We’ve said it before, and we’ll say it again: Arming your business — regardless of its size — with a secure online payment processor is not only a smart choice these days, it’s a must in the COVID-19 era.

Before the move toward contactless payments and online-only shopping, this option might have simply been a gimmick for small businesses that otherwise relied on brick-and-mortar sales for income. Now, it’s often the sole method many businesses have to sell inventory, collect revenue, and. consequently, stay open.

So we don’t really need to sell you on its importance at this stage.

What we also don’t need to tell you is that the holidays bring a surge of growth in retail sales. 2020 looks to continue that trend, with a forecasted 3.6-percent increase in retail sales this holiday season compared to 2019. That’s a lot of customers spending a lot of money — an average of $850 per consumer on retail gifts for Christmas alone, in fact.

Taking all this into account, one thing retailers can do to help incentivize sales this holiday season is to give customers payment flexibility as they shop online — helping them lower their up-front investment and spread out their payments over time.

“Buy now, pay later” financing models are attractive to consumers and growing in popularity, but they can get complicated when it comes to paying merchants in a timely manner and potentially causing businesses to take on temporary debt.

Until now, that is. With the launch of PayPal’s Pay in 4 program, any retailer that uses PayPal Business can now offer payment flexibility at checkout for orders between $30 and $600. Pay in 4 allows customers to pay for their purchases in four interest-free payments over a six-week period, while merchants still get paid up front. It’s a win-win for everyone. (Note that Pay in 4 is only available in the United States.)

Even better, you can seamlessly integrate this option into your order forms with JotForm. Keep on reading to learn how.

How to set up your forms with Pay in 4 from PayPal

To reap the benefits of Pay in 4 from PayPal, you’ll need to have a PayPal Business account. For a refresher on how to set up this account, take a look at our post on the topic.

Now let’s jump straight into how the Pay in 4 functionality works in Jotform’s Form Builder.

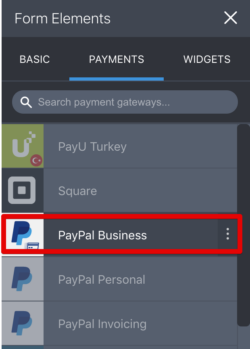

If you haven’t already set up the PayPal Business gateway on your order form, you can find it in Form Elements under Payments in the Form Builder.

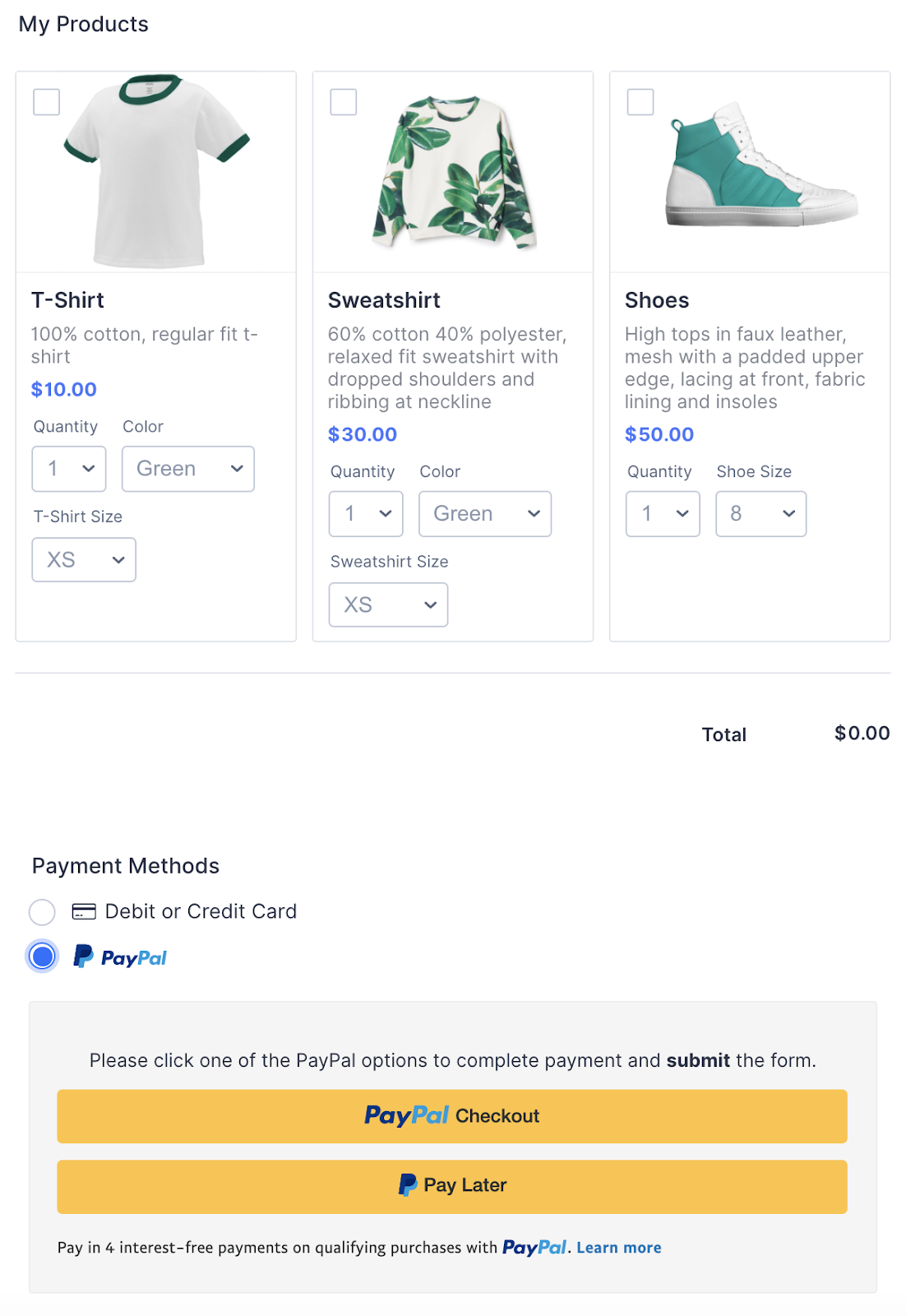

Once you’ve verified the connection, the payment methods on your form will resemble the image below.

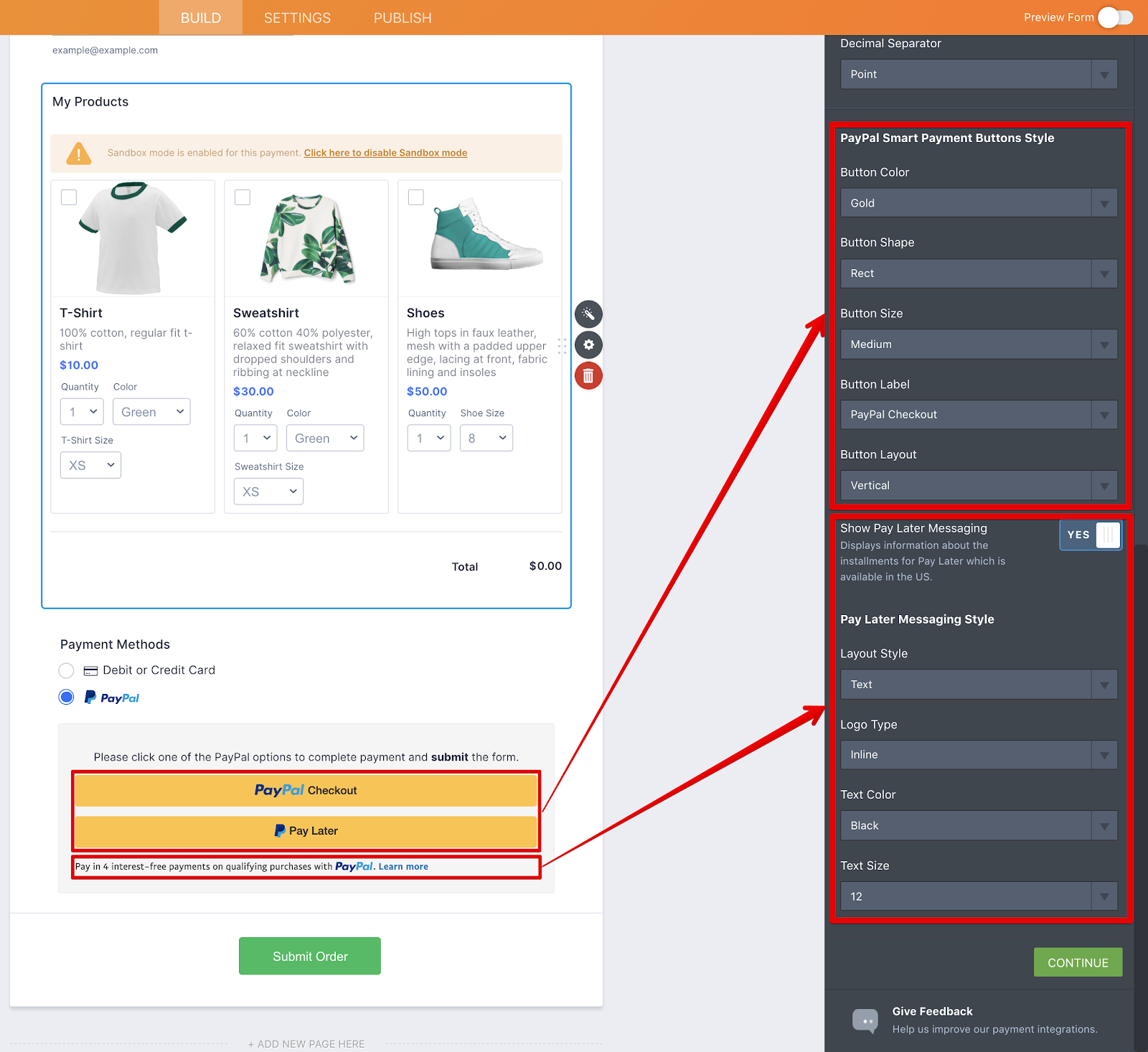

From here, you can customize your PayPal Smart Payment buttons by clicking Payment Settings next to the element in the Form Builder. This will open a field on the right side of the screen where you can adjust the shape, size, and properties of the payment buttons, as well as enable Pay Later messaging.

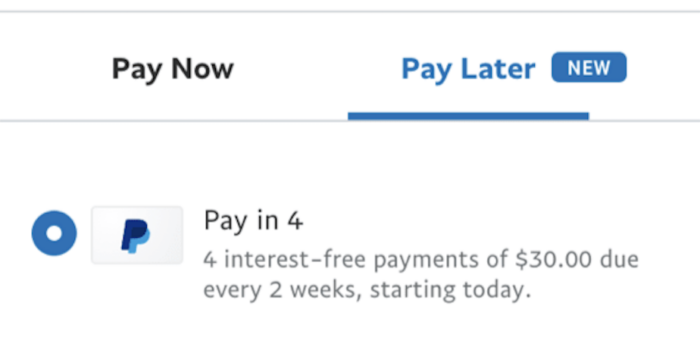

Now, customers will be able to click on the Pay Later button, which will cause the Pay in 4 option to automatically appear as shown below (remember that the transaction must be between $30 and $600 to use this option).

Upon selecting Pay in 4, customers will be redirected to PayPal in a new tab where they can log in and complete their payment. That’s it!

It couldn’t be easier to take advantage of PayPal’s Pay in 4 feature and start adding it to your order forms this holiday season to offer payment flexibility for your shoppers.

Still not convinced? There’s a lot more to cover when it comes to Jotform’s buy now, pay later online forms that we encourage you to check out. But with e-commerce at an all-time high, it’s important to give customers every incentive to buy from your business.

Do you prefer to use a financing option when shopping online? Have you already seen success with a “buy now, pay later” pricing platform for your business? If so, leave us a comment below — we’d love to hear from you.

Send Comment:

1 Comment:

More than a year ago

Awesome!