Most people are familiar with routing numbers. They identify specific financial institutions in the U.S. and are needed when you’re dealing with funds transfers like direct deposits. Did you know there are different types of routing numbers, namely ABA and ACH? Let’s take a look at the two and their unique roles.

ABA routing numbers

ABA routing numbers are associated with the American Bankers Association and help accurately transfer funds from one account to another. They are standardized and consist of nine digits, typically starting with two digits between 00 and 12.

ABA routing numbers encompass all routing numbers, including ACH numbers and domestic wire transfer numbers. So when people use the term routing number, they’re typically referring to an ABA routing number.

Generally, smaller banks are assigned a single routing number, while large, multinational banks may have several. In the latter case, each routing number typically designates a different state. For example, the routing number for Chase in Texas is 111000614, and in Arizona, it’s 122100024.

You typically need a routing number when paying bills, reordering checks, or setting up a direct deposit with your employer (for your paycheck) or the IRS (for a tax refund). Note that routing numbers for domestic or international wire transfers may differ.

Pro Tip

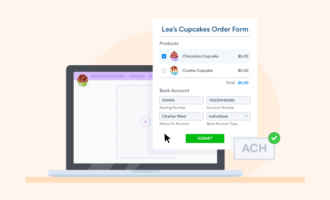

Did you know you can collect ACH payments online using Square and Stripe? Learn how to make a custom ACH form for your business and get paid fast!

ACH routing numbers

Automatic Clearing House (ACH) routing numbers are unique to banks and their branches; they identify the clearinghouse. ACH routing numbers are often used specifically for electronic transfers of usually small payments that may be made one time or on a recurring basis. These transfers come in different types and include a number of codes.

Your bank may or may not have a separate ACH routing number. If it does, like the ABA variety, ACH routing numbers are standardized. They are exactly nine digits long, and the first two digits often range from 61 to 72.

Quick comparison

ABA and ACH numbers are essentially used for the same thing — transfering funds to their appropriate destination. Here’s a quick rundown of their distinctions:

- ABA routing numbers encompass all routing numbers, including ACH. That means all ACH routing numbers are technically ABA routing numbers, though your bank may have a special ACH routing number for electronic transfers.

- Not all ABA routing numbers are ACH routing numbers, but some are. Think about it like squares and rectangles. All squares are rectangles, but not all rectangles are squares because squares have specific criteria.

- ABA and ACH routing numbers have the same format, but they can be different numbers. Verify with your bank before using one of the numbers to move money.

Send Comment: