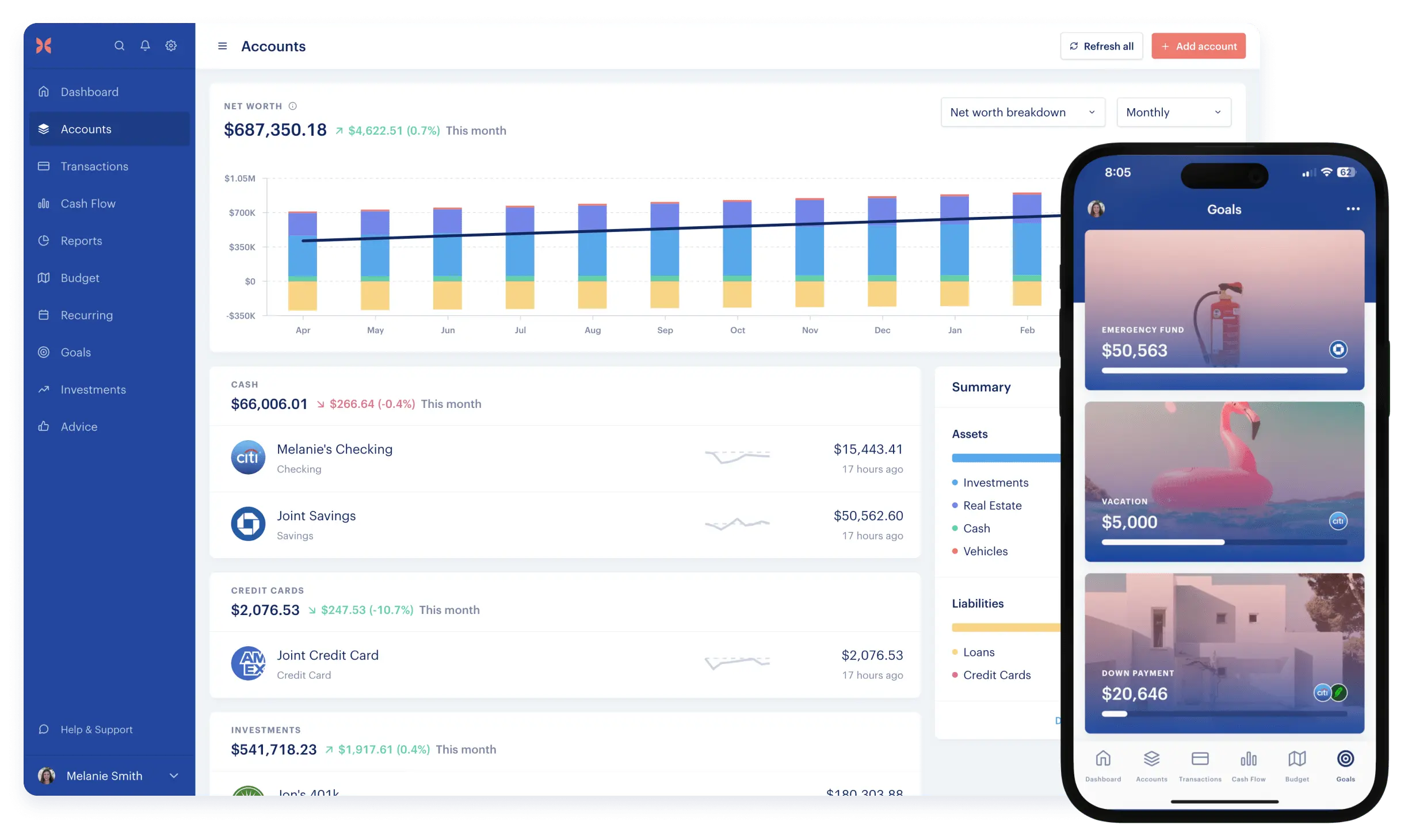

4. Monarch

- Key features: data syncing, custom budget categories, investment tracking and analysis, goal setting, progress tracking, partner collaboration

- Pros: customizable dashboard, finance reporting, search tool, no ads

- Cons: some users have reported issues with bank accounts disconnecting

- Pricing: seven-day free trial then $14.99 per month or $99.99 per year

- Platforms: browser, iOS, Android

- User ratings: 4.9 on Apple’s App Store, 4.7 on Google Play

Monarch provides a holistic view of your finances, tracking all your assets and transactions in one place. Users can create budgets with customizable categories, set and track goals, and view their spending in charts and graphics. Dashboards offer users a comprehensive view of their money, with personalization options and drag-and-drop widgets. Monarch also lets you add a partner to your plan for free.

5. Quicken Simplifi

- Key features: real-time expense tracking and alerts, personalized spending plan using user’s preferred budgeting method, spending categories

- Pros: automatic reports, loan repayment plans, customizable categories

- Cons: some users have reported issues with the user interface and bugs

- Pricing: $47.88 per year ($24 per year with discount)

- Platforms: browser, iOS, Android

- User ratings: 4.2 on Apple’s App Store, 4.3 on Google Play

Quicken Simplifi offers customers personalized spending plans using the budgeting method of their choice (zero-based, 50-30-20, etc.) and real-time money tracking. Users can generate reports on spending and savings. Transactions are synced automatically from users’ accounts and can then be categorized with custom tags. The app can also send users alerts about suspicious transactions, bills, and approaching spending limits.

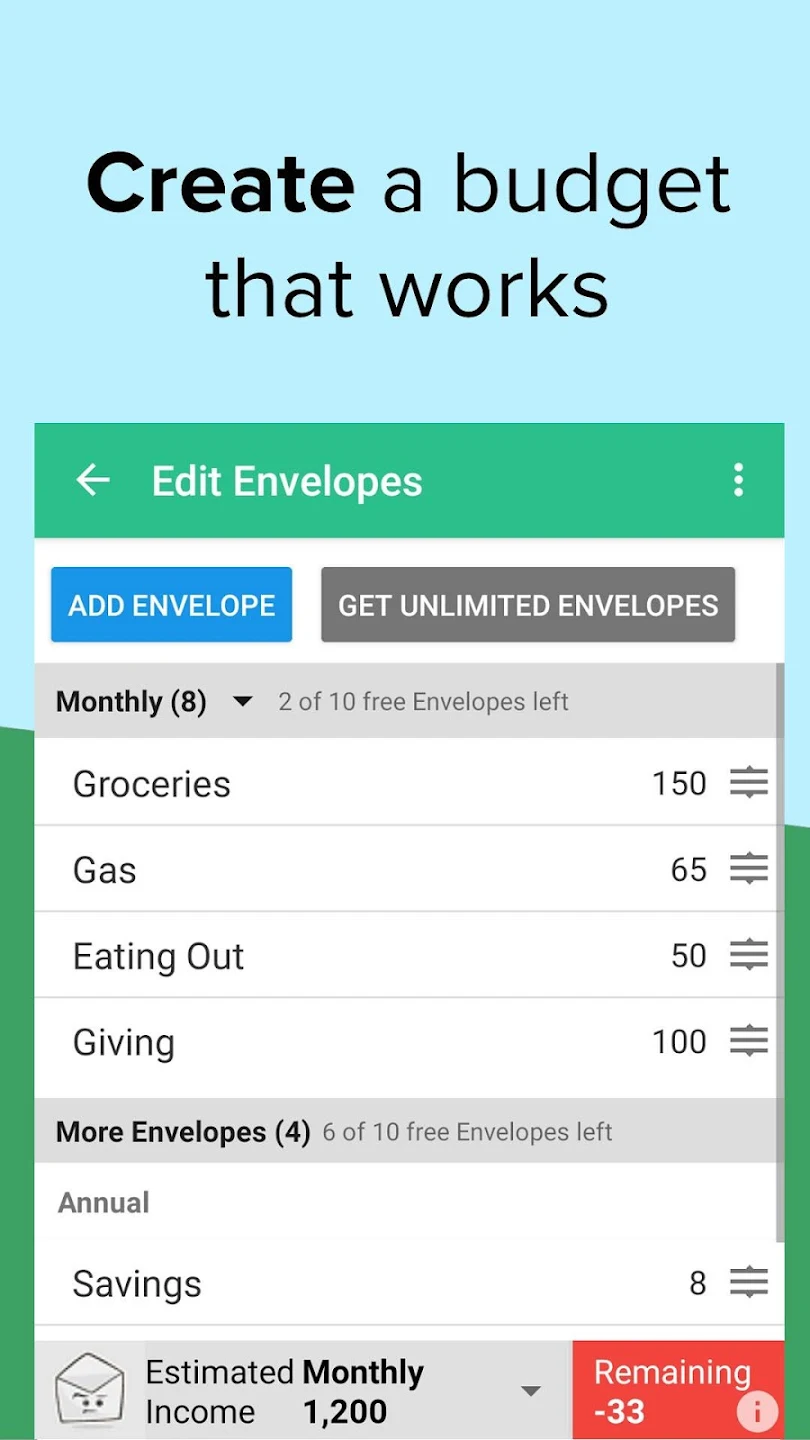

6. Goodbudget

- Key features: envelope budgeting method, debt payoff tracking, cross-platform syncing

- Pros: sharing budgets with family members, saving for large future expenses, spending analysis and cash flow reporting, free option

- Cons: automatic bank syncing available only on paid plan

- Pricing: free plan, Premium ($10 per month or $80 per year)

- Platforms: browser, iOS, Android

- User ratings: 4.6 on Apple’s App Store, 4.0 on Google Play

Goodbudget implements the envelope budgeting method to help users allocate funds and track spending across various categories. The app is especially useful for families or couples who want to manage their finances together by allowing them to share budgets. Users can manually enter transactions on the free plan or automatically sync Goodbudget with their bank accounts on the paid plan.

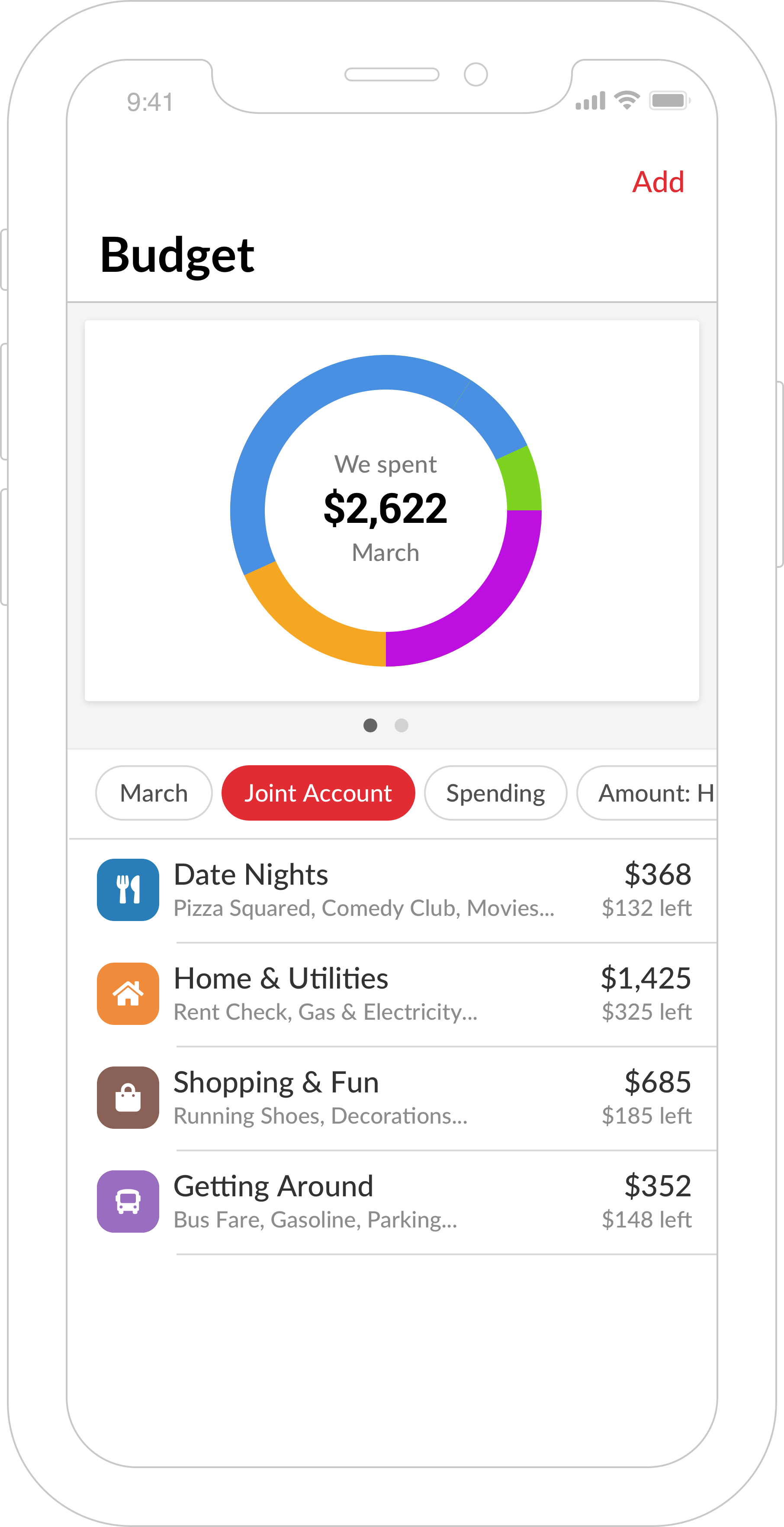

7. Honeydue

- Key features: shared budgeting and expense tracking for couples, bill reminders and notifications, in-app communication with partner

- Pros: comprehensive account tracking, monthly household spending limits, custom transaction categories, expense division

- Cons: only supported on mobile, no web interface

- Pricing: free

- Platforms: iOS, Android

- User ratings: 4.5 on Apple’s App Store, 3.7 on Google Play

Honeydue is specifically designed to help couples track and manage their money together. It includes tools for monthly budgeting, tracking expenses, and setting spending limits. Users can add custom spending categories, use a chat feature to react to a transaction or ask their partner about it, and receive bill reminders.

How to create your own budgeting app with Jotform

Maybe none of the budgeting apps you’ve read about seem quite right for you, and you’d like to have a go at creating your own budgeting app. Jotform Apps can support spreadsheet-based budget tracking and help you easily view and track your finances on the go. You can use the simple drag-and-drop App Builder to add the app elements you want, integrate widgets, and customize the app’s fonts, colors, and layout.

Read on to learn how to make a personalized budgeting app with Jotform Apps. (This article provides more detailed instructions.)

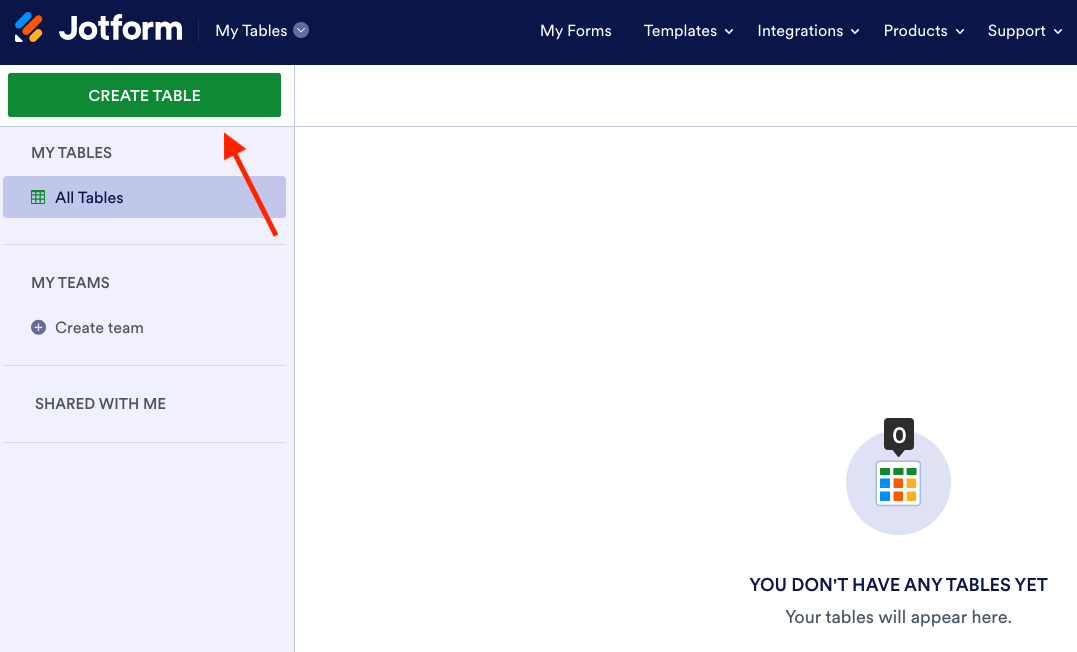

- Log into your Jotform account, or create a new one for free.

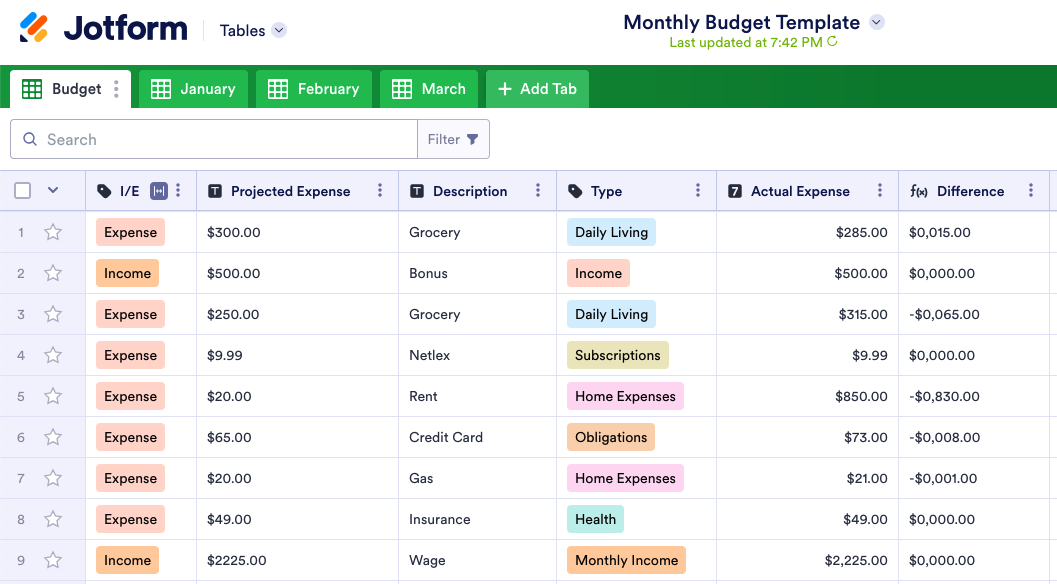

- Go to https://www.jotform.com/mytables/ and click Create table. From here, you can either build a new table from scratch, choose an existing template, or import data from a CSV or Excel file (this can be helpful if you’ve already been tracking your budget in a spreadsheet). In this instance, we’re going to use Jotform’s monthly budget template.

- You’ll be taken to the new table, which you can then customize as desired, creating new rows for transactions, tagging them by custom category, calculating totals, and more.

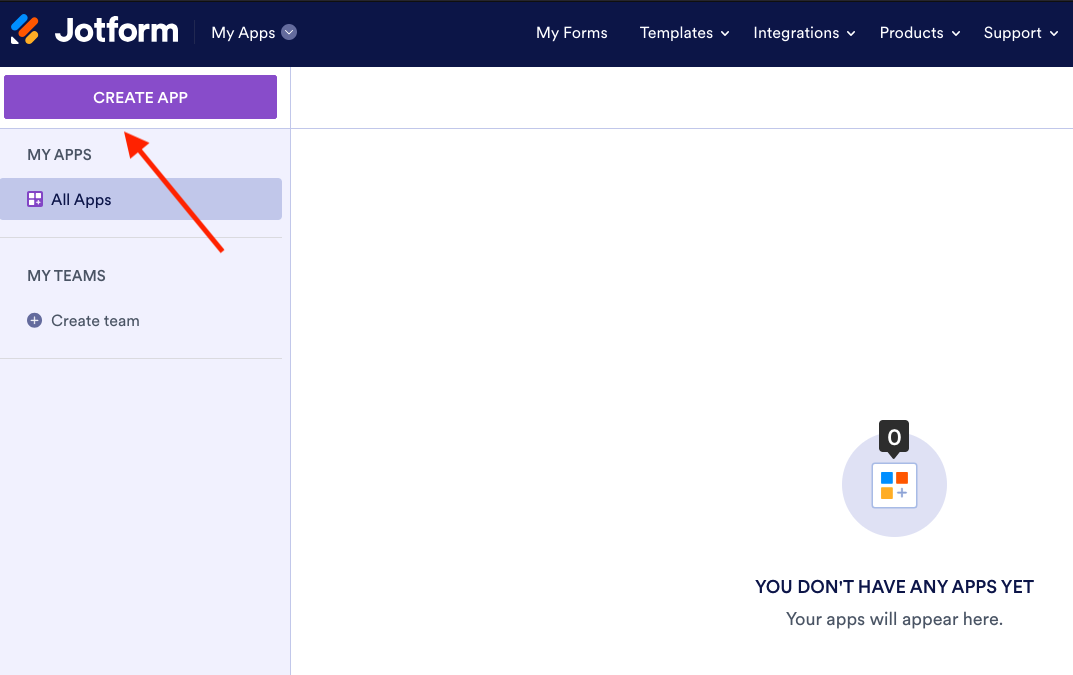

- Go to https://www.jotform.com/myapps/.

- Click Create app. You can choose to either start a new app from scratch or use a template.

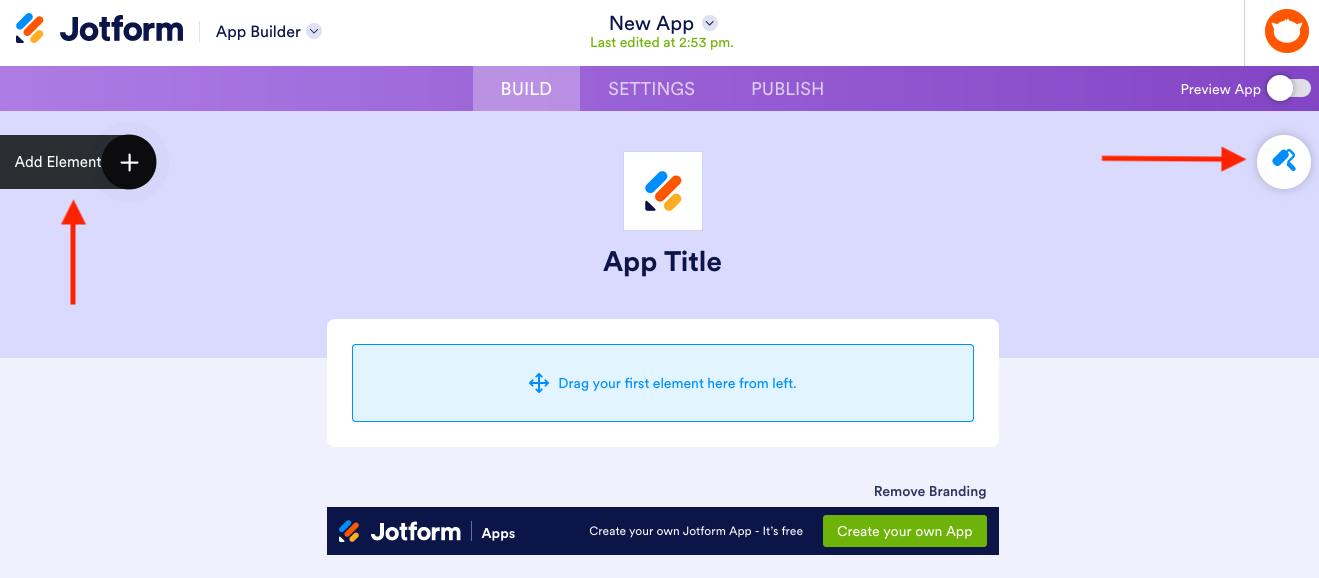

- You’ll be taken to Jotform’s App Builder. Here, you can add app elements, customize the design, and adjust settings. To add a new app element, click Add Element. To customize the design, click the paint roller icon. You can drag and drop app elements to reorder them.

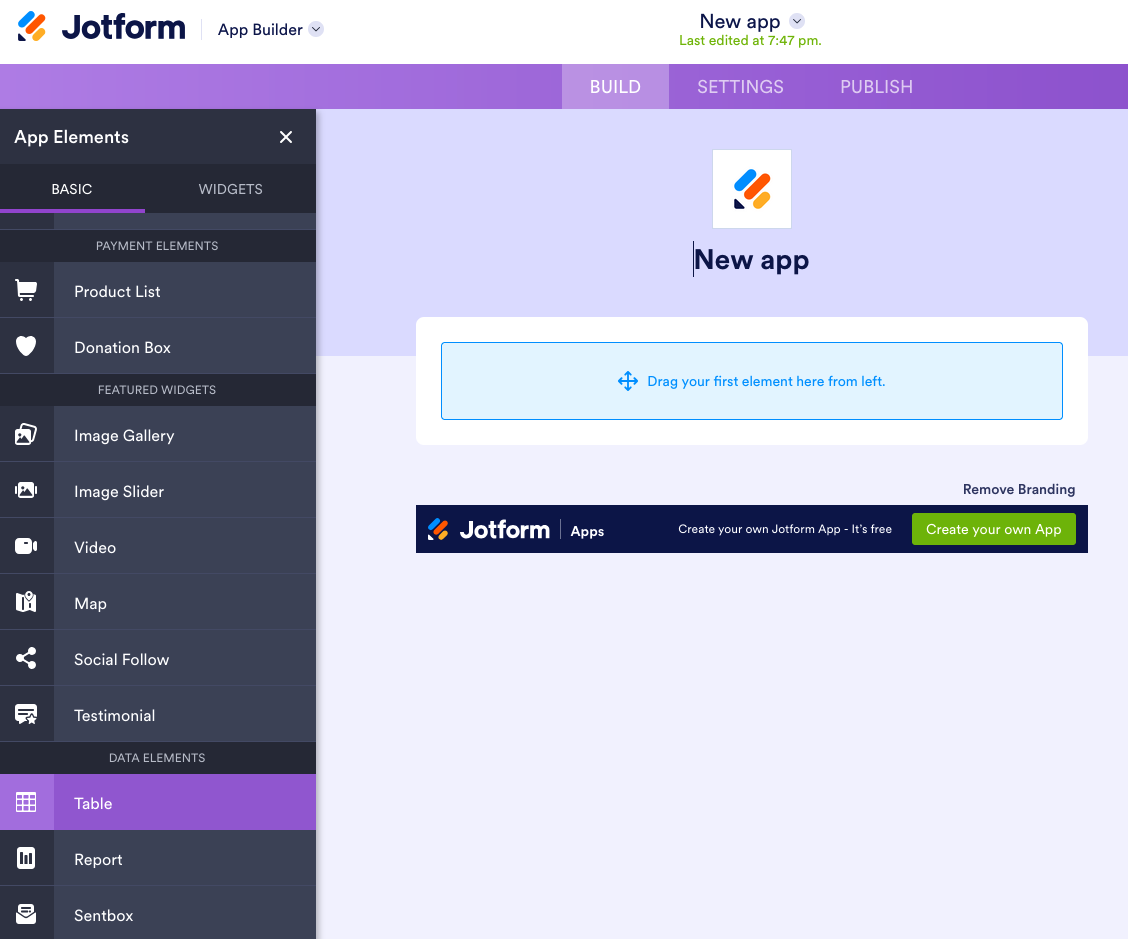

- Click Add Element and select the Table field, or drag and drop it into your app. In the dialog box that opens, choose the monthly budget table you just created and click Add. Your budget table will now be housed in your app.

- You can add more elements to your app and customize it as desired. For example, maybe there’s a financial advice video you find particularly helpful. You can include it in your app by selecting the Video app element. Or maybe there’s a useful financial literacy website — just select the Link app element to make it easily available directly from your app.

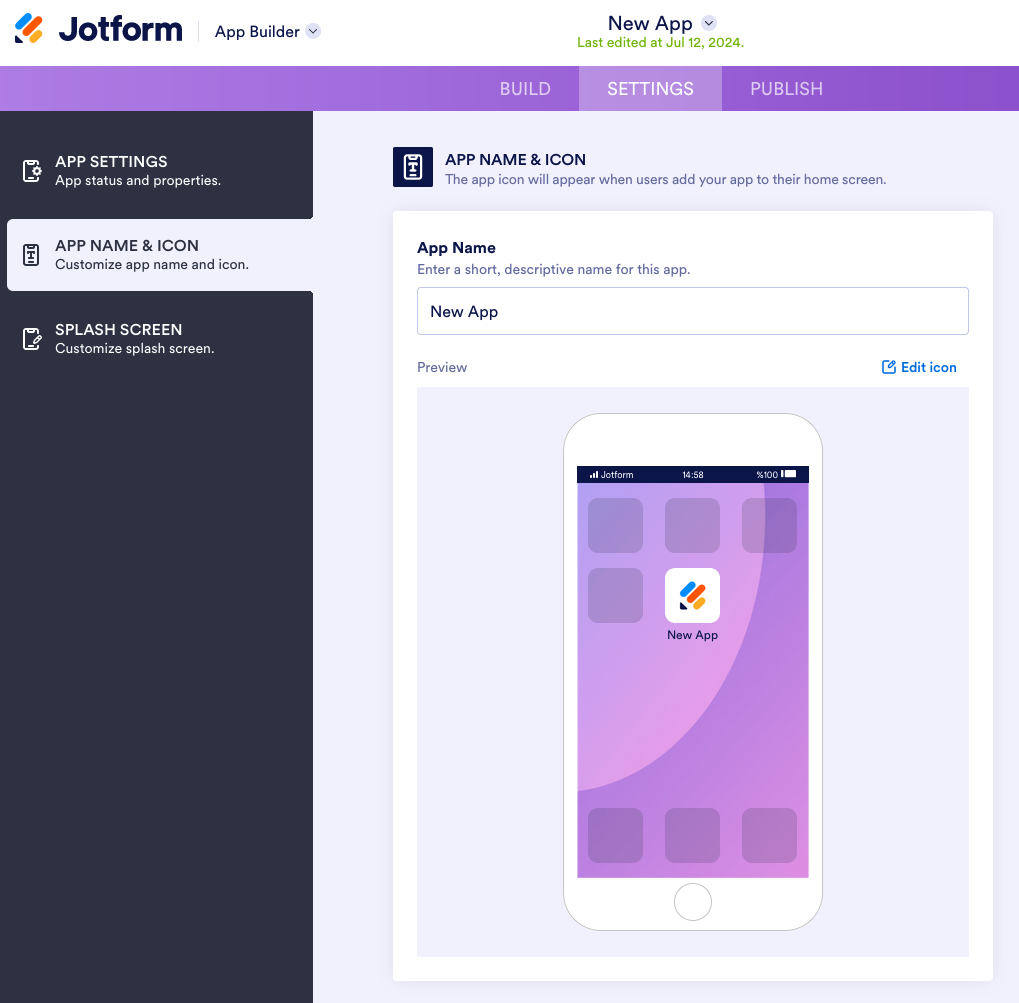

- Click the Settings tab to customize the app’s icon and splash screen.

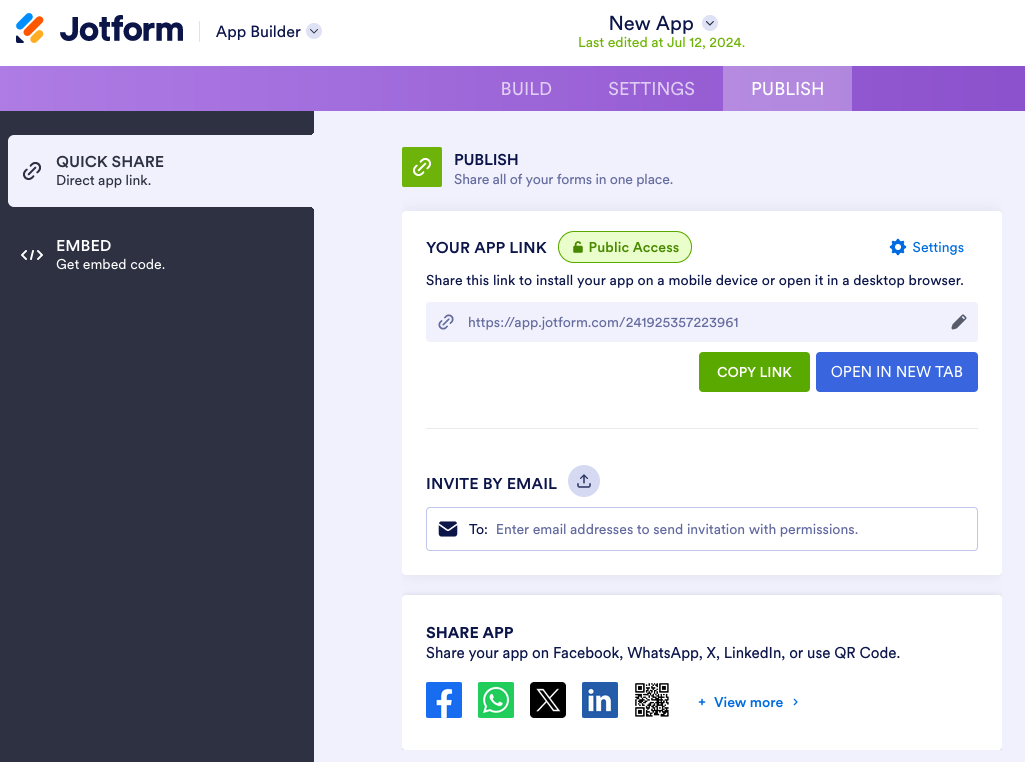

- When you’re done building your app, click the Publish tab. You’ll be able to copy a link to download your app, share the app with an email or social media, create a QR code that links to it, or copy code to embed it into a website.

Once you’ve completed and downloaded your app, you’ll be able to view and edit your budget table from your mobile device wherever you are.

If you prefer a quicker setup, Jotform offers ready-to-use financial templates, like a personal budget app that you can easily customize.

Budgeting apps can revolutionize how you manage your finances, offering comprehensive tracking and planning tools. Whether you want to use an existing budgeting app or create your own, you can find a platform to help you achieve your financial goals.

Photo by Sincerely Media on Unsplash

Send Comment: